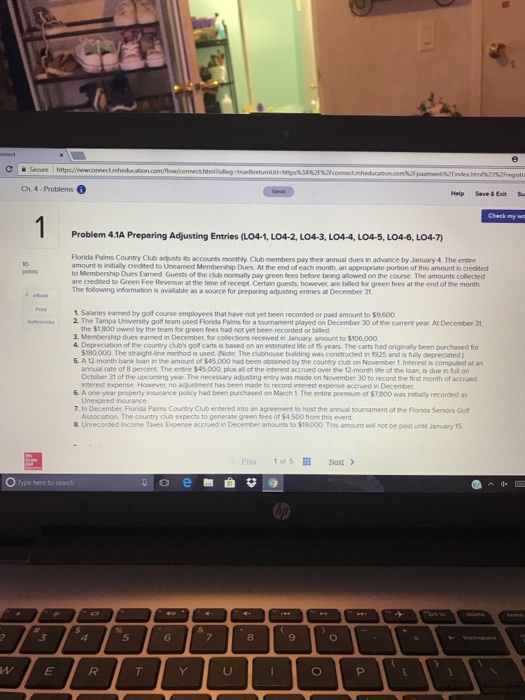

C ISe une l https/ewa Ch. 4.Problems Help Save &Exit Su Check my wo Problem 4.1A Preparing Adjusting Entries (LO4-1, LO4-2, LO4-3, LO4-4, LO4-5, LO4-6, LO4-7) Florida Palms Country Club adjusts its accounts monthly. Club members pay their annual dues in advance by January 4. The entire amount is invitially credited to Unearned Membership Dues At the end of each month, an appropriate portion of thes amount is credited to Membership Dues Earned Guests of the ck romally pay green fees before beng alowed on course The amounts colected are credited to Green Fee Revenue at the time of receipt Certain guests, however, are billed for green fees at the end of the month The following information is available as asource for preparing adjusting enties at December 31 1 Salaries earned by golf course employees that have not yet been recorded or paid amount t0 $9.600 etnences2 The Tampa University goilf team used Florida Palms for a tournament played on December 30 of the current year At December 31, the $1800 owed by the team for green fees had not yet been recorded or biled 3. Membership dues earned in December, for collections receved in January amount to $106,000 4 Depreciation of the country club's golf carts is based on an estimated ife of 15 years The carts had originally been purchased for $180.000 The straight-line method is used (Note: The clubhouse building was constructed in 1925 and is fully depreciated 5. A 12-month bank loan in the amount of S45,000 had been obtained by the country club on November 1 Interest s computed at an annual rate of 8 percent. The entire $45.000, plus all of the interest accrued over the 12-month life of the loan, is due in futl orn October 3t of the upcoming year The necessary adjussing entry was made on November 30 to record the first month of accrued enerest expense. However no adjustment has been made to record interest expense accrued in December 6. A one-year property insurance policy had been purchased on March 1 The entire premium of $7,800 was intialy recorded as 7. In December, Florida Palms Country Club entered into an agreement to host the annual tournament of the Florida Seniors Gol 8 Unrecorded Income Tases Expense accrued in December amounts so $19000 This amount will not be paid unta January 15 Unexpired Insurance Associabon The country club expects to generate green fees of $4,500 from this event Prex 1 of 5EE Next> Type here to search 5 6 8