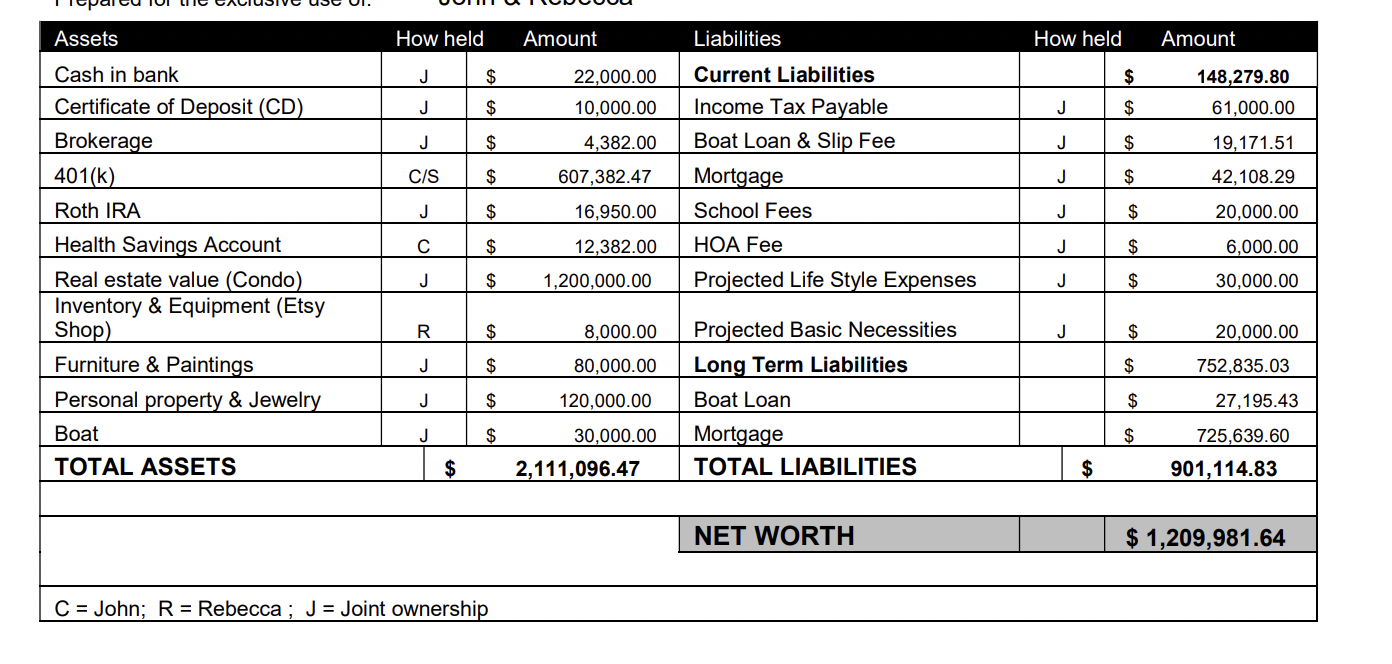

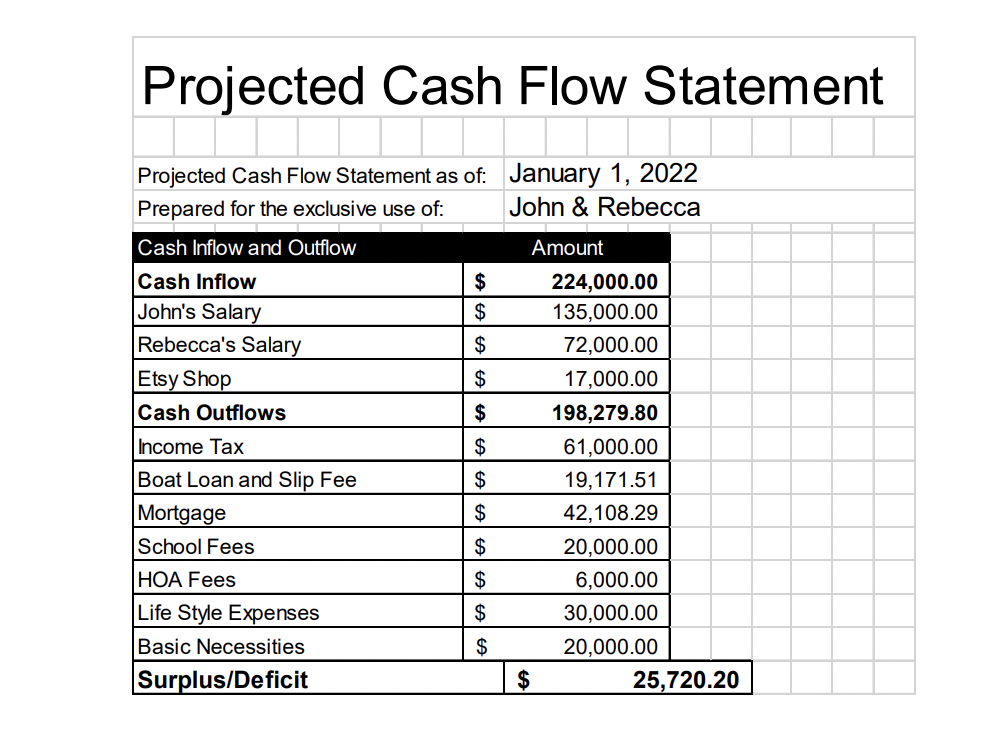

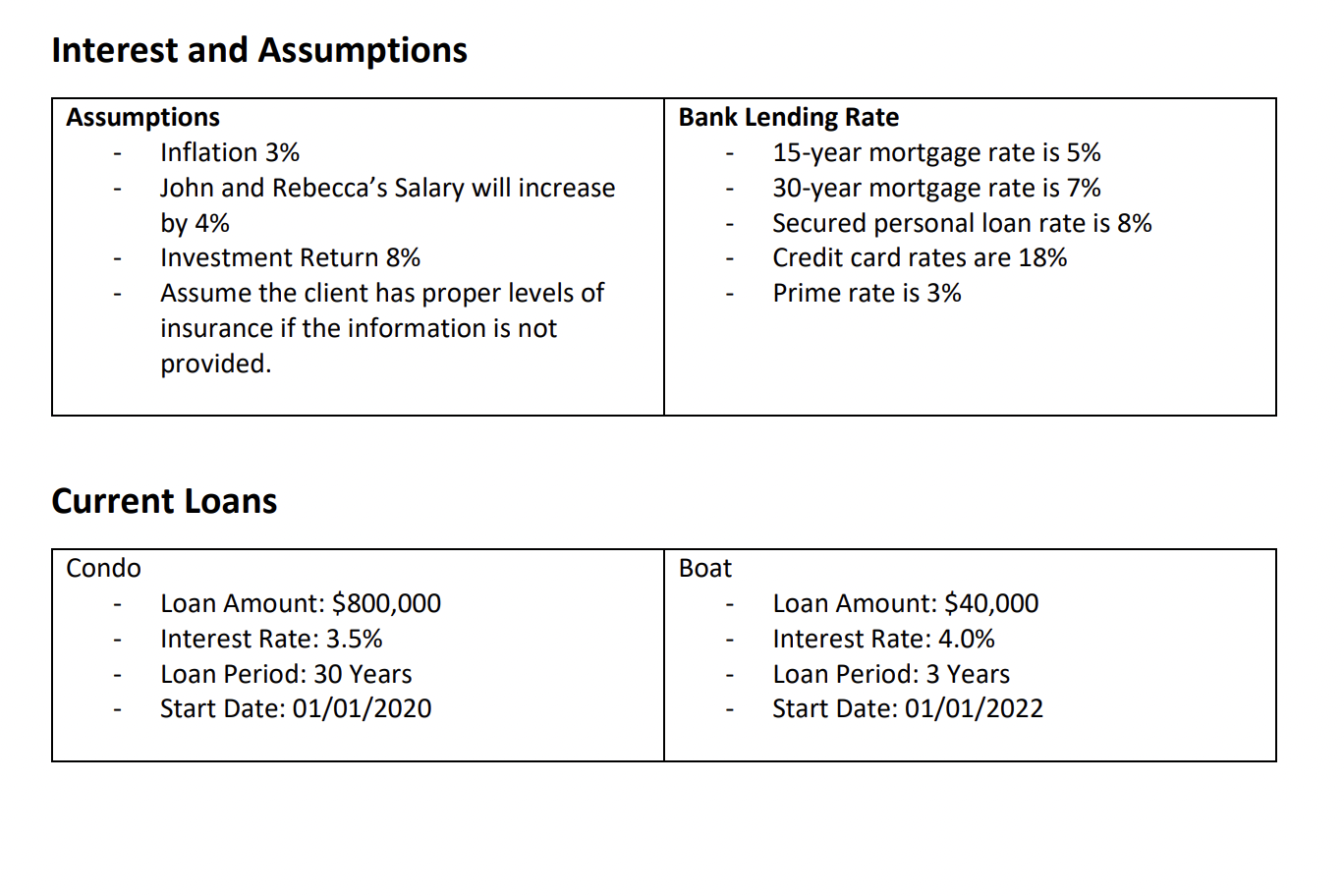

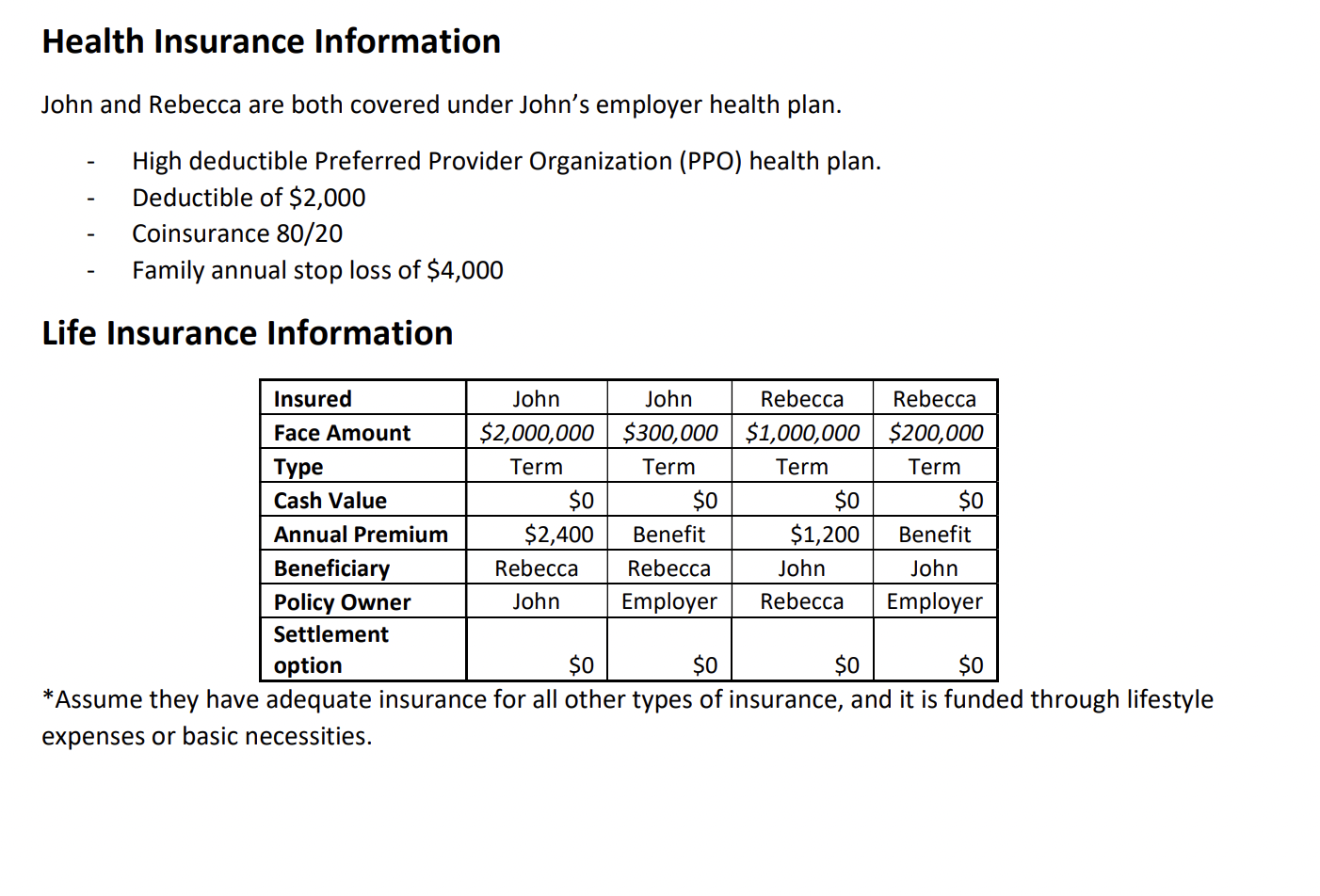

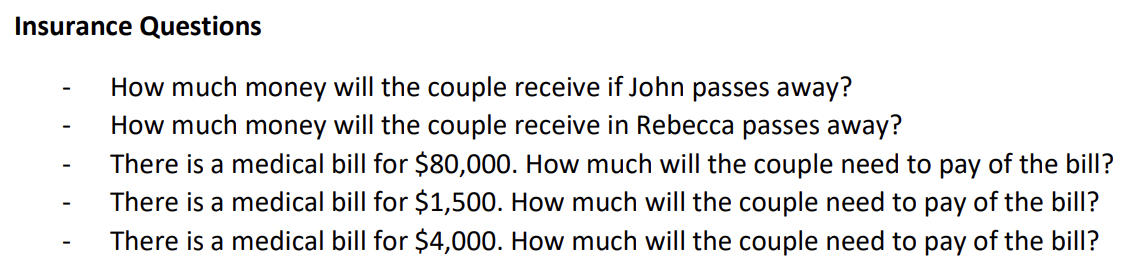

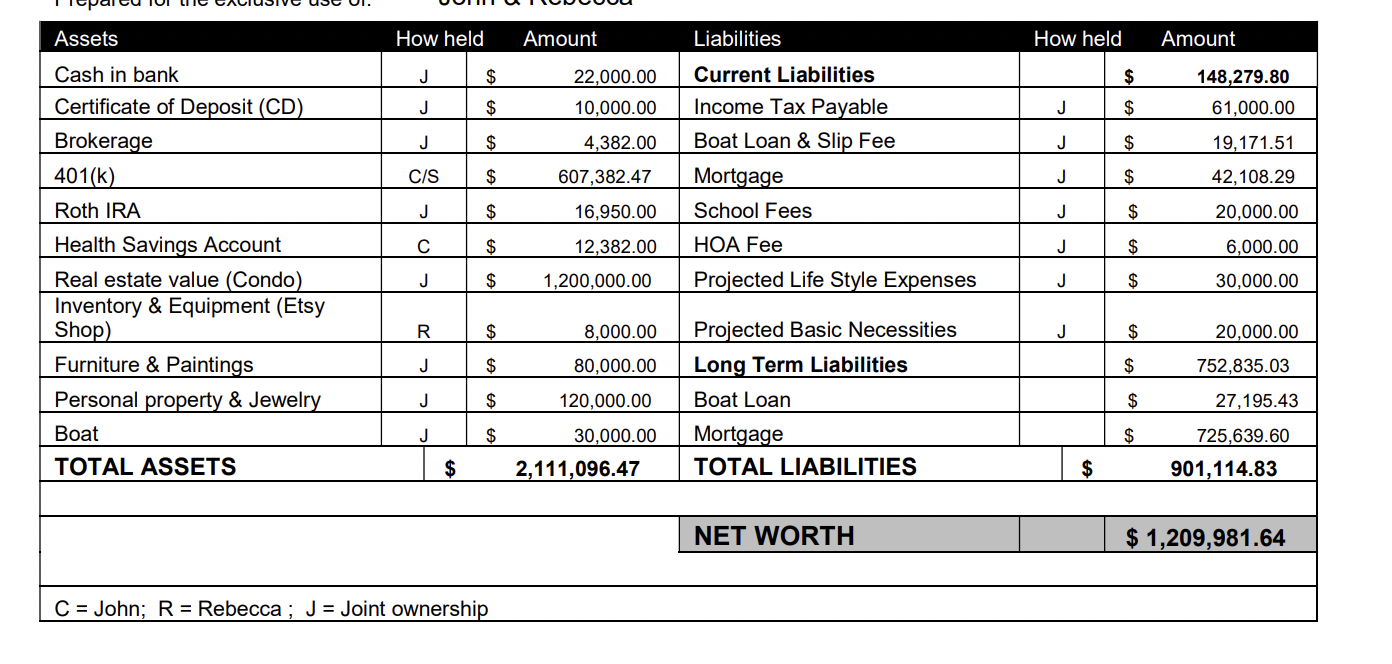

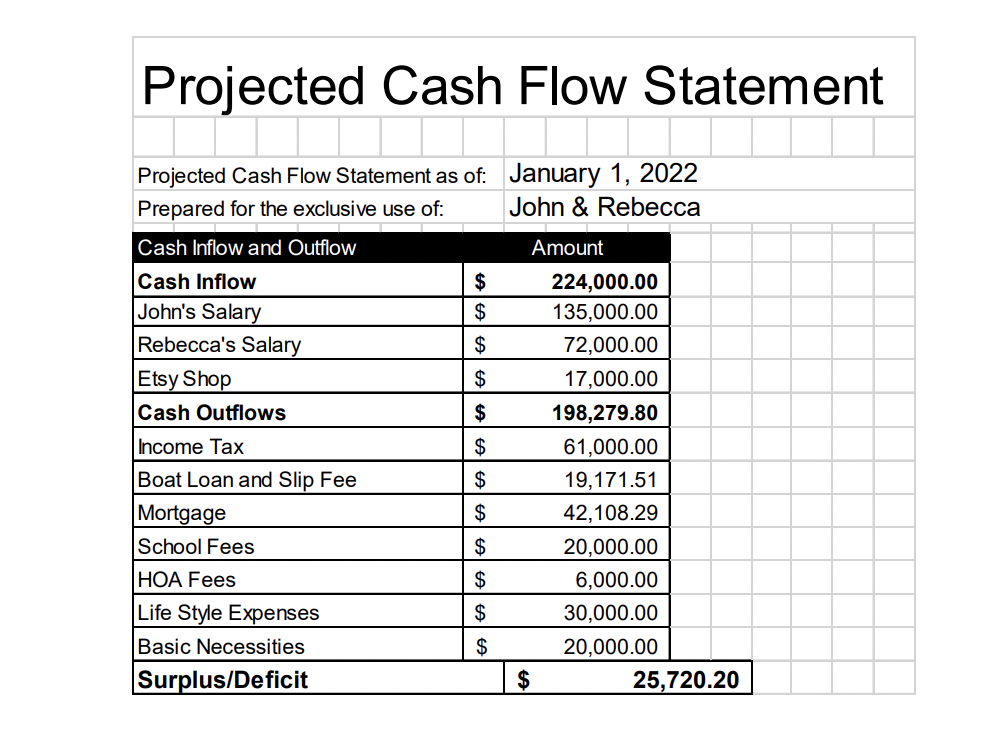

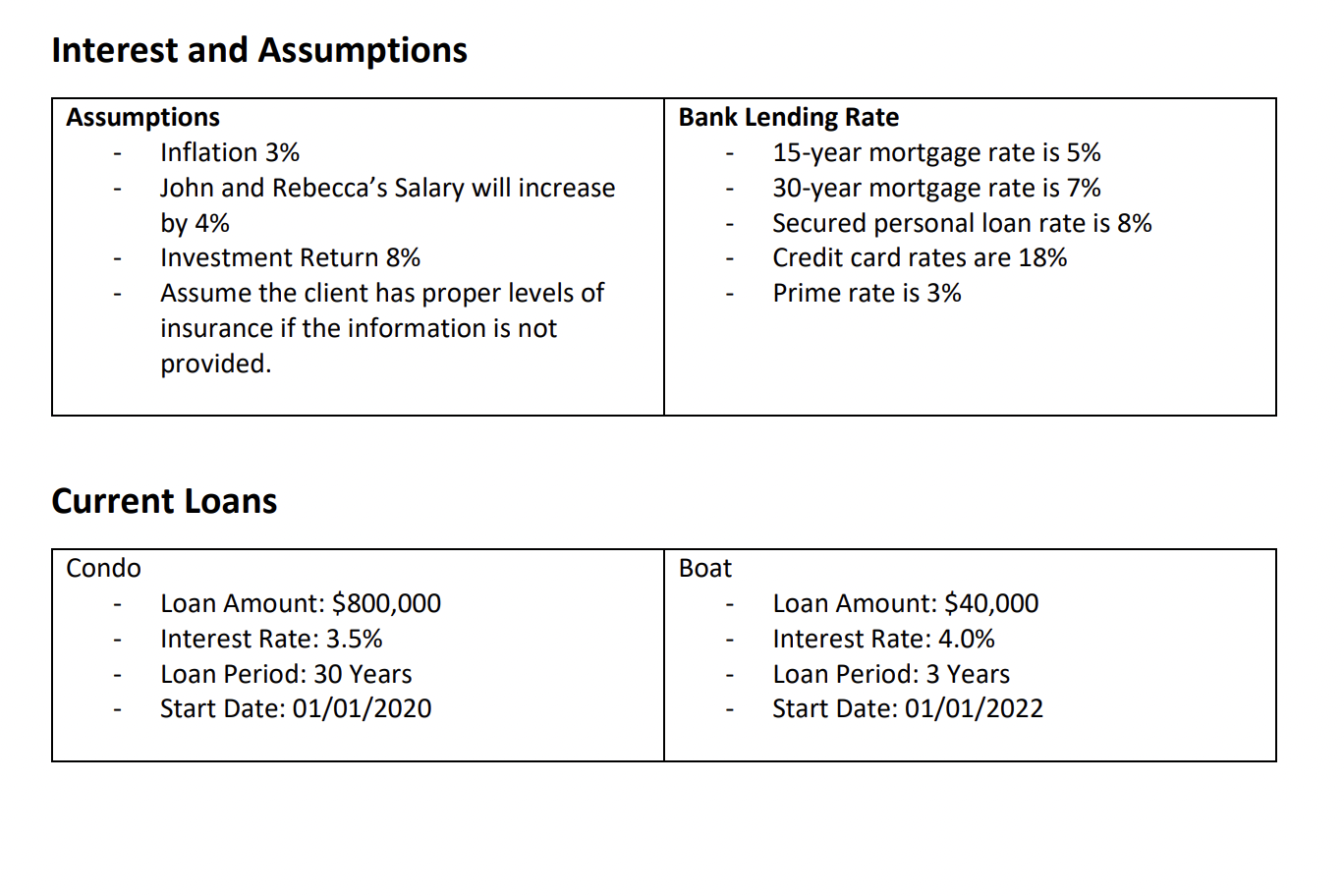

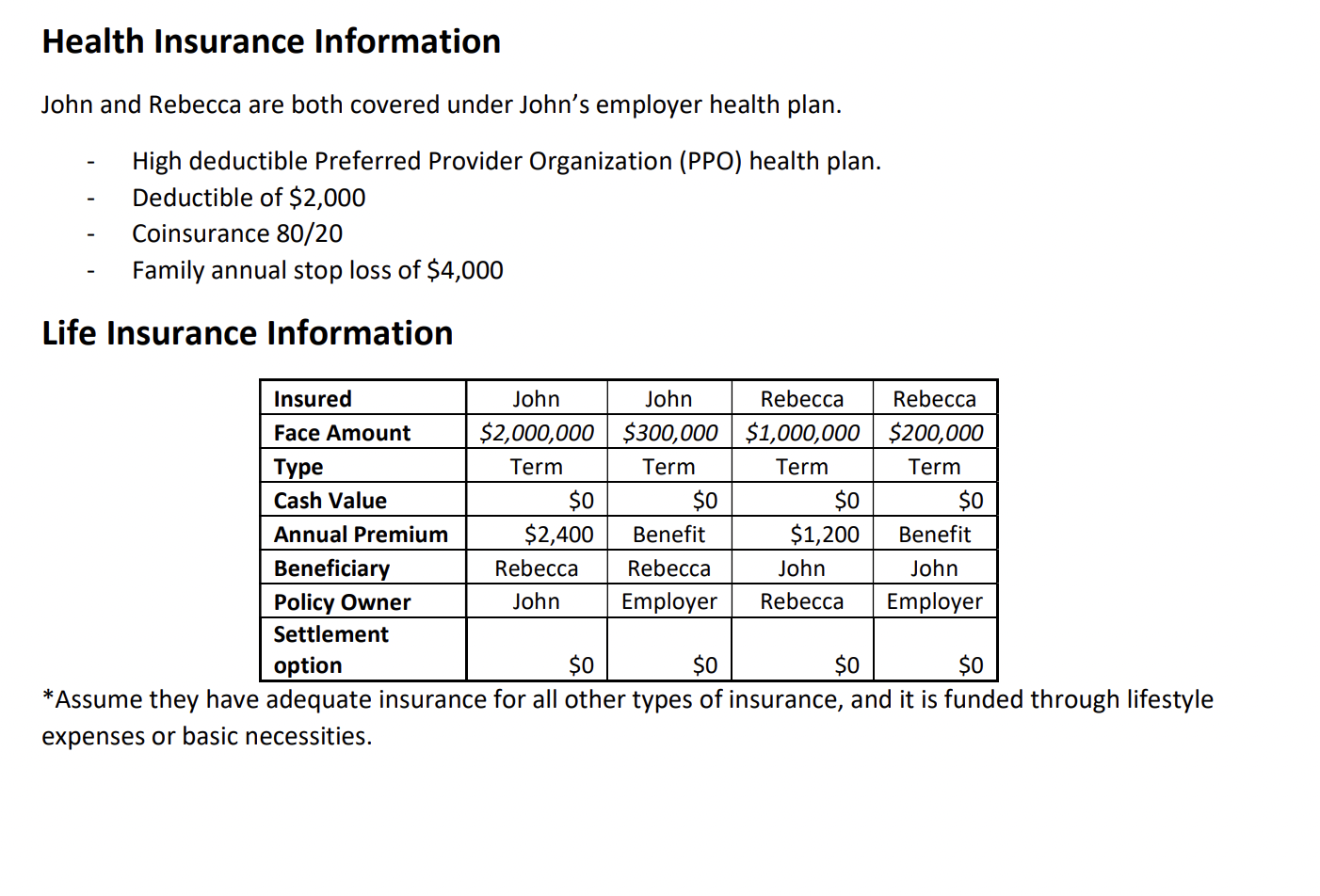

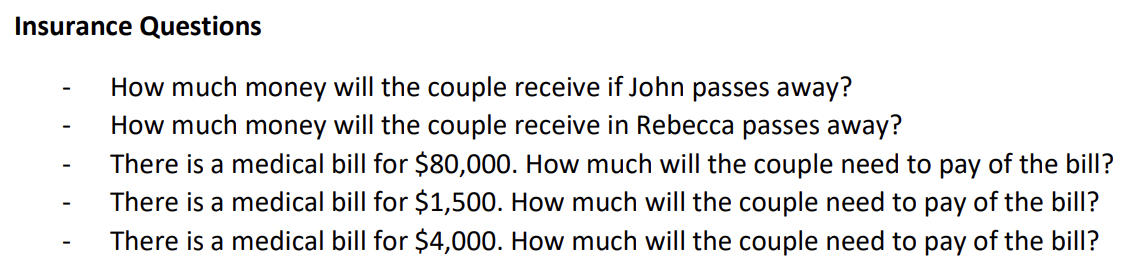

C= John; Projected Cash Flow Statement \begin{tabular}{|l|lc|} \hline Projected Cash Flow Statement as of: & January 1, 2022 \\ \hline Prepared for the exclusive use of: & John \& Rebecca \\ \hline Cash Inflow and Outflow & \multicolumn{2}{c|}{ Amount } \\ \hline Cash Inflow & $ & 224,000.00 \\ \hline John's Salary & $ & 135,000.00 \\ \hline Rebecca's Salary & $ & 72,000.00 \\ \hline Etsy Shop & $ & 17,000.00 \\ \hline Cash Outflows & $ & 198,279.80 \\ \hline Income Tax & $ & 61,000.00 \\ \hline Boat Loan and Slip Fee & $ & 19,171.51 \\ \hline Mortgage & $ & 42,108.29 \\ \hline School Fees & $ & 20,000.00 \\ \hline HOA Fees & $ & 6,000.00 \\ \hline Life Style Expenses & $ & 30,000.00 \\ \hline Basic Necessities & $ & 20,000.00 \\ \hline Surplus/Deficit & & $25,720.20 \\ \hline \end{tabular} Interest and Assumptions Health Insurance Information John and Rebecca are both covered under John's employer health plan. - High deductible Preferred Provider Organization (PPO) health plan. - Deductible of $2,000 - Coinsurance 80/20 - Family annual stop loss of $4,000 Life Insurance Information *Assume they have adequate insurance for all other types of insurance, and it is funded through lifestyle expenses or basic necessities. Insurance Questions - How much money will the couple receive if John passes away? - How much money will the couple receive in Rebecca passes away? - There is a medical bill for $80,000. How much will the couple need to pay of the bill? - There is a medical bill for $1,500. How much will the couple need to pay of the bill? - There is a medical bill for $4,000. How much will the couple need to pay of the bill? C= John; Projected Cash Flow Statement \begin{tabular}{|l|lc|} \hline Projected Cash Flow Statement as of: & January 1, 2022 \\ \hline Prepared for the exclusive use of: & John \& Rebecca \\ \hline Cash Inflow and Outflow & \multicolumn{2}{c|}{ Amount } \\ \hline Cash Inflow & $ & 224,000.00 \\ \hline John's Salary & $ & 135,000.00 \\ \hline Rebecca's Salary & $ & 72,000.00 \\ \hline Etsy Shop & $ & 17,000.00 \\ \hline Cash Outflows & $ & 198,279.80 \\ \hline Income Tax & $ & 61,000.00 \\ \hline Boat Loan and Slip Fee & $ & 19,171.51 \\ \hline Mortgage & $ & 42,108.29 \\ \hline School Fees & $ & 20,000.00 \\ \hline HOA Fees & $ & 6,000.00 \\ \hline Life Style Expenses & $ & 30,000.00 \\ \hline Basic Necessities & $ & 20,000.00 \\ \hline Surplus/Deficit & & $25,720.20 \\ \hline \end{tabular} Interest and Assumptions Health Insurance Information John and Rebecca are both covered under John's employer health plan. - High deductible Preferred Provider Organization (PPO) health plan. - Deductible of $2,000 - Coinsurance 80/20 - Family annual stop loss of $4,000 Life Insurance Information *Assume they have adequate insurance for all other types of insurance, and it is funded through lifestyle expenses or basic necessities. Insurance Questions - How much money will the couple receive if John passes away? - How much money will the couple receive in Rebecca passes away? - There is a medical bill for $80,000. How much will the couple need to pay of the bill? - There is a medical bill for $1,500. How much will the couple need to pay of the bill? - There is a medical bill for $4,000. How much will the couple need to pay of the bill