Answered step by step

Verified Expert Solution

Question

1 Approved Answer

c). Justify your answer in (b) d). Discuss the trade-off using the Payback Period Method in capital budgeting decision making. In capital budgeting, several different

c). Justify your answer in (b)

d). Discuss the trade-off using the Payback Period Method in capital budgeting decision making.

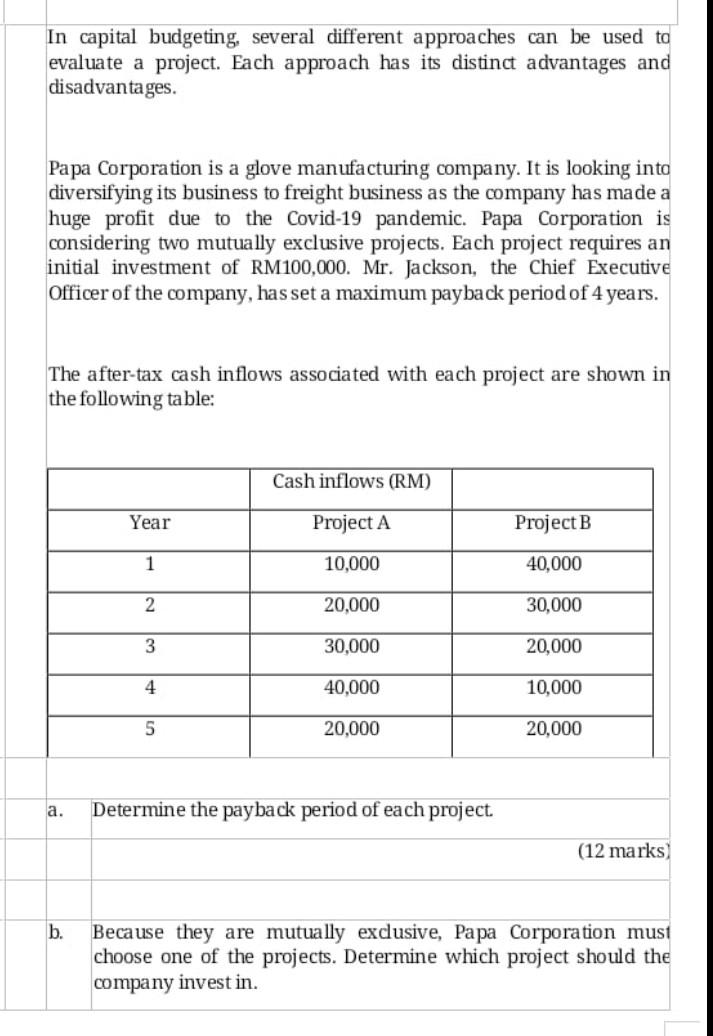

In capital budgeting, several different approaches can be used to evaluate a project. Each approach has its distinct advantages and disadvantages. Papa Corporation is a glove manufacturing company. It is looking into diversifying its business to freight business as the company has made a huge profit due to the Covid-19 pandemic. Papa Corporation is considering two mutually exclusive projects. Each project requires an initial investment of RM100,000. Mr. Jackson, the Chief Executive Officer of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project are shown in the following table: Cash inflows (RM) Year Project A Project B 1 10,000 40,000 2 20,000 30,000 3 30,000 20,000 4 40,000 10,000 5 20,000 20,000 a. Determine the payback period of each project. (12 marks) b. Because they are mutually exclusive, Papa Corporation must choose one of the projects. Determine which project should the company invest inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started