(C)

| | Manufacturing overhead costs are allocated to products based on machine hours at the rate of $27.50 per hour |

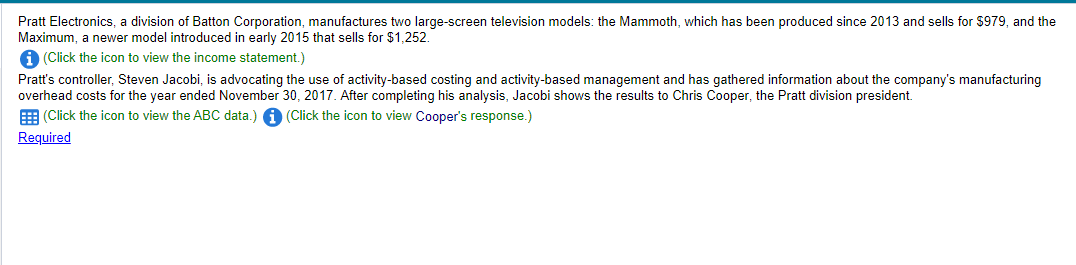

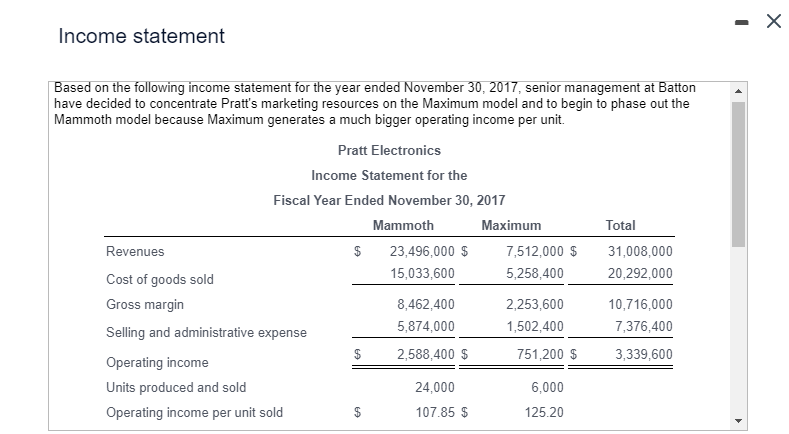

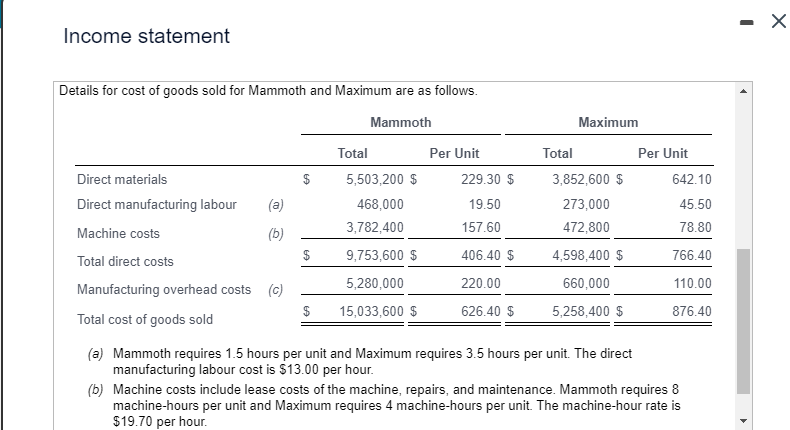

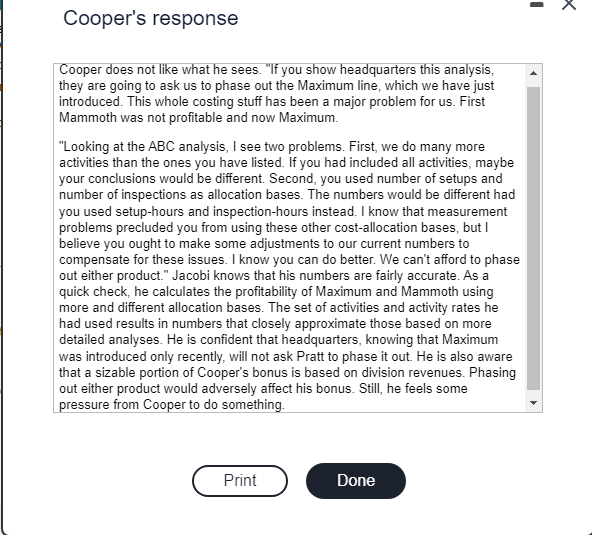

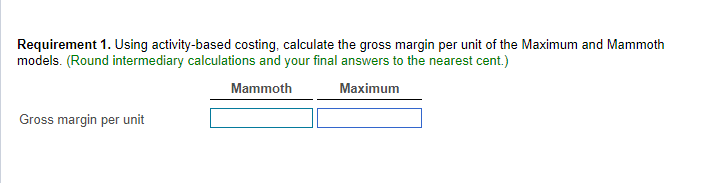

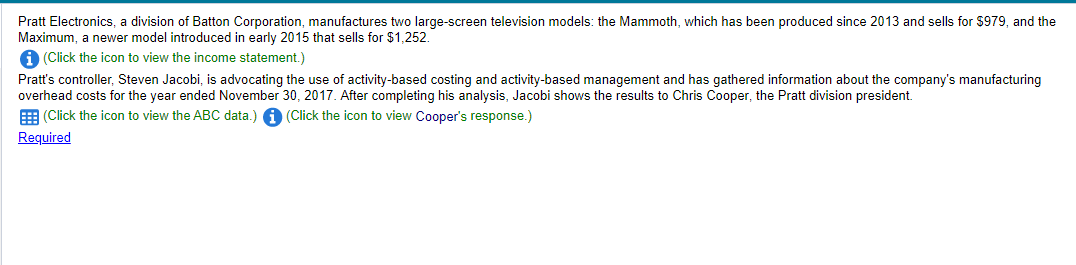

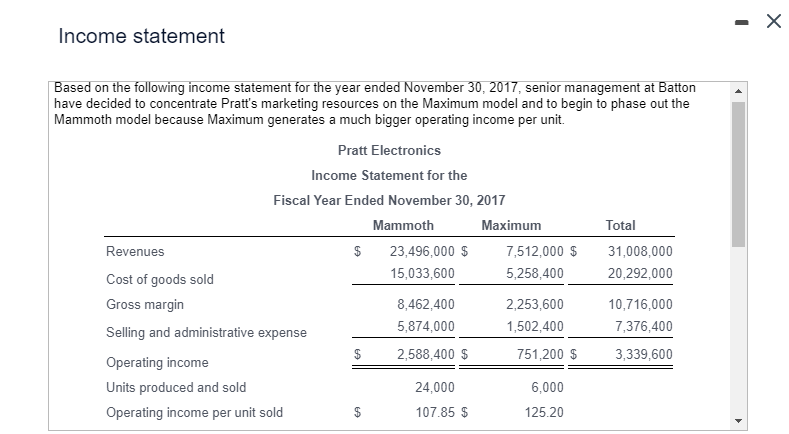

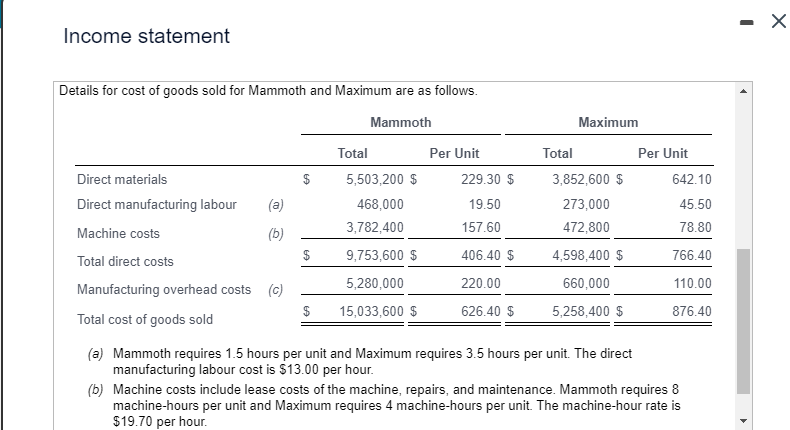

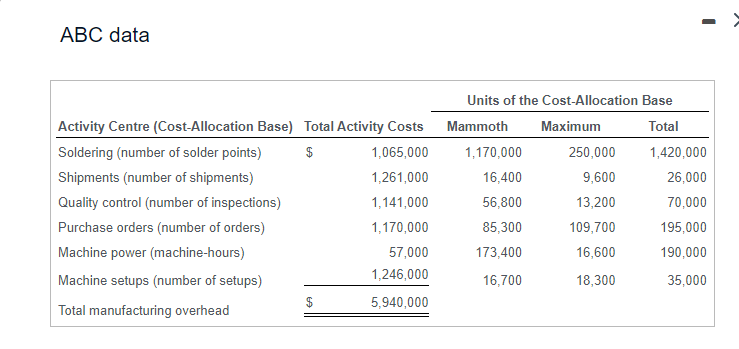

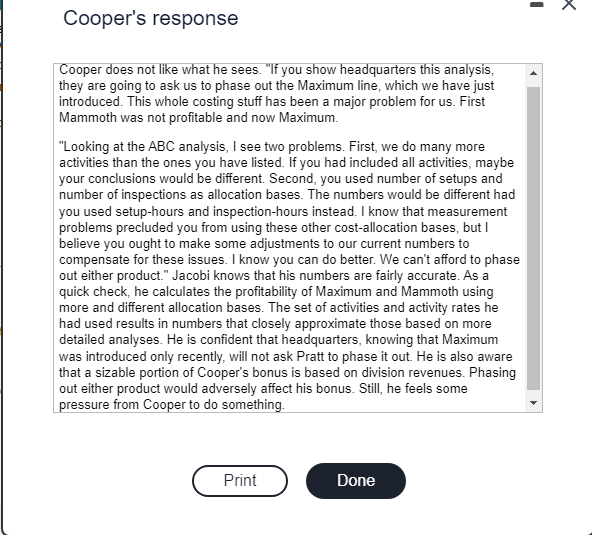

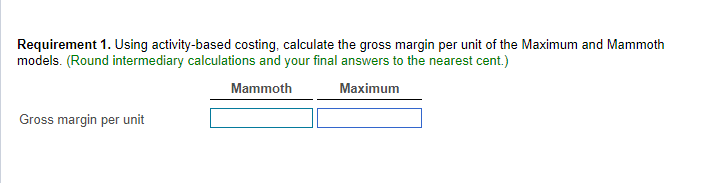

Pratt Electronics, a division of Batton Corporation, manufactures two large-screen television models: the Mammoth, which has been produced since 2013 and sells for $979, and the Maximum, a newer model introduced in early 2015 that sells for $1,252. (Click the icon to view the income statement.) Pratt's controller, Steven Jacobi, is advocating the use of activity-based costing and activity-based management and has gathered information about the company's manufacturing overhead costs for the year ended November 30, 2017. After completing his analysis, Jacobi shows the results to Chris Cooper, the Pratt division president. (Click the icon to view the ABC data.) (Click the icon to view Cooper's response.) Required Income statement Based on the following income statement for the year ended November 30 , 2017, senior management at Batton have decided to concentrate Pratt's marketing resources on the Maximum model and to begin to phase out the Mammoth model because Maximum generates a much bigger operating income per unit. Income statement Details for cost of goods sold for Mammoth and Maximum are as follows. (a) Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. The direct manufacturing labour cost is $13.00 per hour. (b) Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine-hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.70 per hour. ABC data Cooper's response Cooper does not like what he sees. "If you show headquarters this analysis, they are going to ask us to phase out the Maximum line, which we have just introduced. This whole costing stuff has been a major problem for us. First Mammoth was not profitable and now Maximum. "Looking at the ABC analysis, I see two problems. First, we do many more activities than the ones you have listed. If you had included all activities, maybe your conclusions would be different. Second, you used number of setups and number of inspections as allocation bases. The numbers would be different had you used setup-hours and inspection-hours instead. I know that measurement problems precluded you from using these other cost-allocation bases, but I believe you ought to make some adjustments to our current numbers to compensate for these issues. I know you can do better. We can't afford to phase out either product." Jacobi knows that his numbers are fairly accurate. As a quick check, he calculates the profitability of Maximum and Mammoth using more and different allocation bases. The set of activities and activity rates he had used results in numbers that closely approximate those based on more detailed analyses. He is confident that headquarters, knowing that Maximum was introduced only recently, will not ask Pratt to phase it out. He is also aware that a sizable portion of Cooper's bonus is based on division revenues. Phasing out either product would adversely affect his bonus. Still, he feels some pressure from Cooper to do something. Required 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Pratt's existing simple costing system. Requirement 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. (Round intermediary calculations and your final answers to the nearest cent.)