Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(c) Mary has an initial wealth of $1. She can invest an amount x from it in non-dividend- paying stocks, y in bonds and

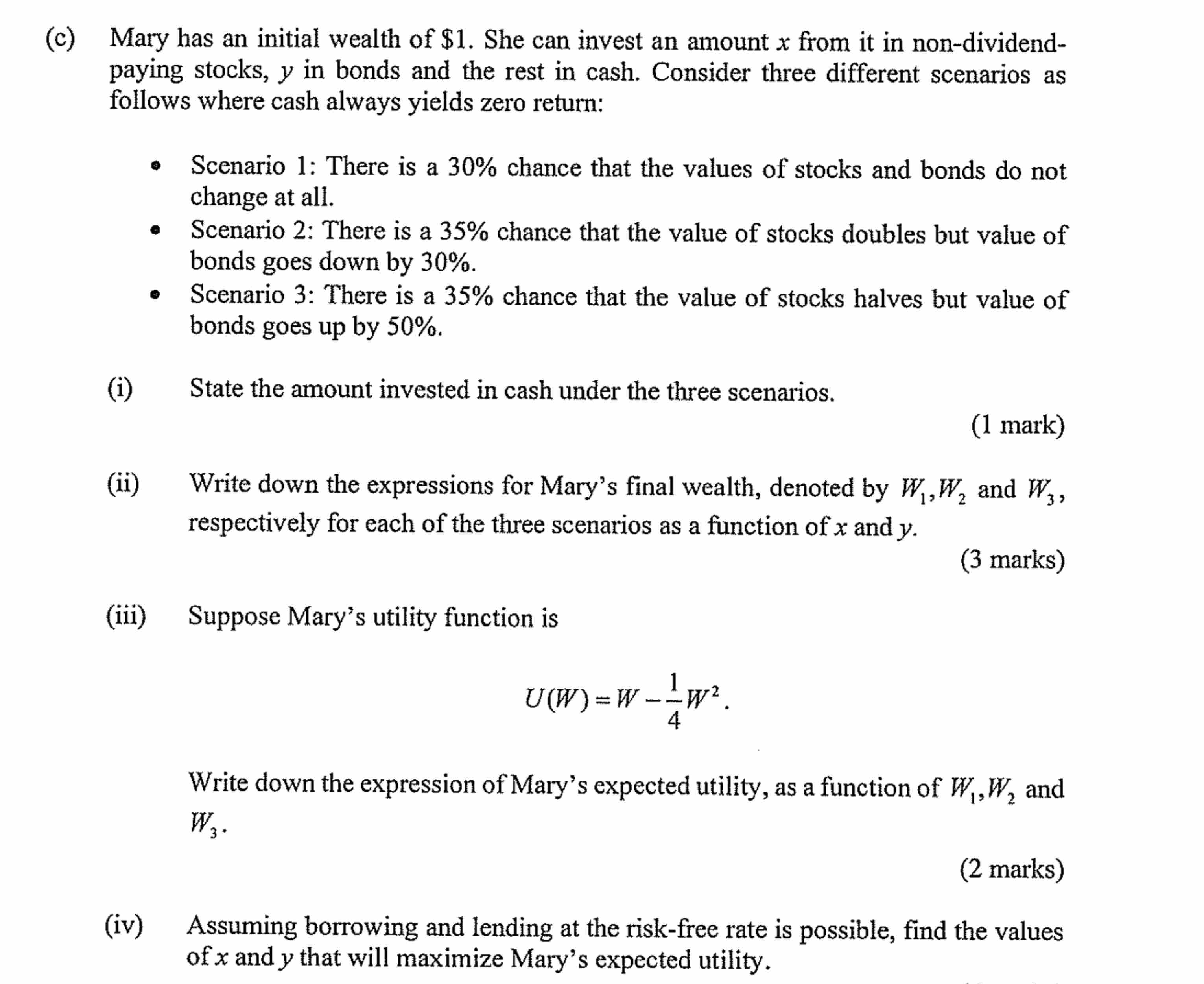

(c) Mary has an initial wealth of $1. She can invest an amount x from it in non-dividend- paying stocks, y in bonds and the rest in cash. Consider three different scenarios as follows where cash always yields zero return: (i) (ii) (iii) (iv) Scenario 1: There is a 30% chance that the values of stocks and bonds do not change at all. Scenario 2: There is a 35% chance that the value of stocks doubles but value of bonds goes down by 30%. Scenario 3: There is a 35% chance that the value of stocks halves but value of bonds goes up by 50%. State the amount invested in cash under the three scenarios. (1 mark) 2 Write down the expressions for Mary's final wealth, denoted by W,W and W, respectively for each of the three scenarios as a function of x and y. Suppose Mary's utility function is A--/ U(W) = W www W. 4 2 Write down the expression of Mary's expected utility, as a function of W,W and W3. (3 marks) (2 marks) Assuming borrowing and lending at the risk-free rate is possible, find the values of x and y that will maximize Mary's expected utility.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Amount invested in cash under the three scenarios Scenario 1 Cash 1 x y Scenario 2 Cash 1 x y Scen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started