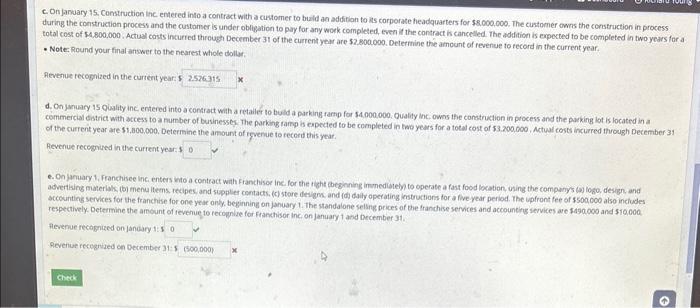

c. Onjandary 15, Construction inc entered into a contract with a cuktomer to buld a0 additian to is corporate headquarters for $8, 000,000. The cintomer owns the construction in process during the construction process and the customser is under obligation to pay for any work completed, even it the contract in cancelled. The addition is expexted to be completed in two years for total cost of $4,800,000. Actual costs incurred through December 31 of the current year are $2,800000. Determine the amount of revenue to record in the current year. - Note Round your final answer to the nearest whole dollar. Aevenue recognized in the current year: 1 d. On january 15 Quality inc entered into a contract with a retailer to buld a parking farmp for S4.000.000, Quality inc, owns the construction in process and the puking lot is located in a commercial Gistrict with access to a number of businesses. The parking tamp is erpected to be completed in two years for a totat cost of 53.200 , 6oo, Actuat cost incurred through December 31 of the current year are $1,800,000, Determine the amount of rgvenue to recerd this year. Aevenue recognised in the curtent year:-1 sccounting services for the franchise for one year only, beginning on january 1. The standalone seling prices of bhe franchice services and accouneing services are jasaogo and $10,000. respectively. Determine the amount of tevenue to recognise for franthisor inci on january 1 and becember 31. Hhevenue recagized on Jandary i: s Revenue recogrused ce becember 31:s c. Onjandary 15, Construction inc entered into a contract with a cuktomer to buld a0 additian to is corporate headquarters for $8, 000,000. The cintomer owns the construction in process during the construction process and the customser is under obligation to pay for any work completed, even it the contract in cancelled. The addition is expexted to be completed in two years for total cost of $4,800,000. Actual costs incurred through December 31 of the current year are $2,800000. Determine the amount of revenue to record in the current year. - Note Round your final answer to the nearest whole dollar. Aevenue recognized in the current year: 1 d. On january 15 Quality inc entered into a contract with a retailer to buld a parking farmp for S4.000.000, Quality inc, owns the construction in process and the puking lot is located in a commercial Gistrict with access to a number of businesses. The parking tamp is erpected to be completed in two years for a totat cost of 53.200 , 6oo, Actuat cost incurred through December 31 of the current year are $1,800,000, Determine the amount of rgvenue to recerd this year. Aevenue recognised in the curtent year:-1 sccounting services for the franchise for one year only, beginning on january 1. The standalone seling prices of bhe franchice services and accouneing services are jasaogo and $10,000. respectively. Determine the amount of tevenue to recognise for franthisor inci on january 1 and becember 31. Hhevenue recagized on Jandary i: s Revenue recogrused ce becember 31:s