Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C# please with screen shot Lab3A: Credit Cards. Financial advisors will almost always tell you that you should pay for things in cash and avoid

C# please with screen shot

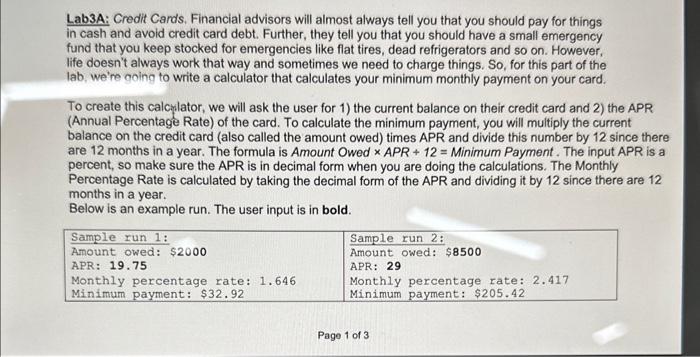

Lab3A: Credit Cards. Financial advisors will almost always tell you that you should pay for things in cash and avoid credit card debt. Further, they tell you that you should have a small emergency fund that you keep stocked for emergencies like flat tires, dead refrigerators and so on. However, life doesn't always work that way and sometimes we need to charge things. So, for this part of the lab, we're going to write a calculator that calculates your minimum monthly payment on your card. To create this calcylator, we will ask the user for 1) the current balance on their credit card and 2) the APR (Annual Percentage Rate) of the card. To calculate the minimum payment, you will multiply the current balance on the credit card (also called the amount owed) times APR and divide this number by 12 since there are 12 months in a year. The formula is Amount Owed APR+12= Minimum Payment. The input APR is a percent, so make sure the APR is in decimal form when you are doing the calculations. The Monthly Percentage Rate is calculated by taking the decimal form of the APR and dividing it by 12 since there are 12 months in a year. Below is an example run. The user input is in bold. Page 1 of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started