Answered step by step

Verified Expert Solution

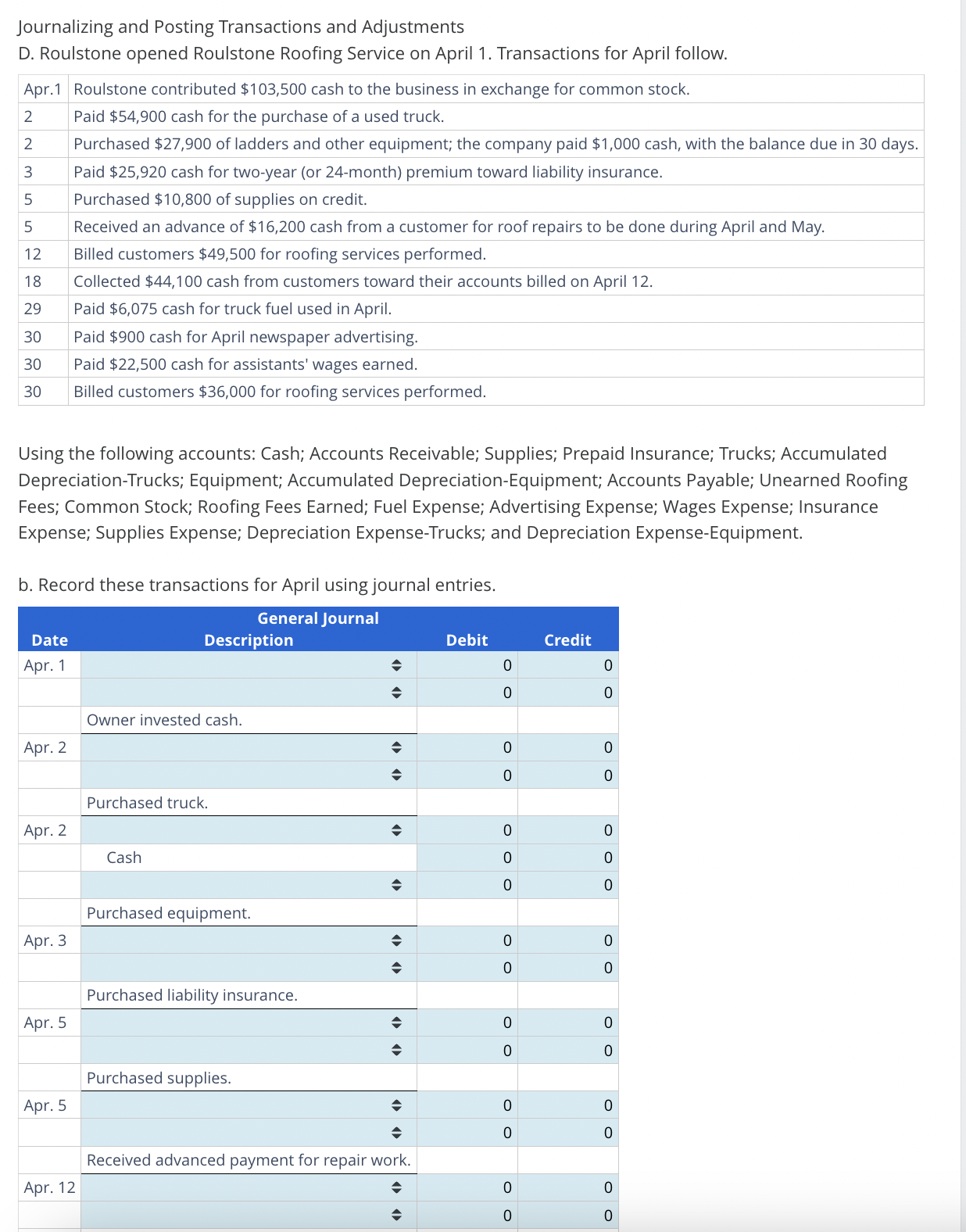

Question

1 Approved Answer

c . Post the above entries to their T - accounts. Enter transactions in the T - accounts in the order they appear using the

c Post the above entries to their Taccounts.

Enter transactions in the Taccounts in the order they appear using the first available answer box on the

appropriate side of the Tacc d Prepare journal entries to adjust the following accounts, and;

e Post the adjusting entries to the above Taccounts.

Record insurance expense for April.

Supplies still available on April was $

Record depreciation expense for truck for April of $

Record depreciation expense for equipment for April of $

Onefourth of roofing fee received April was earned by April

tableDatetableGeneral JournalDescriptionDebit,CreditAprhatVhatAATo record insurance expense.,,,AprhatTo record supplies expense.,,,AprhathatVTo record truck depreciation expense.,,,AprhathatTo record equipment depreciation expense.,,,AprhathatTo record fees earned.,,,ount

Accumulated Depreciation Equipment

d Prepare journal entries to adjust the following accounts, and;

e Post the adjusting entries to the above Taccounts.

Record insurance expense for April.

Supplies still available on April was $

Record depreciation expense for truck for April of $

Record depreciation expense for equipment for April of $

Onefourth of roofing fee received April was earned bv April

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started