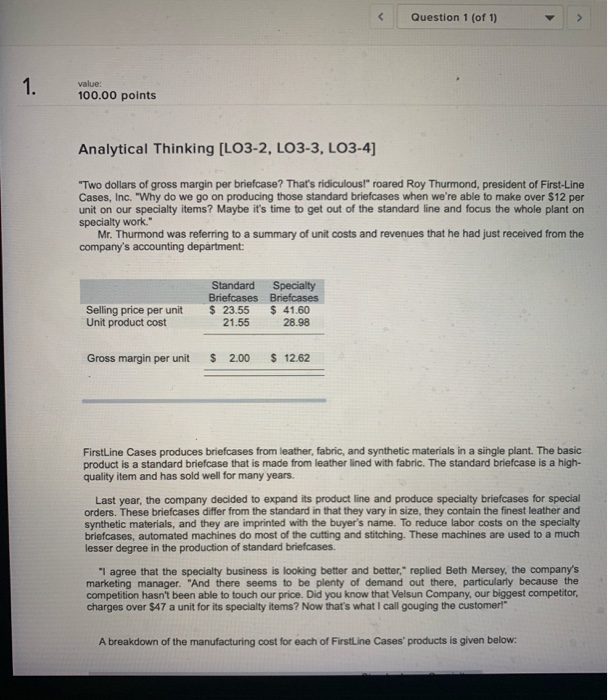

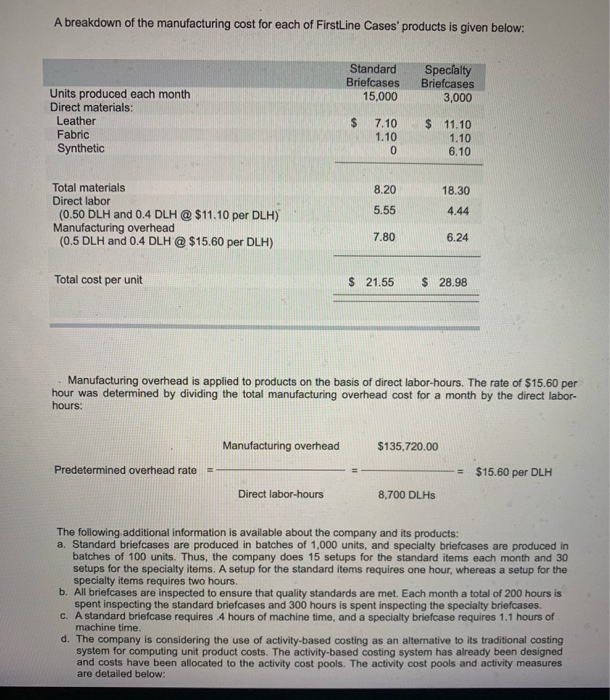

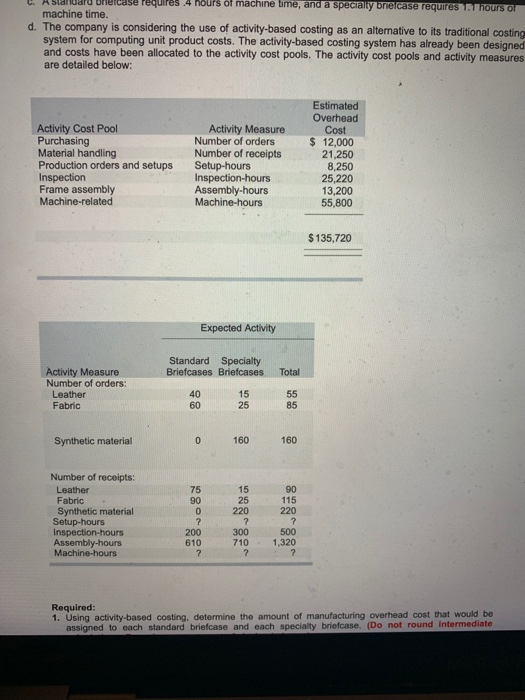

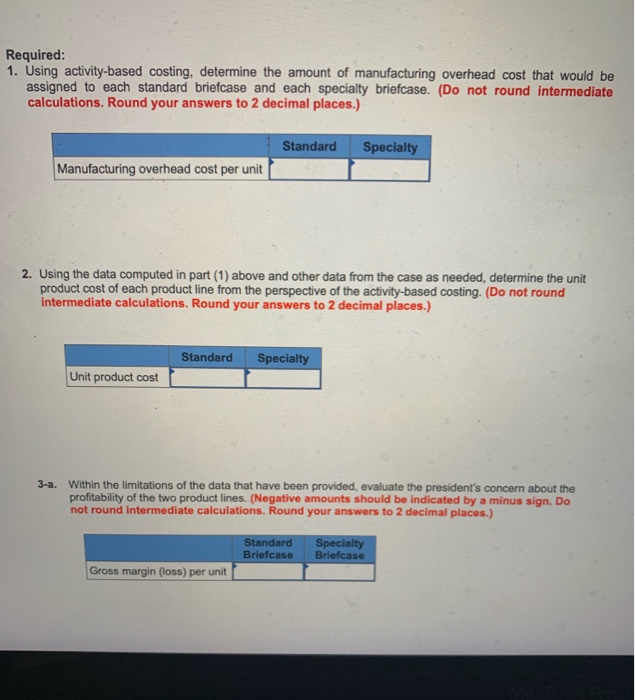

C Question 1 (of 1) value: 100.00 points Analytical Thinking [LO3-2, LO3-3, LO3-4] "Two dollars of gross margin per briefcase? That's ridiculous!" roared Roy Thurmond, president of First-Line Cases, Inc. "Why do we go on producing those standard briefcases when we're able to make over $12 per unit on our specialty items? Maybe it's time to get out of the standard line and focus the whole plant on specialty work." Mr. Thurmond was referring to a summary of unit costs and revenues that he had just received from the company's accounting department: Selling price per unit Unit product cost Standard Specialty Briefcases Briefcases $ 23.55 $ 41.60 21.55 28.98 Gross margin per unit $ 2.00 $ 12.62 FirstLine Cases produces briefcases from leather, fabric, and synthetic materials in a single plant. The basic product is a standard briefcase that is made from leather lined with fabric. The standard briefcase is a high- quality item and has sold well for many years Last year, the company decided to expand its product line and produce specialty briefcases for special orders. These briefcases differ from the standard in that they vary in size, they contain the finest leather and synthetic materials, and they are imprinted with the buyer's name. To reduce labor costs on the specialty briefcases, automated machines do most of the cutting and stitching. These machines are used to a much lesser degree in the production of standard briefcases. "I agree that the specialty business is looking better and better," replied Beth Mersey, the company's marketing manager. "And there seems to be plenty of demand out there, particularly because the competition hasn't been able to touch our price. Did you know that Velsun Company, our biggest competitor, charges over $47 a unit for its specialty items? Now that's what I call gouging the customer!" A breakdown of the manufacturing cost for each of FirstLine Cases products is given below: A breakdown of the manufacturing cost for each of FirstLine Cases' products is given below: Standard Briefcases 15,000 Specialty Briefcases 3,000 Units produced each month Direct materials: Leather Fabric Synthetic $ 7.10 1.10 $ 11.10 1.10 6.10 Total materials Direct labor (0.50 DLH and 0.4 DLH @ $11.10 per DLH) Manufacturing overhead (0.5 DLH and 0.4 DLH @ $15.60 per DLH) 8.20 5.55 18.30 4.44 7.80 6.24 Total cost per unit $ 21.55 $28.98 Manufacturing overhead is applied to products on the basis of direct labor-hours. The rate of $15.60 per hour was determined by dividing the total manufacturing overhead cost for a month by the direct labor. hours: Manufacturing overhead $135,720.00 Predetermined overhead rate =- = $15.60 per DLH Direct labor-hours 8,700 DLHS The following additional information is available about the company and its products: a. Standard briefcases are produced in batches of 1,000 units, and specialty briefcases are produced in batches of 100 units. Thus, the company does 15 setups for the standard items each month and 30 setups for the specialty items. A setup for the standard items requires one hour, whereas a setup for the specialty items requires two hours. b. All briefcases are inspected to ensure that quality standards are met. Each month a total of 200 hours is spent inspecting the standard briefcases and 300 hours is spent inspecting the specialty briefcases. C. A standard briefcase requires 4 hours of machine time, and a specialty briefcase requires 1.1 hours of machine time. d. The company is considering the use of activity-based costing as an alternative to its traditional costing system for computing unit product costs. The activity-based costing system has already been designed and costs have been allocated to the activity cost pools. The activity cost pools and activity measures are detailed below: Required: 1. Using activity-based costing, determine the amount of manufacturing overhead cost that would be assigned to each standard briefcase and each specialty briefcase. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Standard Specialty Manufacturing overhead cost per unit 2. Using the data computed in part (1) above and other data from the case as needed, determine the unit product cost of each product line from the perspective of the activity-based costing. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Standard Specialty Unit product cost 3-a. Within the limitations of the data that have been provided, evaluate the president's concern about the profitability of the two product lines. (Negative amounts should be indicated by a minus sign. Do not round Intermediate calculations. Round your answers to 2 decimal places.) Standard Briefcase Specialty Briefcase Gross margin (loss) per unit