Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C. Rockwood Industries has 90 million shares outstanding, a current share price of 25, and no debt. Rockwood's management believes that the shares are under-priced,

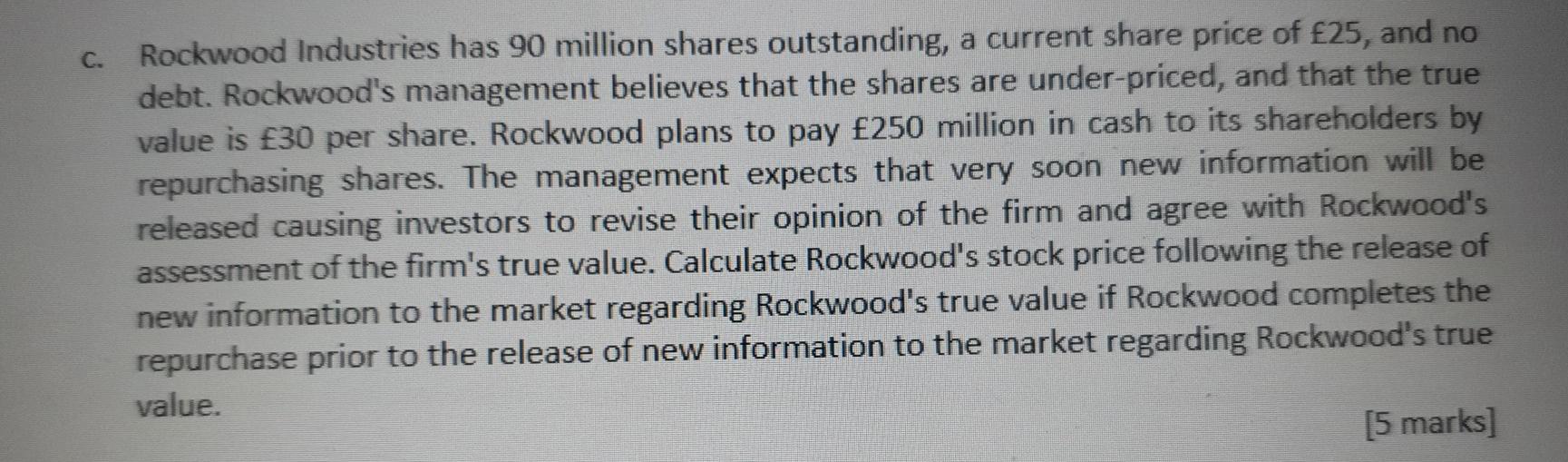

C. Rockwood Industries has 90 million shares outstanding, a current share price of 25, and no debt. Rockwood's management believes that the shares are under-priced, and that the true value is 30 per share. Rockwood plans to pay 250 million in cash to its shareholders by repurchasing shares. The management expects that very soon new information will be released causing investors to revise their opinion of the firm and agree with Rockwood's assessment of the firm's true value. Calculate Rockwood's stock price following the release of new information to the market regarding Rockwood's true value if Rockwood completes the repurchase prior to the release of new information to the market regarding Rockwood's true value. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started