Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C Secure https://newconnect.mheducation.com/flow/connect.html Chapter 3 Homework i 1 1.66 points ebook Mc Graw HIR Print References ype here to search Chapter 3 Homework X

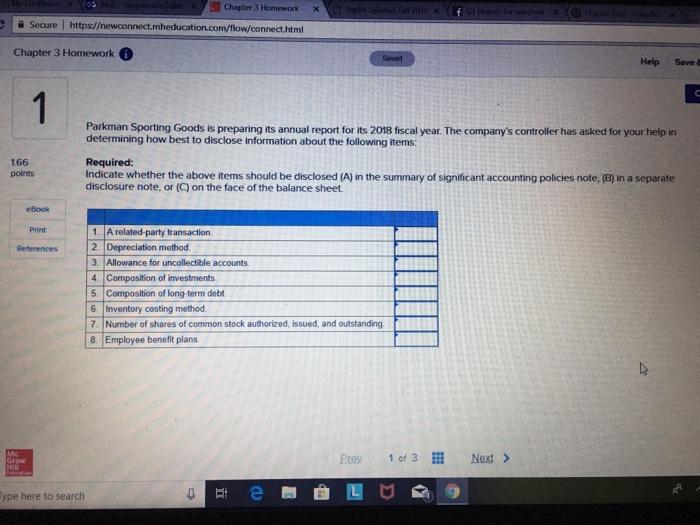

C Secure https://newconnect.mheducation.com/flow/connect.html Chapter 3 Homework i 1 1.66 points ebook Mc Graw HIR Print References ype here to search Chapter 3 Homework X 1. A related-party transaction. 2 Depreciation method 3 Allowance for uncollectible accounts. Composition of investments Composition of long-term debt 4. 5 Parkman Sporting Goods is preparing its annual report for its 2018 fiscal year. The company's controller has asked for your help in determining how best to disclose information about the following items: 0 13: Toplin Syllabus Fall 2016 K Required: Indicate whether the above items should be disclosed (A) in the summary of significant accounting policies note, (B) in a separate disclosure note, or (C) on the face of the balance sheet. 6 Inventory costing method. 7. Number of shares of common stock authorized, issued, and outstanding 8. Employee benefit plans. I Sever e Prev 21 thnes le saghi X 1 of 3 Help Save a Next > 4 C

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION ANSWER Parkman spooting goods in prepating its annual report fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started