Answered step by step

Verified Expert Solution

Question

1 Approved Answer

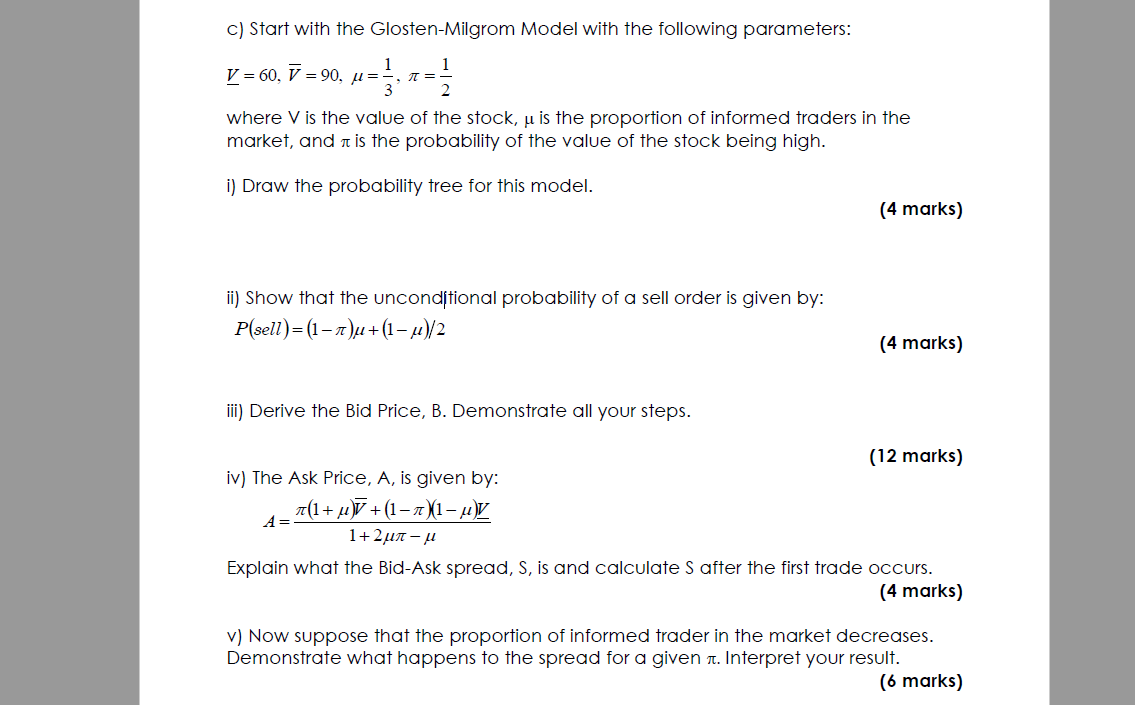

c) Start with the Glosten-Milgrom Model with the following parameters: 1 V = 60, V = 90, =- 3 = where V is the

c) Start with the Glosten-Milgrom Model with the following parameters: 1 V = 60, V = 90, =- 3 = where V is the value of the stock, u is the proportion of informed traders in the market, and is the probability of the value of the stock being high. i) Draw the probability tree for this model. ii) Show that the unconditional probability of a sell order is given by: P(sell)= (1-7)+(1-)/2 iii) Derive the Bid Price, B. Demonstrate all your steps. iv) The Ask Price, A, is given by: (1+ V +(1-7)(1-)V A = (4 marks) (4 marks) (12 marks) 1+2- Explain what the Bid-Ask spread, S, is and calculate S after the first trade occurs. (4 marks) v) Now suppose that the proportion of informed trader in the market decreases. Demonstrate what happens to the spread for a given . Interpret your result. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The GlostenMilgrom Model is a financial model commonly used in market microstructure theory to analyze the bidask spread and trading behavior in finan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started