Answered step by step

Verified Expert Solution

Question

1 Approved Answer

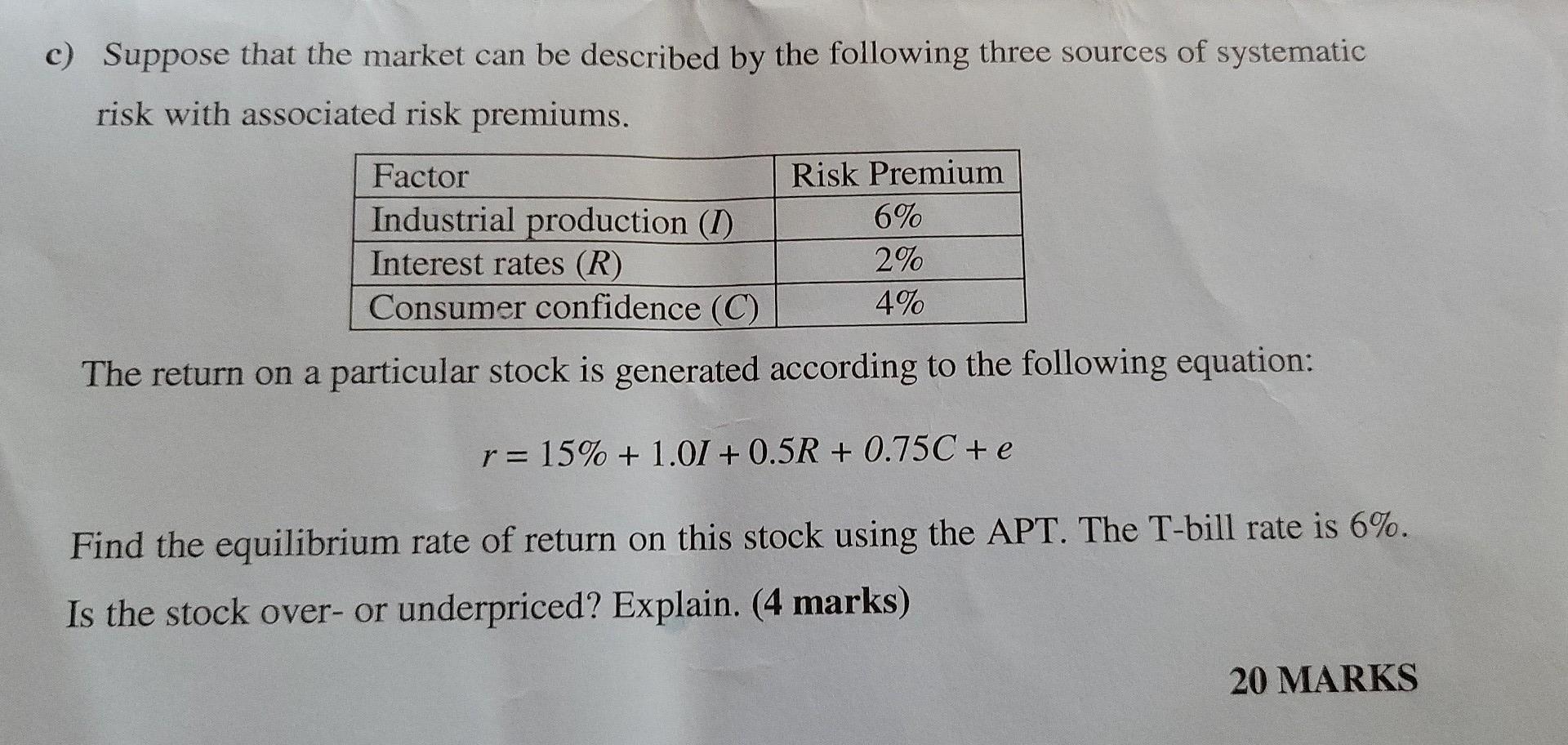

c) Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums. Factor Risk Premium Industrial production

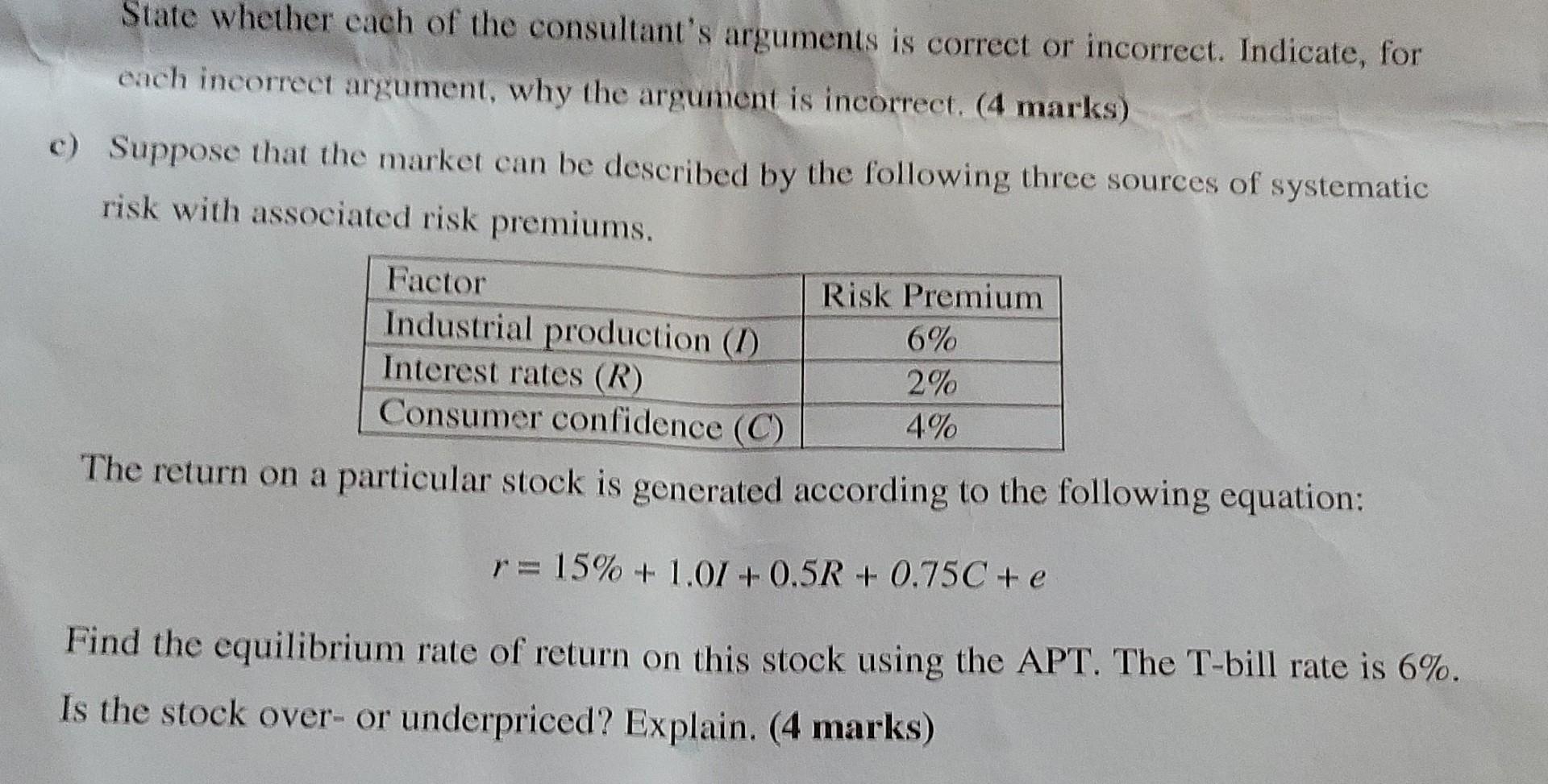

c) Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums. Factor Risk Premium Industrial production (1) 6% Interest rates (R) 2% Consumer confidence (C) 4% The return on a particular stock is generated according to the following equation: r= 15% + 1.01 + 0.5R + 0.75C + e Find the equilibrium rate of return on this stock using the APT. The T-bill rate is 6%. Is the stock over- or underpriced? Explain. (4 marks) 20 MARKS State whether each of the consultant's arguments is correct or incorrect. Indicate, for each incorrect argument, why the argument is incorrect. (4 marks) c) Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums. Factor Risk Premium Industrial production (1) 6% Interest rates (R) 2% Consumer confidence (C) 4% The return on a particular stock is generated according to the following equation: r= 15% + 1.07 +0.5R +0.75C + e Find the equilibrium rate of return on this stock using the APT. The T-bill rate is 6%. Is the stock over- or underpriced? Explain. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started