Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(C) suppose you are considering whether to make particular changes to the benchmark portfolio in part (a). specifically, you are considering whether to increase the

(C) suppose you are considering whether to make particular changes to the benchmark portfolio in part (a). specifically, you are considering whether to increase the real estate allocation to 10% and decrease the bond allocation to 25%. what is the Sharpe ratio for this new portfolio? how does this Sharpe ratio help you to decide whether to make changes to the portfolio in part a?

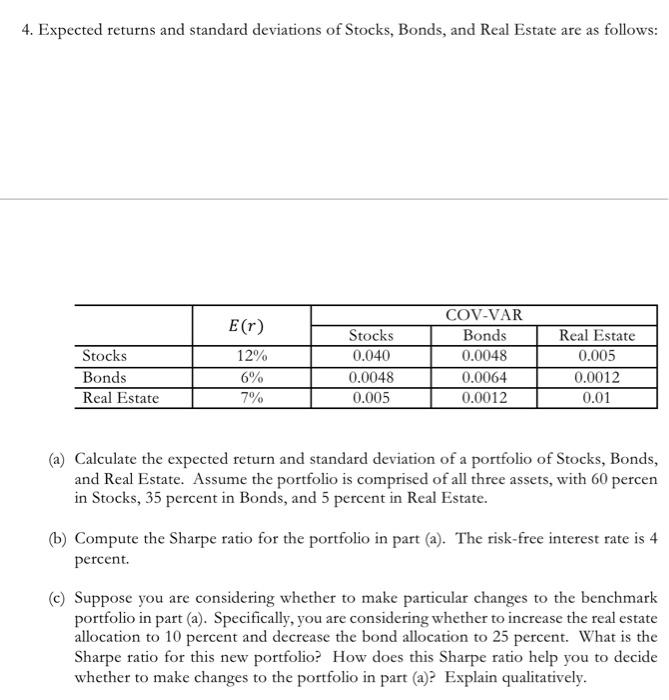

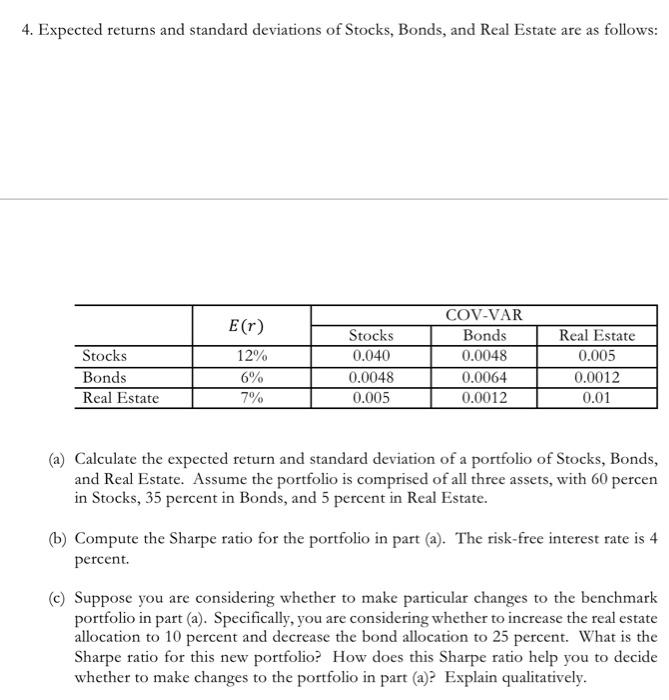

4. Expected returns and standard deviations of Stocks, Bonds, and Real Estate are as follows: (a) Calculate the expected return and standard deviation of a portfolio of Stocks, Bonds, and Real Estate. Assume the portfolio is comprised of all three assets, with 60 percen in Stocks, 35 percent in Bonds, and 5 percent in Real Estate. (b) Compute the Sharpe ratio for the portfolio in part (a). The risk-free interest rate is 4 percent. (c) Suppose you are considering whether to make particular changes to the benchmark portfolio in part (a). Specifically, you are considering whether to increase the real estate allocation to 10 percent and decrease the bond allocation to 25 percent. What is the Sharpe ratio for this new portfolio? How does this Sharpe ratio help you to decide whether to make changes to the portfolio in part (a)? Explain qualitatively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started