Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C The Samsons are trying to determine whether they can claim their 22-year-old adopted son, Jason, as a dependent. Jason is currently a full-time

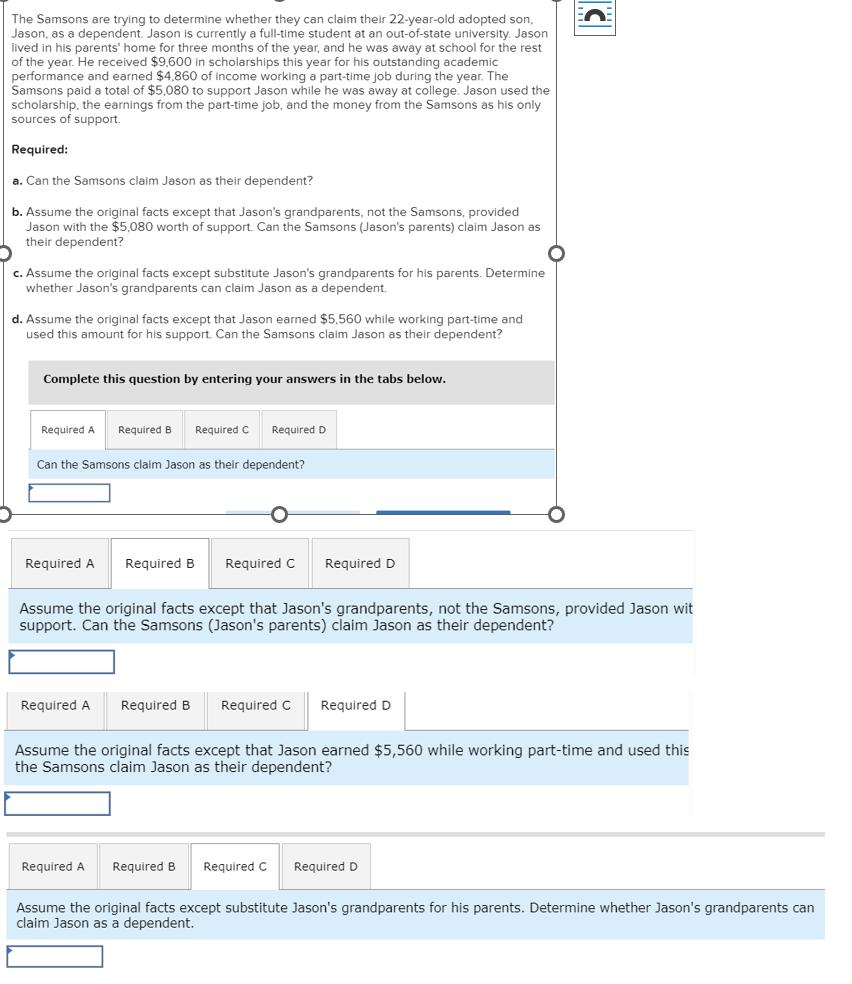

C The Samsons are trying to determine whether they can claim their 22-year-old adopted son, Jason, as a dependent. Jason is currently a full-time student at an out-of-state university. Jason lived in his parents' home for three months of the year, and he was away at school for the rest of the year. He received $9,600 in scholarships this year for his outstanding academic performance and earned $4,860 of Income working a part-time job during the year. The Samsons paid a total of $5,080 to support Jason while he was away at college. Jason used the scholarship, the earnings from the part-time job, and the money from the Samsons as his only sources of support. Required: a. Can the Samsons claim Jason as their dependent? b. Assume the original facts except that Jason's grandparents, not the Samsons, provided Jason with the $5,080 worth of support. Can the Samsons (Jason's parents) claim Jason as their dependent? c. Assume the original facts except substitute Jason's grandparents for his parents. Determine whether Jason's grandparents can claim Jason as a dependent. d. Assume the original facts except that Jason earned $5,560 while working part-time and used this amount for his support. Can the Samsons claim Jason as their dependent? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Can the Samsons claim Jason as their dependent? Required A Required B Required C Required D Assume the original facts except that Jason's grandparents, not the Samsons, provided Jason wit support. Can the Samsons (Jason's parents) claim Jason as their dependent? Required A Required B Required C Required D Assume the original facts except that Jason earned $5,560 while working part-time and used this the Samsons claim Jason as their dependent? Required A Required B Required C Required D Assume the original facts except substitute Jason's grandparents for his parents. Determine whether Jason's grandparents can claim Jason as a dependent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started