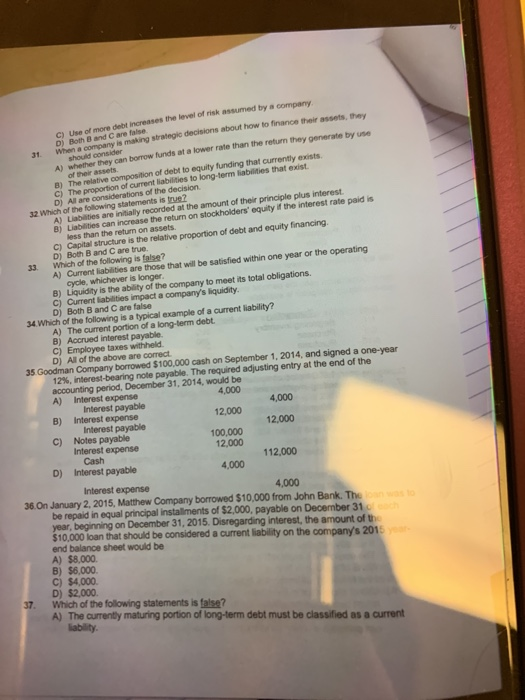

C) Use of more debt increases the level of risk assumed by a company D) Both B and C are false. When a company is making strategic decisions about how to finance their assets, they should consider A) whether they can borrow funds at a lower rate than the return they generate by use of their assets 8) The relative composition of debt to equity funding that currently exists. c) The proportion of current liabilities to long-term liabilities that exist D) All are considerations of the decision 31 A) Liabilities are initially recorded at the amount of their principle plus interest 8) Liabilities can increase the return on stockholders' equity if the interest rate paid is less than the retun on assets. C) Capital structure is the relative proportion of debt and equity financing D) Both B and C are true. Which of the following is false? 32 Which of the following statements is true? 33 A) Current liabilities are those that will be satisfied within one year or the operating cycle, whichever is longer. B) Liquidity is the ability of the company to meet its total obligations. c) Current liabilities impact a company's liquidity D) Both B and C are false 34 Which of the following is a typical example of a current liability? A) The current portion of a long-term debt B) Accrued interest payable C) Employee taxes withheld. D) All of the above are correct 35 Goodman Company borrowed $100,000 cash on September 1, 2014, and signed a one-year 12%, interest-bearing note payable. The required adjusting entry at the end of the accounting period, December 31, 2014, would be Interest expense 4,000 A) Interest payable Interest expense Interest payable C) Notes payable Interest expense Cash D) Interest payable 4,000 12,000 B) 12,000 100,000 12,000 112,000 4,000 Interest expense 4,000 36.On January 2, 2015, Matthew Company borrowed $10,000 from John Bank. Thoan was to be repaid in equal principal installments of $2,000, payable on December 31 ch year, beginning on December 31, 2015. Disregarding interest, the amount of the $10,000 loan that should be considered a current liability on the company's 2015 ya end balance sheet would be A) $8,000 B) $6,000 C) $4,000 D) $2,000 Which of the following statements is false? A) The currently maturing portion of long-term debt must be classified as a current liability. 37