Answered step by step

Verified Expert Solution

Question

1 Approved Answer

c) Your boss believes that the correct expected return for Telestor equals 0,11. Show how you can put together a portfolio of Oljelund, H20Kraft,

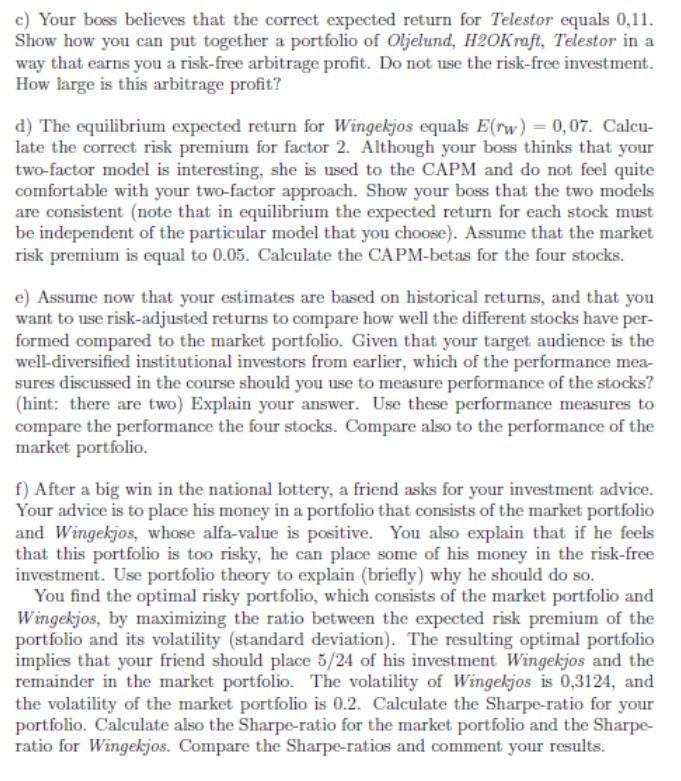

c) Your boss believes that the correct expected return for Telestor equals 0,11. Show how you can put together a portfolio of Oljelund, H20Kraft, Telestor in a way that earns you a risk-free arbitrage profit. Do not use the risk-free investment. How large is this arbitrage profit? d) The equilibrium expected return for Wingekjos equals E(rw) = 0,07. Calcu- late the correct risk premium for factor 2. Although your boss thinks that your two-factor model is interesting, she is used to the CAPM and do not feel quite comfortable with your two-factor approach. Show your boss that the two models are consistent (note that in equilibrium the expected return for each stock must be independent of the particular model that you choose). Assume that the market risk premium is equal to 0.05. Calculate the CAPM-betas for the four stocks. e) Assume now that your estimates are based on historical returns, and that you want to use risk-adjusted returns to compare how well the different stocks have per- formed compared to the market portfolio. Given that your target audience is the well-diversified institutional investors from earlier, which of the performance mea- sures discussed in the course should you use to measure performance of the stocks? (hint: there are two) Explain your answer. Use these performance measures to compare the performance the four stocks. Compare also to the performance of the market portfolio. f) After a big win in the national lottery, a friend asks for your investment advice. Your advice is to place his money in a portfolio that consists of the market portfolio and Wingekjos, whose alfa-value is positive. You also explain that if he feels that this portfolio is too risky, he can place some of his money in the risk-free investment. Use portfolio theory to explain (briefly) why he should do so. You find the optimal risky portfolio, which consists of the market portfolio and Wingekjos, by maximizing the ratio between the expected risk premium of the portfolio and its volatility (standard deviation). The resulting optimal portfolio implies that your friend should place 5/24 of his investment Wingekjos and the remainder in the market portfolio. The volatility of Wingekjos is 0,3124, and the volatility of the market portfolio is 0.2. Calculate the Sharpe-ratio for your portfolio. Calculate also the Sharpe-ratio for the market portfolio and the Sharpe- ratio for Wingekjos. Compare the Sharpe-ratios and comment your results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

c To earn a riskfree arbitrage profit we need to find a combination of Oljelund H2OKraft and Telestor that has an expected return greater than 11 with...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642458cbad8e_983697.pdf

180 KBs PDF File

6642458cbad8e_983697.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started