Your company is considering going public and wants an idea of what its stock price should be. You need to forecast out the companys financial

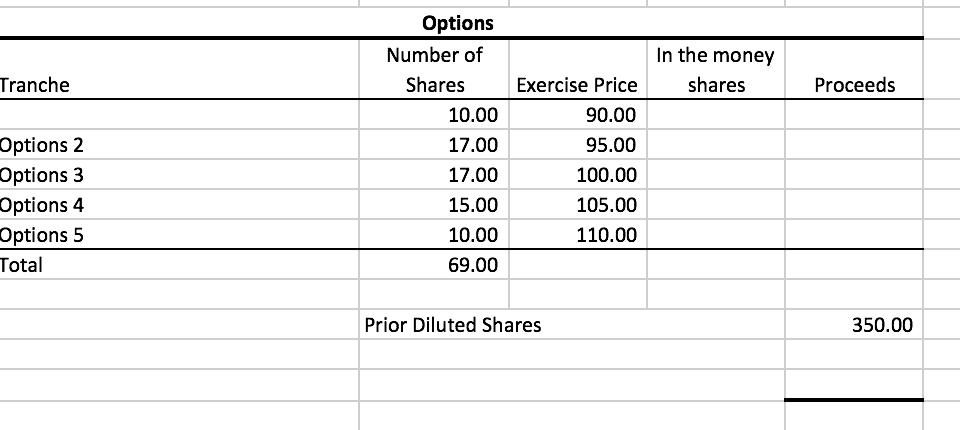

Your company is considering going public and wants an idea of what its stock price should be. You need to forecast out the company’s financial statements for the next five years. Also, create two FCF/DCF analyses, one using the perpetuity method and one using the exit multiple method (EMM), to calculate the stock price for the company. Make sure to include option dilution, the implied perpetuity growth rate (for the EMM sheet), and the implied EBITDA Exit Multiple (for the perpetuity sheet). The discount rate is 15%.

Lastly, create a sensitivity analysis using a one-way data table on both the perpetuity DCF analysis and the EMM DCF analysis sheets. For the perpetuity sheet, create the data table to determine the impact of a 13%, 14%, 15%, 16%, or 17% discount rate on the implied stock price. For the EMM sheet, create the data table to determine the impact of an EBITDA multiple of 13, 14, 15, 16, or 17 on the implied stock price.

Options Number of In the money Tranche Shares Exercise Price shares Proceeds 10.00 90.00 Options 2 Options 3 17.00 95.00 17.00 100.00 Options 4 15.00 105.00 Options 5 Total 10.00 110.00 69.00 Prior Diluted Shares 350.00

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

B F G 1 Scenario 1 2 Loan 3 interest rate Scenano 2 Scenario 3 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started