Answered step by step

Verified Expert Solution

Question

1 Approved Answer

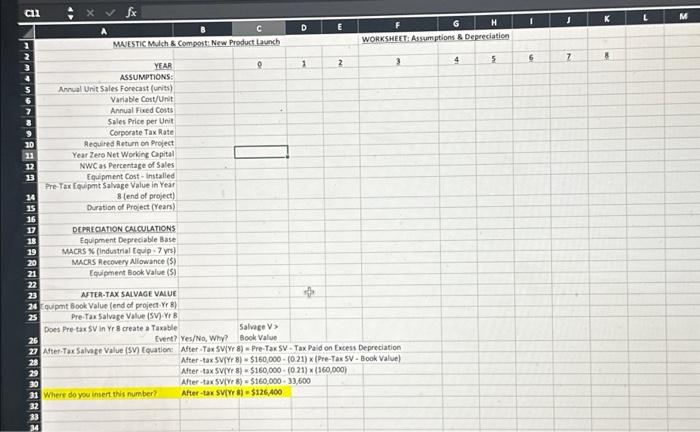

C11 1 2 3 4 5 6 7 MANNNBC 6. 14 19 20 21 25 C MAJESTIC Mulch & Compost: New Product Launch Pre-Tax YEAR

C11 1 2 3 4 5 6 7 MANNNBC 6. 14 19 20 21 25 C MAJESTIC Mulch & Compost: New Product Launch Pre-Tax YEAR ASSUMPTIONS: Annual Unit Sales Forecast (units) Variable Cost/Unit Annual Fixed Costs Sales Price per Unit Corporate Tax Rate Required Return on Project Year Zero Net Working Capital NWC as Percentage of Sales Equipment Cost - Installed Equipmt Salvage Value in Year 8 (end of project) Duration of Project (Years) DEPRECIATION CALCULATIONS Equipment Depreciable Base MACRS % (Industrial Equip - 7 yrs) MACRS Recovery Allowance ($) Equipment Book Value ($) AFTER-TAX SALVAGE VALUE 24 Equipmt Book Value (end of project-Yr 8) Pre-Tax Salvage Value (SV)-Yr 8 Does Pre-tax SV in Yr 8 create a Taxable 0 D 1 E 2 G H WORKSHEET: Assumptions & Depreciation F 3 Salvage V> 26 Event? Yes/No, Why? Book Value 27 After-Tax Salvage Value (SV) Equation: After -Tax SV(Yr 8) = Pre-Tax SV - Tax Paid on Excess Depreciation 28 After-tax SV(Yr 8) = $160,000 - (0.21) x (Pre-Tax SV - Book Value) 29 After-tax SV(Yr 8) = $160,000 - (0.21) x (160,000) 30 After-tax SV(Yr 8) = $160,000 - 33,600 31 Where do you insert this number? After-tax SV(Yr 8) = $126,400 32 33 34 4 5 I 6 J 7 K 8 L M

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started