Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C11-5 Royal Dutch Shell PLC: Identifying differences and similarities between IFRS and GAAP (LO 11-10) 4. How does the the impairment loss affe ment

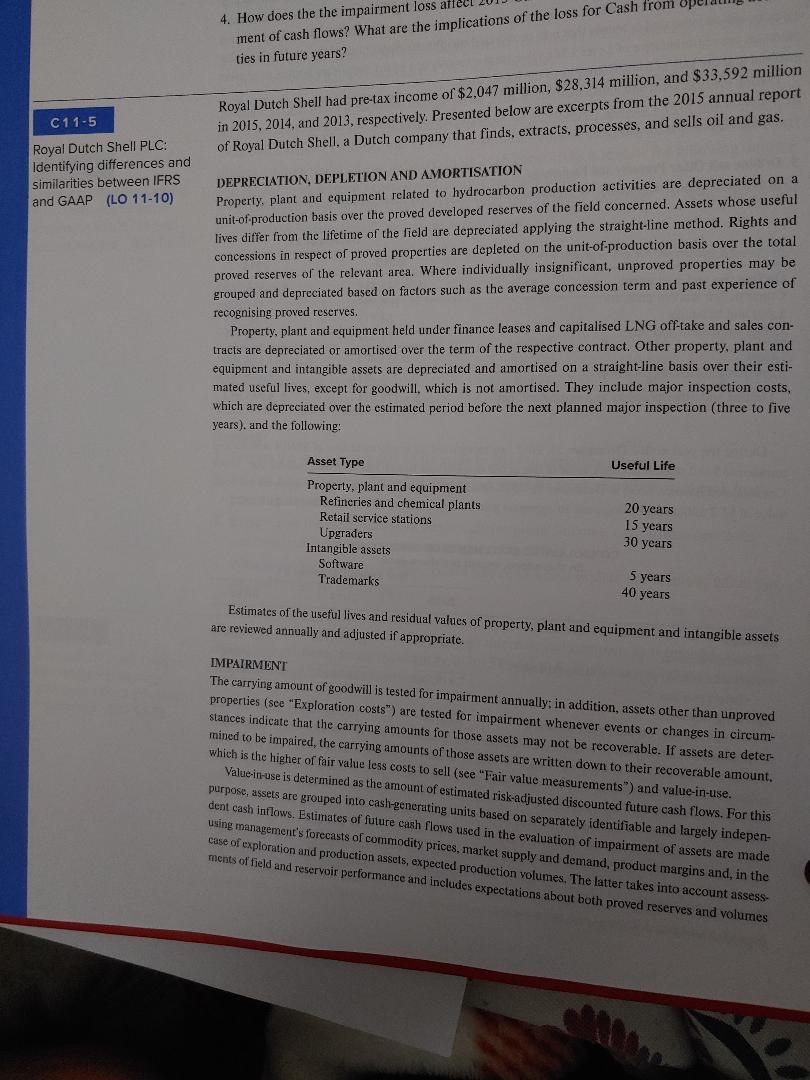

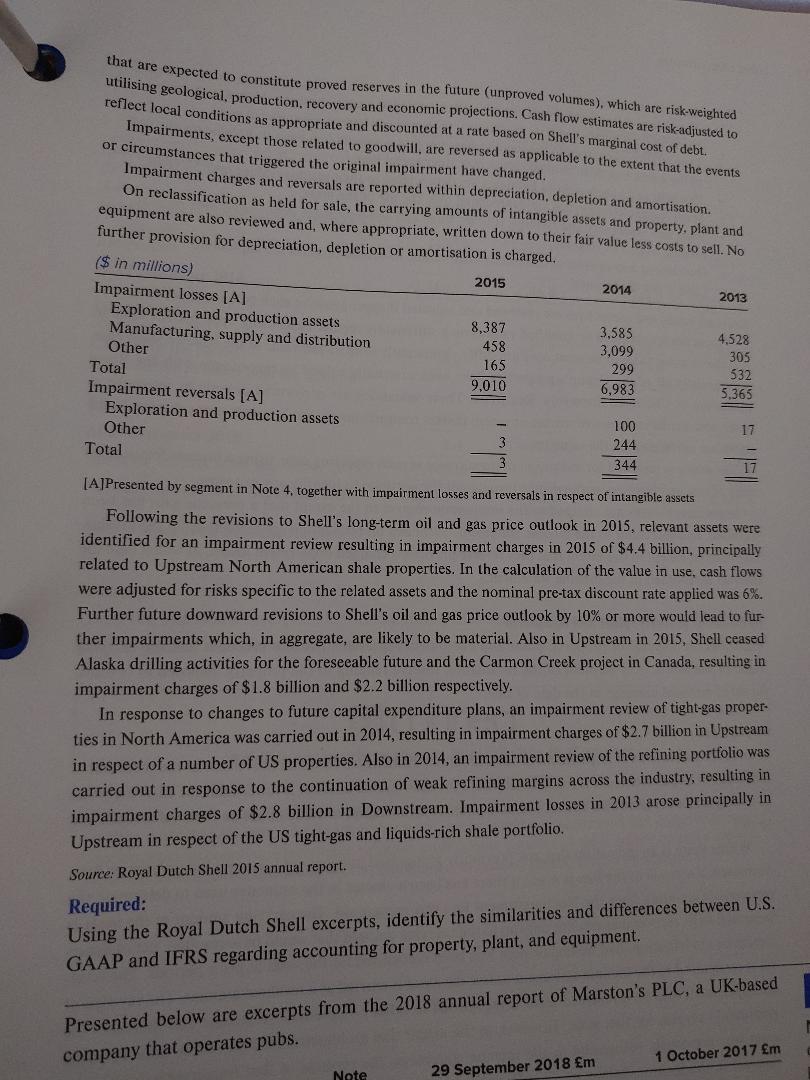

C11-5 Royal Dutch Shell PLC: Identifying differences and similarities between IFRS and GAAP (LO 11-10) 4. How does the the impairment loss affe ment of cash flows? What are the implications of the loss for Cash from ties in future years? Royal Dutch Shell had pre-tax income of $2,047 million, $28,314 million, and $33,592 million in 2015, 2014, and 2013, respectively. Presented below are excerpts from the 2015 annual report of Royal Dutch Shell, a Dutch company that finds, extracts, processes, and sells oil and gas. DEPRECIATION, DEPLETION AND AMORTISATION Property, plant and equipment related to hydrocarbon production activities are depreciated on a unit-of-production basis over the proved developed reserves of the field concerned. Assets whose useful lives differ from the lifetime of the field are depreciated applying the straight-line method. Rights and concessions in respect of proved properties are depleted on the unit-of-production basis over the total proved reserves of the relevant area. Where individually insignificant, unproved properties may be grouped and depreciated based on factors such as the average concession term and past experience of recognising proved reserves. Property, plant and equipment held under finance leases and capitalised LNG off-take and sales con- tracts are depreciated or amortised over the term of the respective contract. Other property, plant and equipment and intangible assets are depreciated and amortised on a straight-line basis over their esti- mated useful lives, except for goodwill, which is not amortised. They include major inspection costs, which are depreciated over the estimated period before the next planned major inspection (three to five years), and the following: Asset Type Property, plant and equipment Refineries and chemical plants Retail service stations Upgraders Intangible assets Software Trademarks Useful Life 20 years 15 years 30 years 5 years 40 years Estimates of the useful lives and residual values of property, plant and equipment and intangible assets are reviewed annually and adjusted if appropriate. IMPAIRMENT The carrying amount of goodwill is tested for impairment annually; in addition, assets other than unproved properties (see "Exploration costs") are tested for impairment whenever events or changes in circum- stances indicate that the carrying amounts for those assets may not be recoverable. If assets are deter- mined to be impaired, the carrying amounts of those assets are written down to their recoverable amount. which is the higher of fair value less costs to sell (see "Fair value measurements") and value-in-use. Value-in-use is determined as the amount of estimated risk-adjusted discounted future cash flows. For this purpose, assets are grouped into cash-generating units based on separately identifiable and largely indepen- dent cash inflows. Estimates of future cash flows used in the evaluation of impairment of assets are made using management's forecasts of commodity prices, market supply and demand, product margins and, in the case of exploration and production assets, expected production volumes. The latter takes into account assess- ments of field and reservoir performance and includes expectations about both proved reserves and volumes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started