C.17 P.3

C.17 P.3

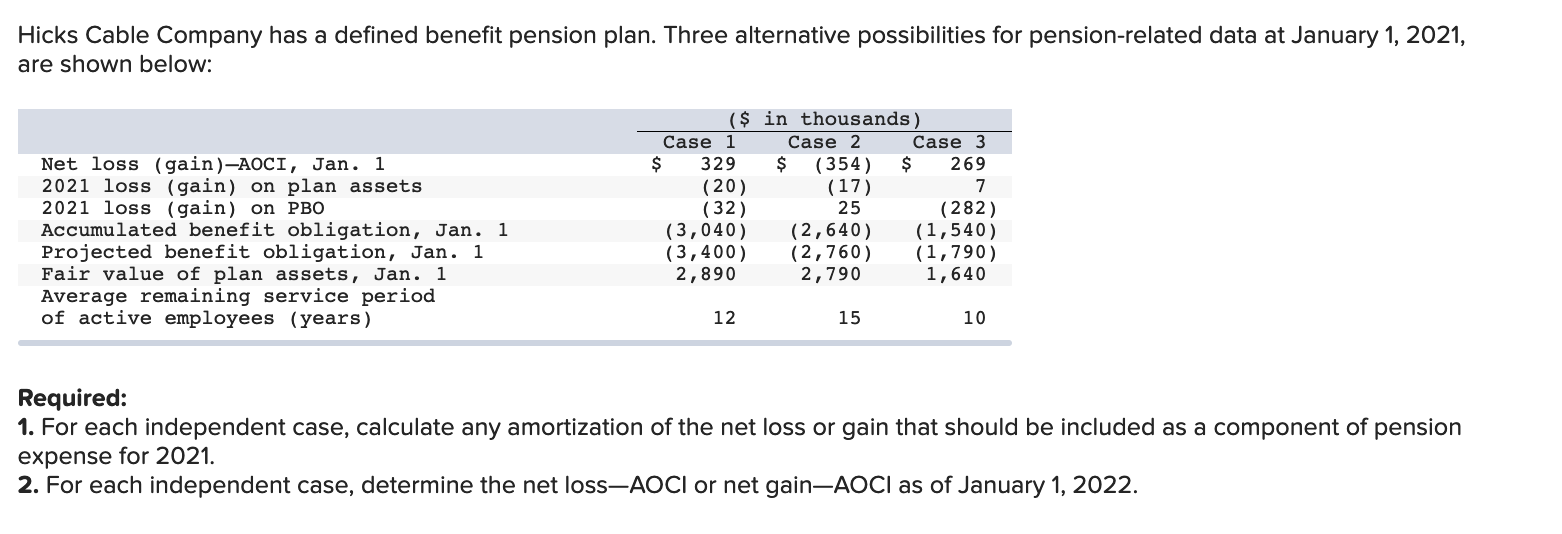

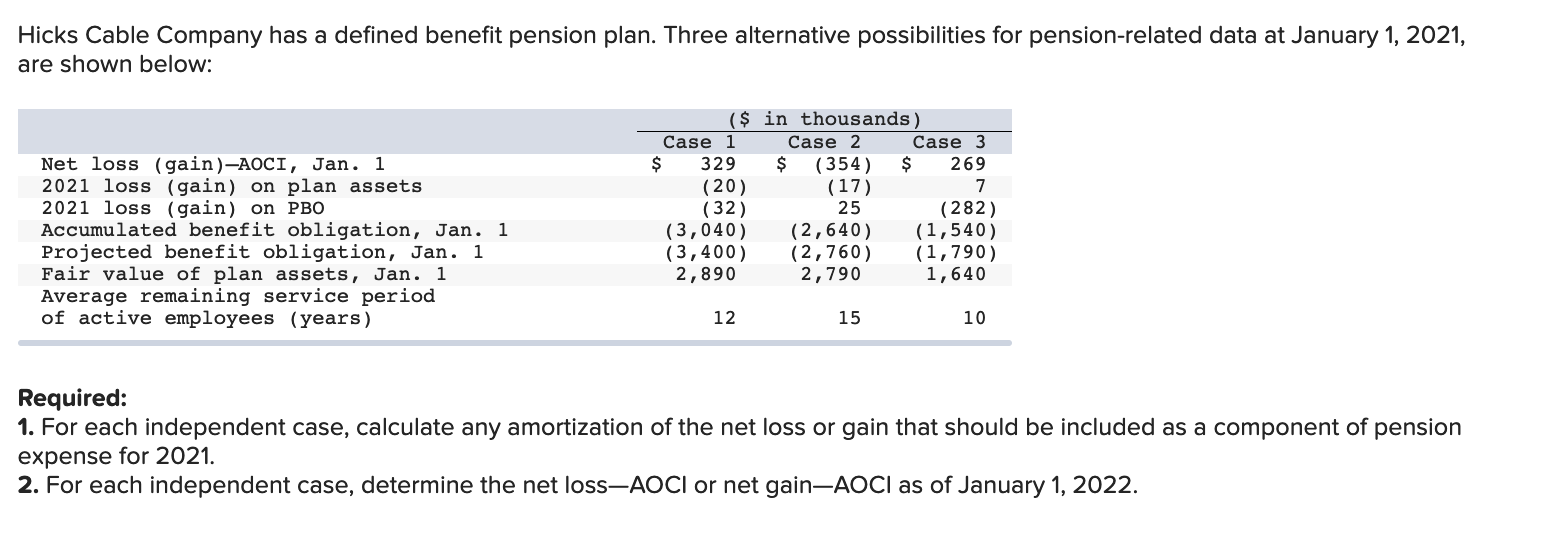

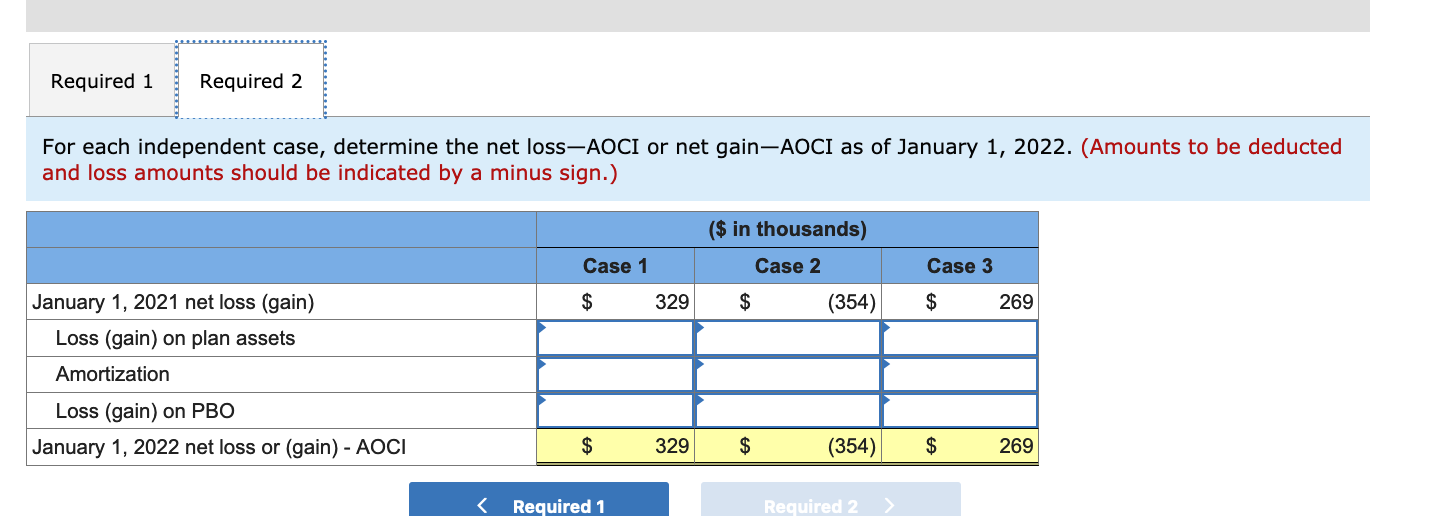

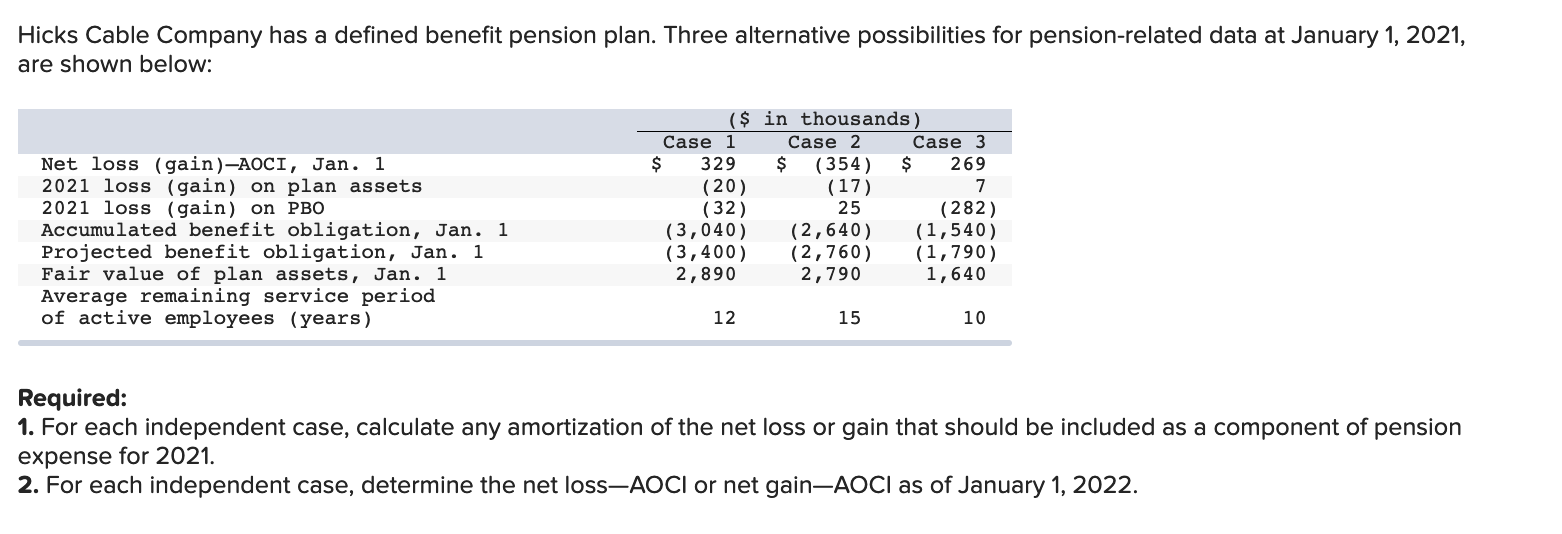

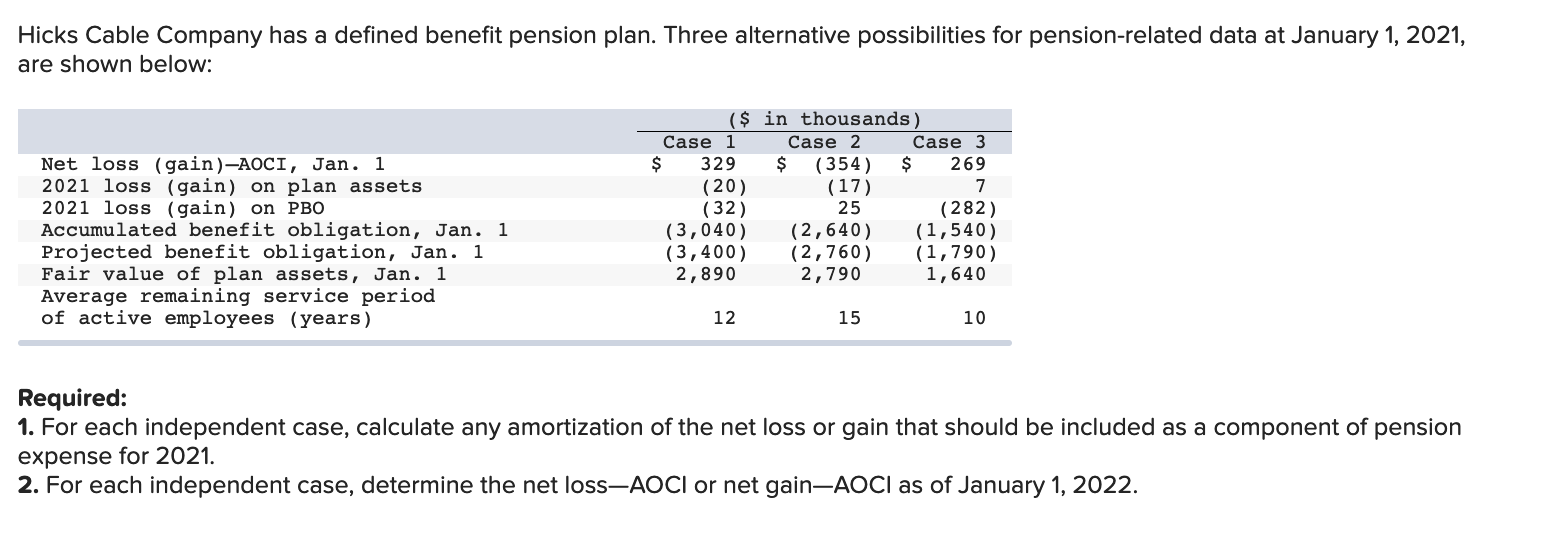

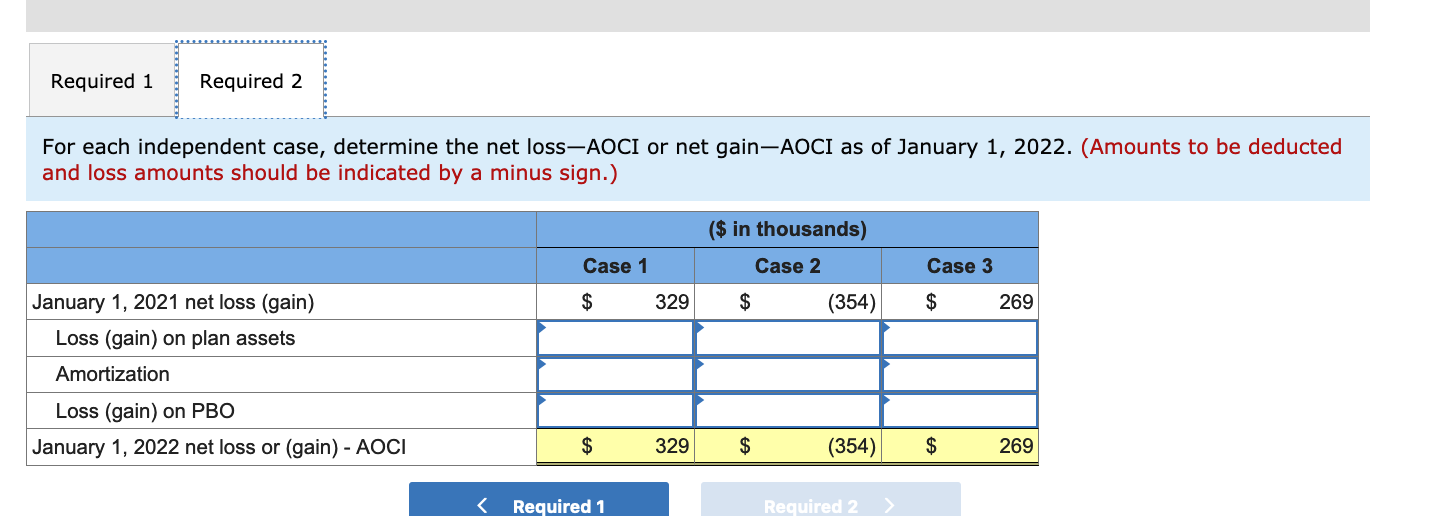

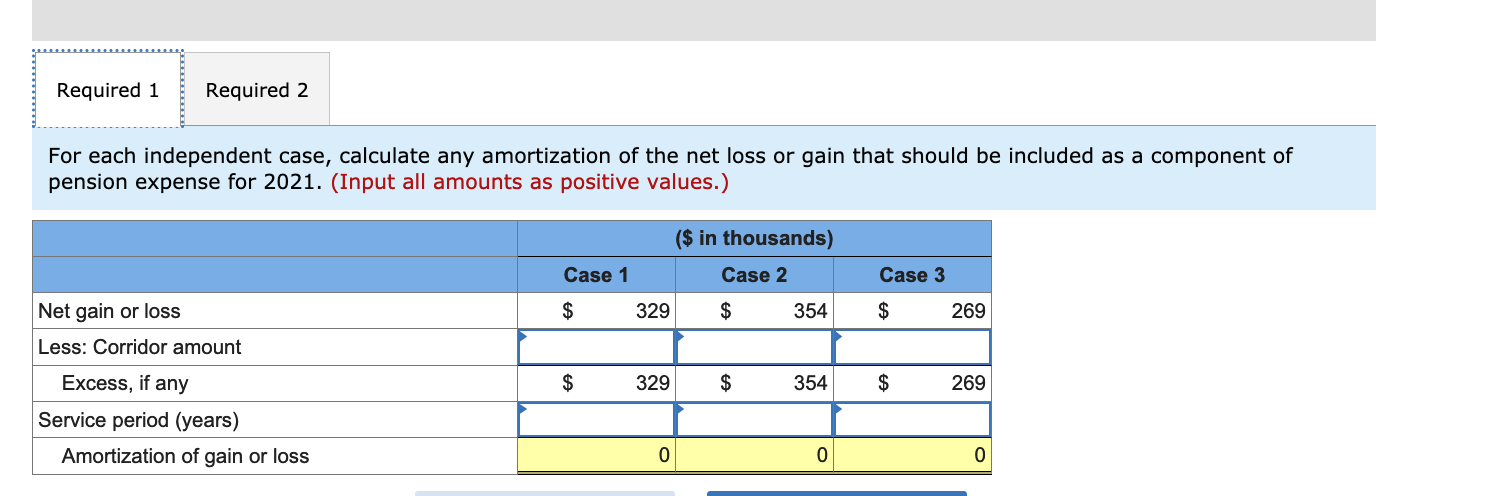

Required 1 Required 2 For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021. (Input all amounts as positive values.) ($ in thousands) Case 1 Case 2 Case 3 $ 329 $ 354 $ 269 Net gain or loss Less: Corridor amount $ 329 $ 354 $ 269 Excess, if any Service period (years) Amortization of gain or loss 0 0 0 Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021, are shown below: Net loss (gain)-AOCI, Jan. 1 2021 loss (gain) on plan assets 2021 loss (gain) on PBO Accumulated benefit obligation, Jan. 1 Projected benefit obligation, Jan. 1 Fair value of plan assets, Jan. 1 Average remaining service period of active employees (years) ($ in thousands Case 1 Case 2 Case 3 $ 329 $ (354) $ 269 (20) (17) 7 (32) 25 (282) (3,040) (2,640) (1,540) (3,400) (2,760) (1,790) 2,890 2,790 1,640 12 15 10 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021. 2. For each independent case, determine the net loss-AOCI or net gainAOCI as of January 1, 2022. Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021, are shown below: Net loss (gain)-AOCI, Jan. 1 2021 loss (gain) on plan assets 2021 loss (gain) on PBO Accumulated benefit obligation, Jan. 1 Projected benefit obligation, Jan. 1 Fair value of plan assets, Jan. 1 Average remaining service period of active employees (years) ($ in thousands Case 1 Case 2 Case 3 $ 329 $ (354) $ 269 (20) (17) 7 (32) 25 (282) (3,040) (2,640) (1,540) (3,400) (2,760) (1,790) 2,890 2,790 1,640 12 15 10 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021. 2. For each independent case, determine the net loss-AOCI or net gainAOCI as of January 1, 2022. Required 1 Required 2 For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022. (Amounts to be deducted and loss amounts should be indicated by a minus sign.) ($ in thousands) Case 1 Case 2 Case 3 $ 329 $ (354) $ 269 January 1, 2021 net loss (gain) Loss (gain) on plan assets Amortization Loss (gain) on PBO January 1, 2022 net loss or (gain) - AOCI $ 329 $ (354) $ 269 Required 1 Required 2 >

C.17 P.3

C.17 P.3