Answered step by step

Verified Expert Solution

Question

1 Approved Answer

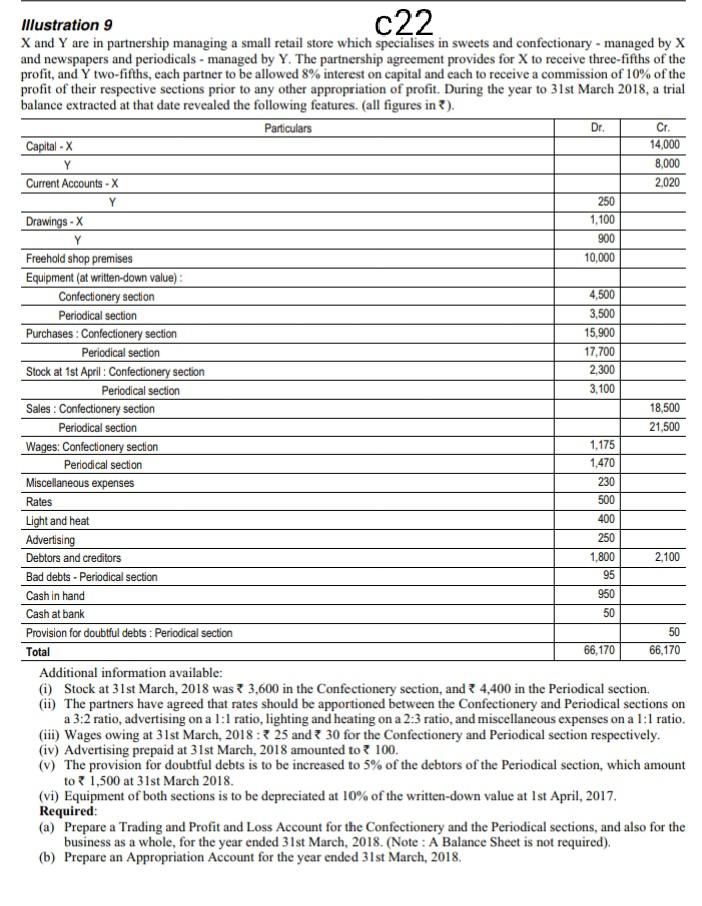

c22 Y Y Illustration 9 X and Y are in partnership managing a small retail store which specialises in sweets and confectionary - managed by

c22 Y Y Illustration 9 X and Y are in partnership managing a small retail store which specialises in sweets and confectionary - managed by X and newspapers and periodicals - managed by Y. The partnership agreement provides for X to receive three-fifths of the profit, and Y two-fifths, each partner to be allowed 8% interest on capital and each to receive a commission of 10% of the profit of their respective sections prior to any other appropriation of profit. During the year to 31st March 2018, a trial balance extracted at that date revealed the following features. (all figures in ). Particulars Dr. Cr. Capital - X 14,000 8,000 Current Accounts - X 2.020 250 Drawings - X 1.100 Y 900 Freehold shop premises 10,000 Equipment (at written-down value) Confectionery section 4,500 Periodical section 3,500 Purchases: Confectionery section 15,900 Periodical section 17,700 Stock at 1st April : Confectionery section 2,300 Periodical section 3,100 Sales : Confectionery section 18,500 Periodical section 21,500 Wages: Confectionery section 1.175 Periodical section 1,470 Miscellaneous expenses 230 Rates 500 Light and heat 400 Advertising 250 Debtors and creditors 1,800 2,100 Bad debts - Periodical section 95 Cash in hand 950 Cash at bank 50 Provision for doubtful debts : Periodical section 50 Total 66,170 66,170 Additional information available: (1) Stock at 31st March, 2018 was 3,600 in the Confectionery section, and 4,400 in the Periodical section. (ii) The partners have agreed that rates should be apportioned between the Confectionery and Periodical sections on a 3:2 ratio, advertising on a l:1 ratio, lighting and heating on a 2:3 ratio, and miscellaneous expenses on a 1:1 ratio. (iii) Wages owing at 31st March, 2018 : 25 and 30 for the Confectionery and Periodical section respectively. (iv) Advertising prepaid at 31st March, 2018 amounted to 100. (1) The provision for doubtful debts is to be increased to 5% of the debtors of the Periodical section, which amount to 1,500 at 31st March 2018. (vi) Equipment of both sections is to be depreciated at 10% of the written-down value at 1st April, 2017. Required: (a) Prepare a Trading and Profit and Loss Account for the Confectionery and the Periodical sections, and also for the business as a whole, for the year ended 31st March, 2018. (Note: A Balance Sheet is not required) (b) Prepare an Appropriation Account for the year ended 31st March, 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started