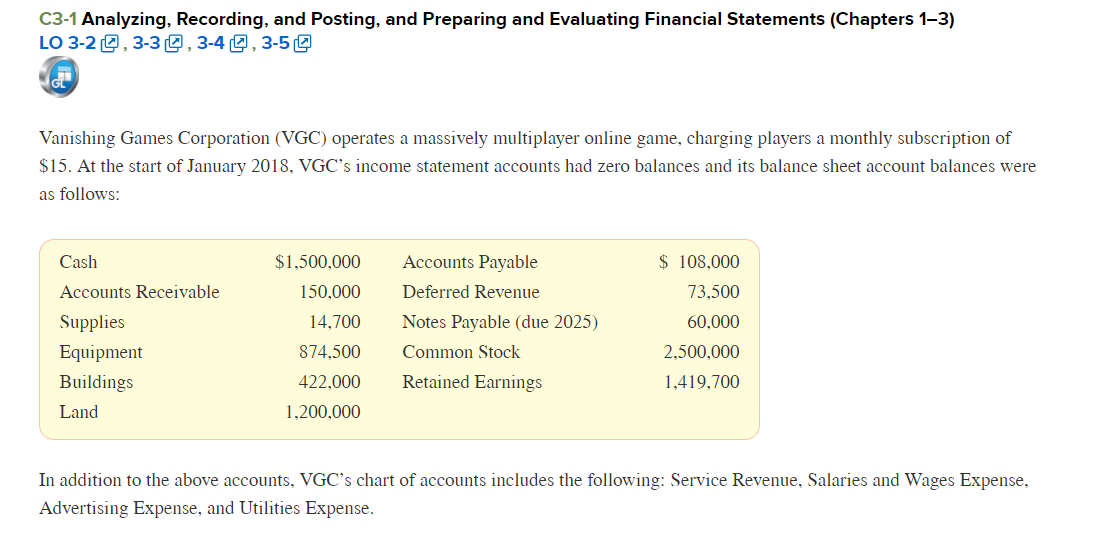

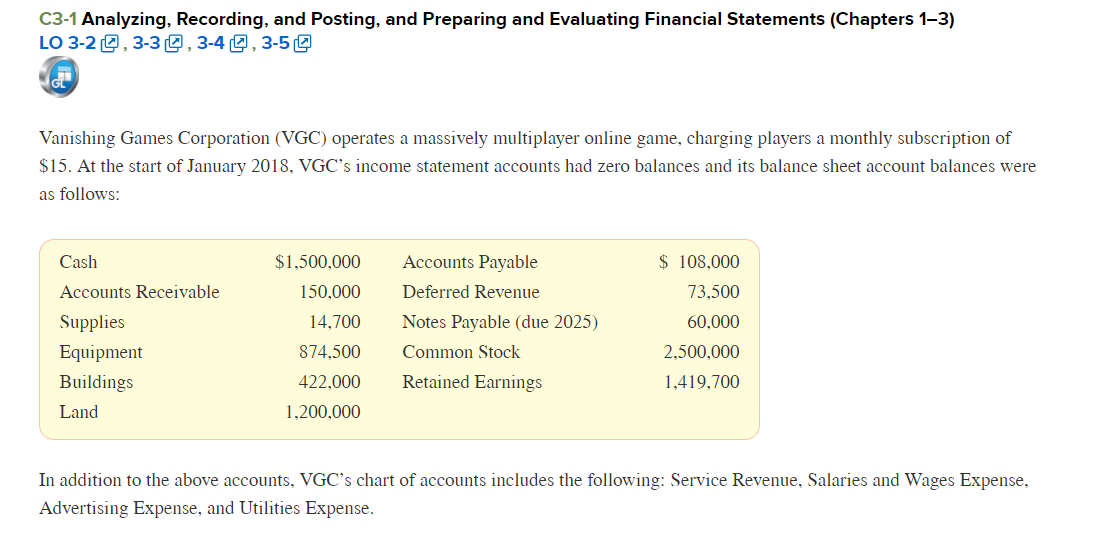

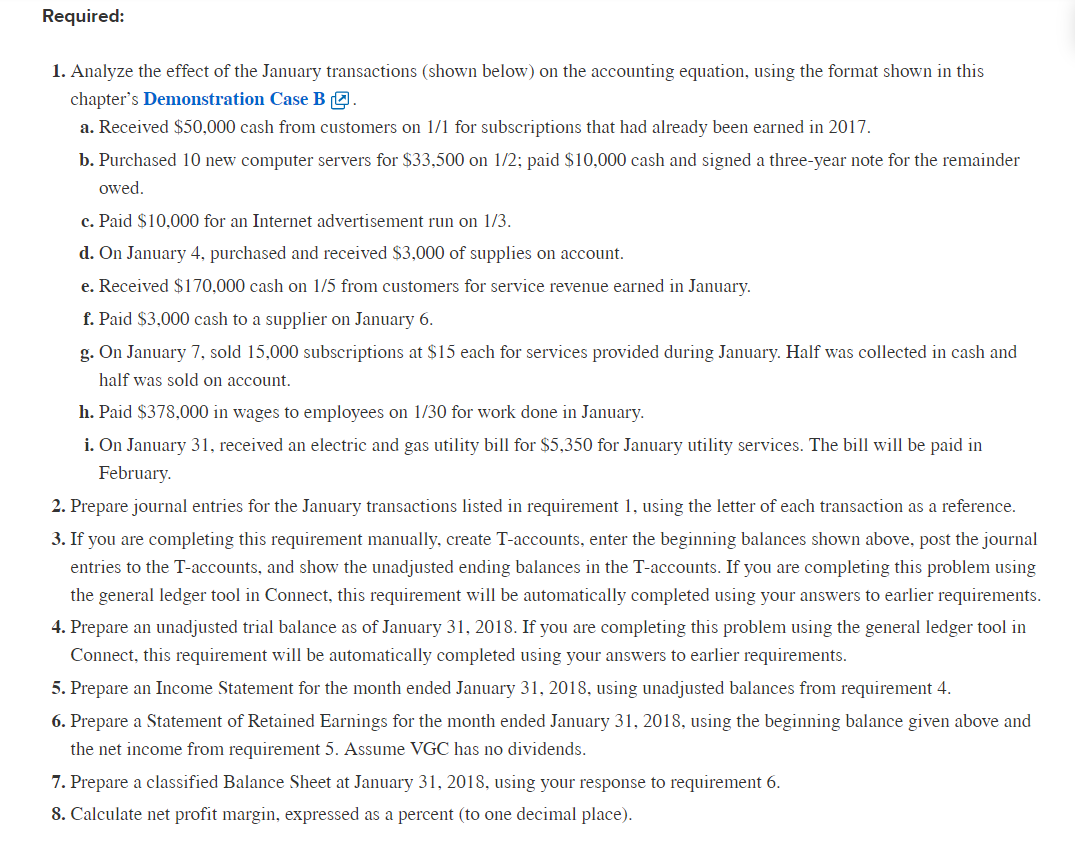

C3-1 Analyzing, Recording, and Posting, and Preparing and Evaluating Financial Statements (Chapters 1-3) LO 3-2,3-3,3-4, 3-5 Vanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a monthly subscription of $15. At the start of January 2018, VGC's income statement accounts had zero balances and its balance sheet account balances were as follows: Cash $1,500,000 150,000 Accounts Receivable 14,700 Accounts Payable Deferred Revenue Notes Payable (due 2025) Common Stock Retained Earnings Supplies Equipment Buildings Land $ 108,000 73,500 60.000 2,500,000 1,419,700 874,500 422,000 1,200,000 In addition to the above accounts, VGC's chart of accounts includes the following: Service Revenue, Salaries and Wages Expense, Advertising Expense, and Utilities Expense. Required: 1. Analyze the effect of the January transactions (shown below) on the accounting equation, using the format shown in this chapter's Demonstration Case B Q. a. Received $50,000 cash from customers on 1/1 for subscriptions that had already been earned in 2017. b. Purchased 10 new computer servers for $33,500 on 1/2; paid $10,000 cash and signed a three-year note for the remainder owed. c. Paid $10,000 for an Internet advertisement run on 1/3. d. On January 4, purchased and received $3,000 of supplies on account. e. Received $170,000 cash on 1/5 from customers for service revenue earned in January. f. Paid $3,000 cash to a supplier on January 6. g. On January 7, sold 15,000 subscriptions at $15 each for services provided during January. Half was collected in cash and half was sold on account. h. Paid $378,000 in wages to employees on 1/30 for work done in January. i. On January 31, received an electric and gas utility bill for $5,350 for January utility services. The bill will be paid in February 2. Prepare journal entries for the January transactions listed in requirement 1, using the letter of each transaction as a reference. 3. If you are completing this requirement manually, create T-accounts, enter the beginning balances shown above, post the journal entries to the T-accounts, and show the unadjusted ending balances in the T-accounts. If you are completing this problem using the general ledger tool in Connect, this requirement will be automatically completed using your answers to earlier requirements. 4. Prepare an unadjusted trial balance as of January 31, 2018. If you are completing this problem using the general ledger tool in Connect, this requirement will be automatically completed using your answers to earlier requirements. 5. Prepare an Income Statement for the month ended January 31, 2018, using unadjusted balances from requirement 4. 6. Prepare a Statement of Retained Earnings for the month ended January 31, 2018, using the beginning balance given above and the net income from requirement 5. Assume VGC has no dividends. 7. Prepare a classified Balance Sheet at January 31, 2018, using your response to requirement 6. 8. Calculate net profit margin, expressed as a percent (to one decimal place)