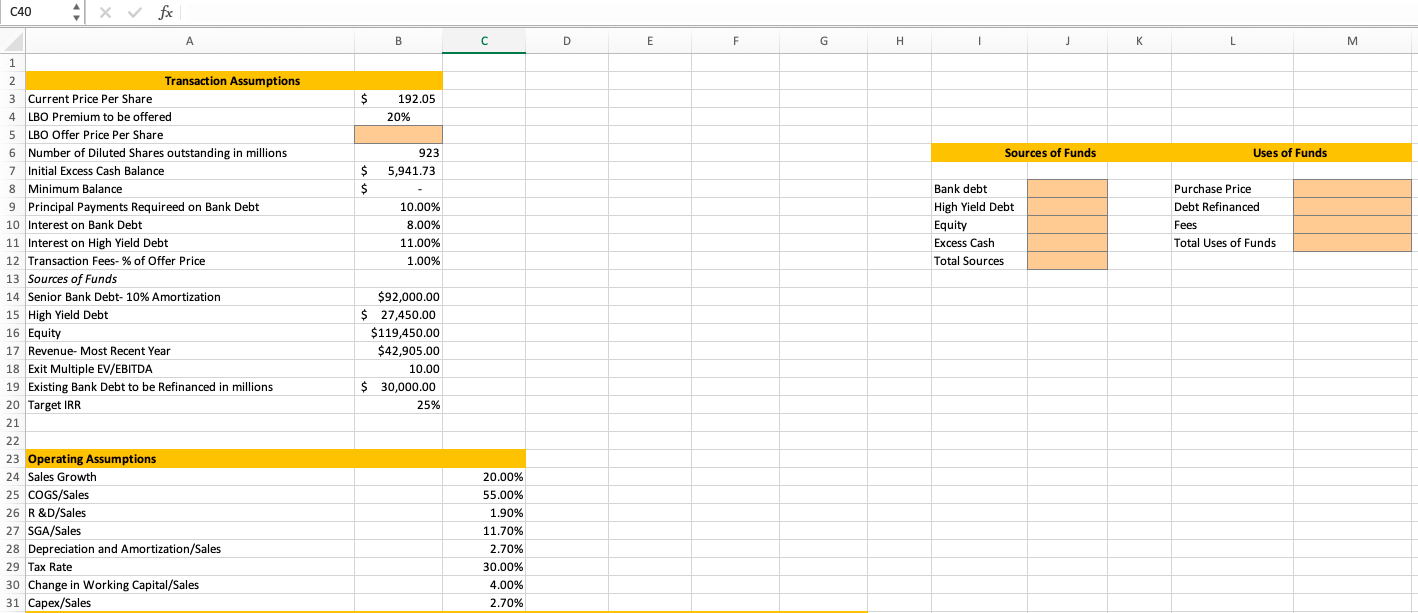

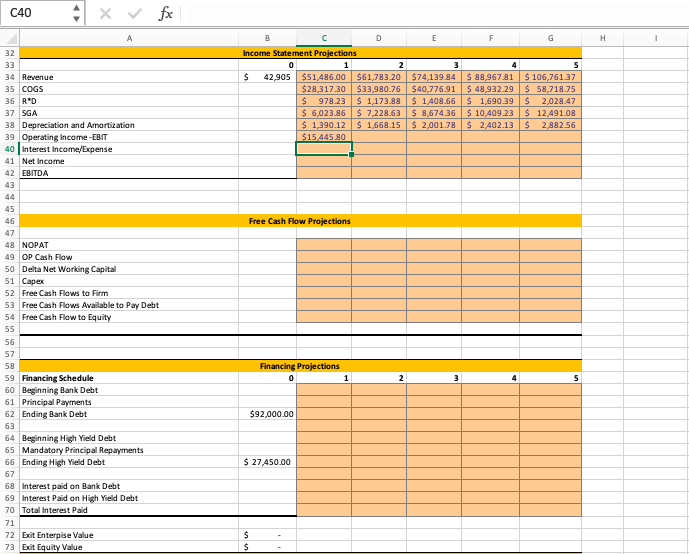

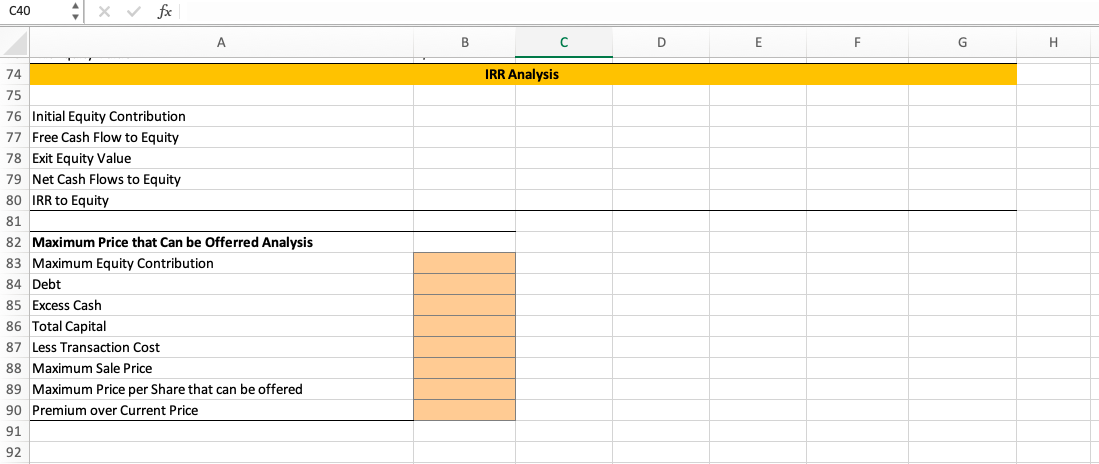

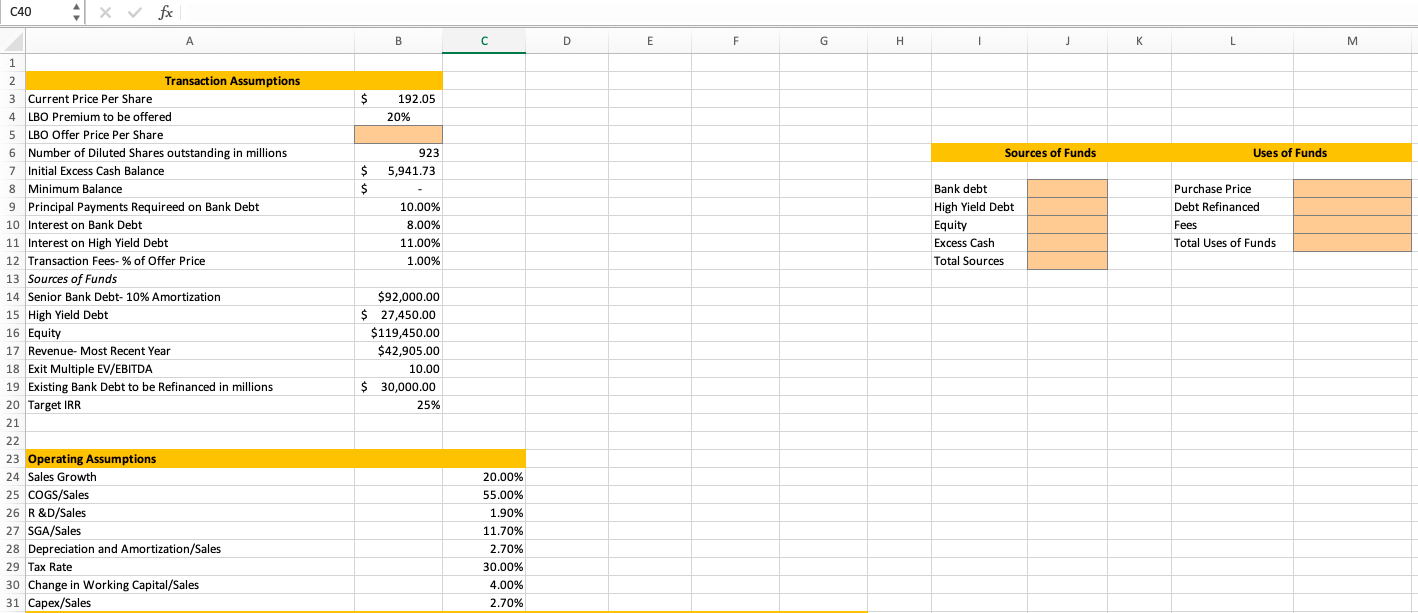

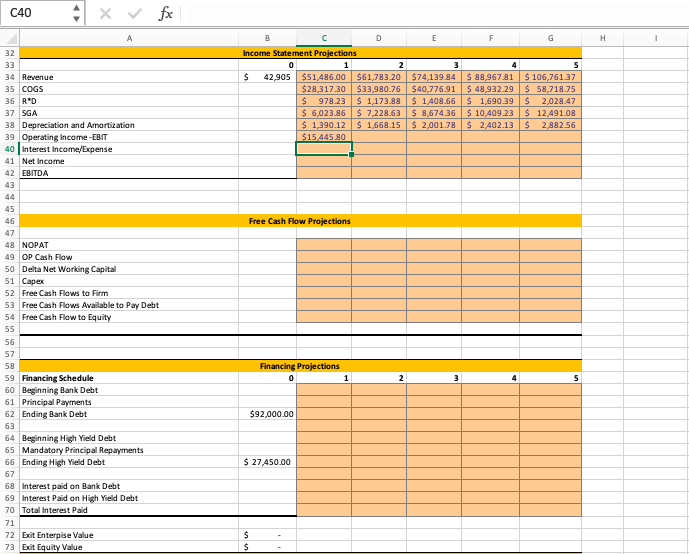

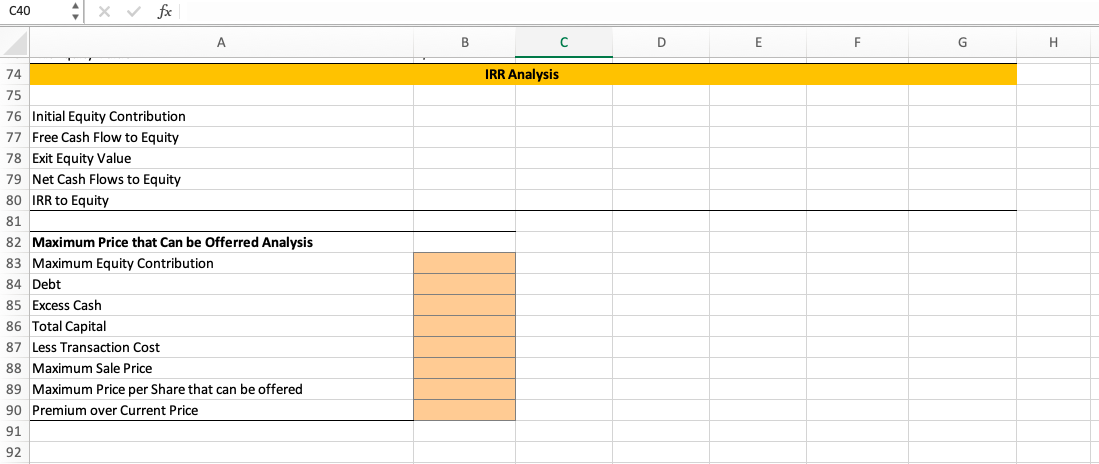

C40 4 xv fx B D E F G . j K L $ 192.05 20% Sources of Funds Uses of Funds 923 5,941.73 $ $ 10.00% 8.00% 11.00% 1.00% Bank debt High Yield Debt Equity Excess Cash Total Sources Purchase Price Debt Refinanced Fees Total Uses of Funds 1 2 Transaction Assumptions 3 Current Price Per Share 4 LBO Premium to be offered 5 LBO Offer Price Per Share 6 Number of Diluted Shares outstanding in millions 7 Initial Excess Cash Balance 8 Minimum Balance 9 Principal Payments Requireed on Bank Debt 10 Interest on Bank Debt 11 Interest on High Yield Debt 12 Transaction Fees- % of Offer Price 13 Sources of Funds 14 Senior Bank Debt- 10% Amortization 15 High Yield Debt 16 Equity 17 Revenue- Most Recent Year 18 Exit Multiple EV/EBITDA 19 Existing Bank Debt to be Refinanced in millions 20 Target IRR 21 22 23 Operating Assumptions 24 Sales Growth 25 COGS/Sales 26 R&D/Sales 27 SGA/Sales 28 Depreciation and Amortization/Sales 29 Tax Rate 30 Change in Working Capital/Sales 31 Capex/Sales $92,000.00 $ 27.450.00 $119,450.00 $42,905.00 10.00 $ 30,000.00 25% 20.00% 55.00% 1.90% 11.70% 2.70% 30.00% 4.00% 2.70% C40 A xv fx A D E G H 32 33 34 Revenue 35 COGS 36 RED 37 SGA 38 Depreciation and Amortization 39 Operating Income-EBIT 40 Interest Income/Expense 41 Net Income 42 EBITDA 43 Income Statement Projections 0 1 2 $ 42,905 $51,486.00 $61,783.20 $28,317.30 $33.980.76 $ 978.23 $ 1,173.88 $ 6,023.86 $ 7.228.63 $ 1,390.12 $ 1,668.15 $15 445 80 $74,139.84 $40.776.91 $ 1,408.66 $ 8,674.36 $ 2,001.78 4 5 $ 88,967.81 $ 106,761.37 $ 48,932.29 $ 58,718.75 $ 1,690.39 $ 2,028.47 $ 10,409.23 $ 12,491.08 $ 2,402.13 $ 2.882.56 Free Cash Flow Projections 45 46 47 48 NOPAT 49 OP Cash Flow 50 Delta Net Working Capital 51 Capex 52 Free Cash Flows to Firm 53 Free Cash Flows Available to Pay Debt 54 Free Cash Flow to Equity 55 56 57 58 59 Financing Schedule 60 Beginning Bank Debt 61 Principal Payments 62 Ending Bank Debt 63 64 Beginning High Yield Debt 65 Mandatory Principal Repayments 66 Ending High Yield Debt 67 68 Interest paid on Bank Debt 69 Interest Paid on High Yield Debt 70 Total Interest Paid 71 72 Exit Enterpise Value 73 Edt Equity Value Financing Projections 0 1 2 3 4 5 $92,000.00 $ 27,450.00 $ $ C40 A x fx A B D E F G H IRR Analysis 74 75 76 Initial Equity Contribution 77 Free Cash Flow to Equity 78 Exit Equity Value 79 Net Cash Flows to Equity 80 IRR to Equity 81 82 Maximum Price that can be Offerred Analysis 83 Maximum Equity Contribution 84 Debt 85 Excess Cash 86 Total Capital 87 Less Transaction Cost 88 Maximum Sale Price 89 Maximum Price per Share that can be offered 90 Premium over Current Price 91 92 C40 4 xv fx B D E F G . j K L $ 192.05 20% Sources of Funds Uses of Funds 923 5,941.73 $ $ 10.00% 8.00% 11.00% 1.00% Bank debt High Yield Debt Equity Excess Cash Total Sources Purchase Price Debt Refinanced Fees Total Uses of Funds 1 2 Transaction Assumptions 3 Current Price Per Share 4 LBO Premium to be offered 5 LBO Offer Price Per Share 6 Number of Diluted Shares outstanding in millions 7 Initial Excess Cash Balance 8 Minimum Balance 9 Principal Payments Requireed on Bank Debt 10 Interest on Bank Debt 11 Interest on High Yield Debt 12 Transaction Fees- % of Offer Price 13 Sources of Funds 14 Senior Bank Debt- 10% Amortization 15 High Yield Debt 16 Equity 17 Revenue- Most Recent Year 18 Exit Multiple EV/EBITDA 19 Existing Bank Debt to be Refinanced in millions 20 Target IRR 21 22 23 Operating Assumptions 24 Sales Growth 25 COGS/Sales 26 R&D/Sales 27 SGA/Sales 28 Depreciation and Amortization/Sales 29 Tax Rate 30 Change in Working Capital/Sales 31 Capex/Sales $92,000.00 $ 27.450.00 $119,450.00 $42,905.00 10.00 $ 30,000.00 25% 20.00% 55.00% 1.90% 11.70% 2.70% 30.00% 4.00% 2.70% C40 A xv fx A D E G H 32 33 34 Revenue 35 COGS 36 RED 37 SGA 38 Depreciation and Amortization 39 Operating Income-EBIT 40 Interest Income/Expense 41 Net Income 42 EBITDA 43 Income Statement Projections 0 1 2 $ 42,905 $51,486.00 $61,783.20 $28,317.30 $33.980.76 $ 978.23 $ 1,173.88 $ 6,023.86 $ 7.228.63 $ 1,390.12 $ 1,668.15 $15 445 80 $74,139.84 $40.776.91 $ 1,408.66 $ 8,674.36 $ 2,001.78 4 5 $ 88,967.81 $ 106,761.37 $ 48,932.29 $ 58,718.75 $ 1,690.39 $ 2,028.47 $ 10,409.23 $ 12,491.08 $ 2,402.13 $ 2.882.56 Free Cash Flow Projections 45 46 47 48 NOPAT 49 OP Cash Flow 50 Delta Net Working Capital 51 Capex 52 Free Cash Flows to Firm 53 Free Cash Flows Available to Pay Debt 54 Free Cash Flow to Equity 55 56 57 58 59 Financing Schedule 60 Beginning Bank Debt 61 Principal Payments 62 Ending Bank Debt 63 64 Beginning High Yield Debt 65 Mandatory Principal Repayments 66 Ending High Yield Debt 67 68 Interest paid on Bank Debt 69 Interest Paid on High Yield Debt 70 Total Interest Paid 71 72 Exit Enterpise Value 73 Edt Equity Value Financing Projections 0 1 2 3 4 5 $92,000.00 $ 27,450.00 $ $ C40 A x fx A B D E F G H IRR Analysis 74 75 76 Initial Equity Contribution 77 Free Cash Flow to Equity 78 Exit Equity Value 79 Net Cash Flows to Equity 80 IRR to Equity 81 82 Maximum Price that can be Offerred Analysis 83 Maximum Equity Contribution 84 Debt 85 Excess Cash 86 Total Capital 87 Less Transaction Cost 88 Maximum Sale Price 89 Maximum Price per Share that can be offered 90 Premium over Current Price 91 92