Question

C4-57. Analyzing a Projected Statement of Cash Flows and Loan Covenants The president and CFO of Lambert Co. will be meeting with their bankers next

C4-57. Analyzing a Projected Statement of Cash Flows and Loan Covenants

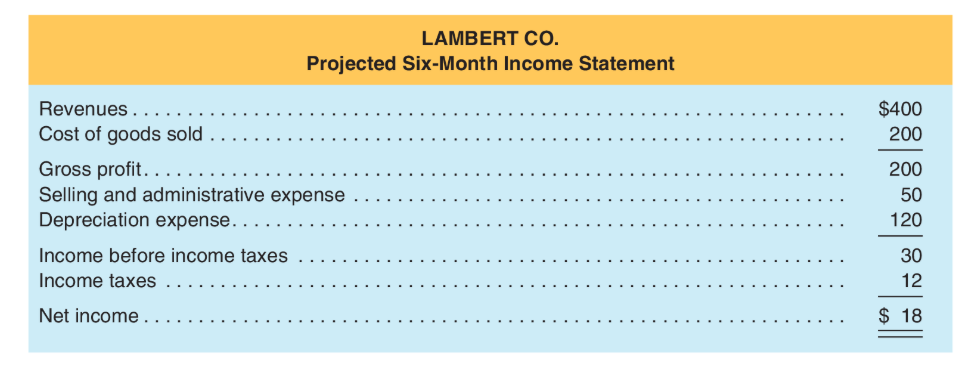

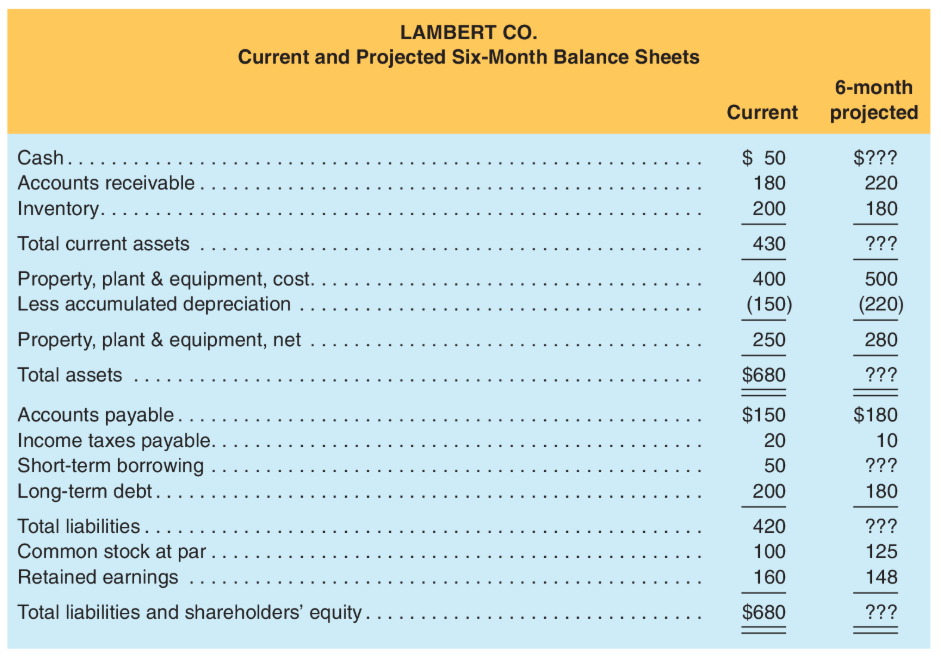

The president and CFO of Lambert Co. will be meeting with their bankers next week to discuss

the short-term financing needs of the company for the next six months. Lamberts controller has

provided a projected income statement for the next six-month period, and a current balance sheet

along with a projected balance sheet for the end of that six-month period. These statements are

presented below ($ millions).

Additional Information (already reected in the projected income statement and balance sheet):

Lamberts current long-term debt includes $100 that is due within the next six months. During

the next six months, the company plans to take advantage of lower interest rates by issuing

new long-term debt that will provide $80 in cash proceeds.

During the next six months, the company plans to dispose of equipment with an original cost

of $125 and accumulated depreciation of $50. An appraisal by an equipment broker indicates

that Lambert should be able to get $75 in cash for the equipment. In addition, Lambert plans

to acquire new equipment at a cost of $225.

A small issue of common stock for cash ($25) and a cash dividend to shareholders ($30) are

planned in the next six months.

Lamberts outstanding long-term debt imposes a restrictive loan covenant on the company that

requires Lambert to maintain a debt-to-equity ratio below 1.75.

REQUIRED

The CFO says, I would like a clear estimate of the amount of short-term borrowing that we will

need six months from now. I want you to prepare a forecasted statement of cash ows that we can

take to the meeting next week.

Prepare the required statement of cash ows, using the indirect method to compute cash ow

from operating activities. The forecasted statement should include the needed amount of short-term

borrowing and should be consistent with the projected balance sheet and income statement, as well

as the loan covenant restriction

LAMBERT CO. Projected Six-Month Income Statement $400 200 200 50 Revenues ................................................................. Cost of goods sold ............... Gross profit. ............ Selling and administrative expense .... Depreciation expense.. Income before income taxes ..... Income taxes ................. Net income...... 120 LAMBERT CO. Current and Projected Six-Month Balance Sheets Current 6-month projected Cash .......................................................... Accounts receivable ...... Inventory.............. $ 50 180 200 $??? 220 180 ??? 430 400 (150) 250 500 (220) 280 $680 ??? $150 Total current assets .............. Property, plant & equipment, cost. ... Less accumulated depreciation ..... Property, plant & equipment, net .... Total assets ...................... Accounts payable......... Income taxes payable...... Short-term borrowing .... Long-term debt........ Total liabilities ....... Common stock at par... Retained earnings .................... Total liabilities and shareholders' equity............ 20 $180 10 ??? 50 180 200 420 ??? 125 100 160 148 $680Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started