Question

C5:3-33 Stock in Random Corporation is owned equally by two individual shareholders. During the current year, Random reports the following results: Income: Rentals $200,000 Dividend

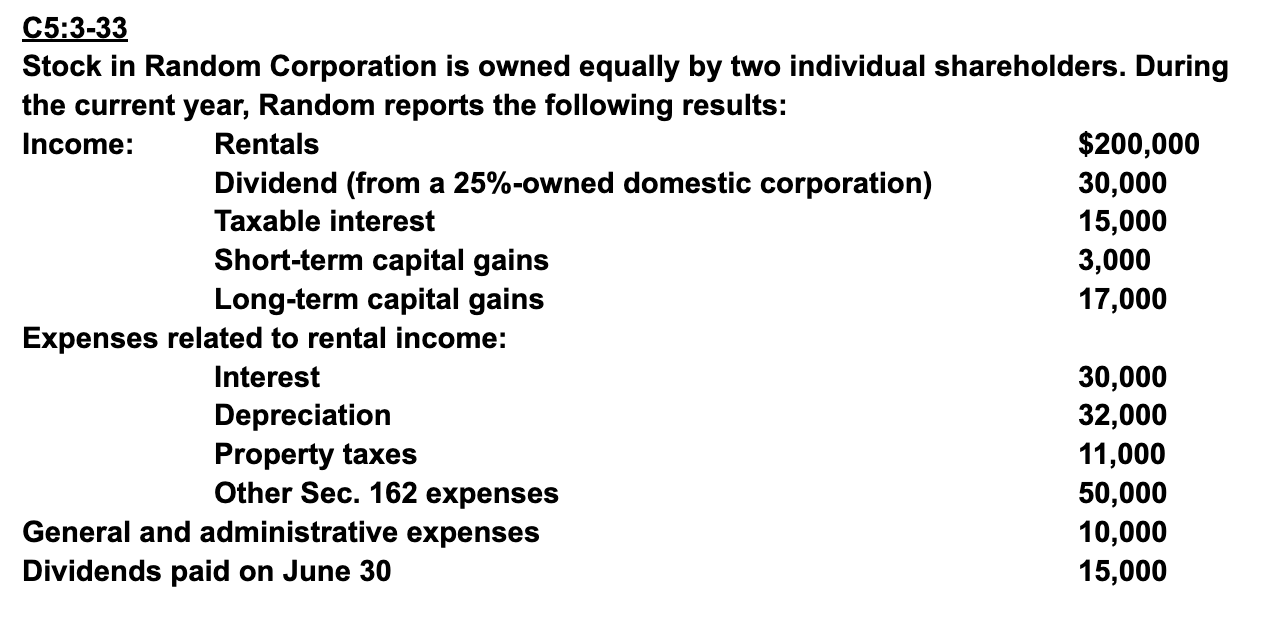

C5:3-33 Stock in Random Corporation is owned equally by two individual shareholders. During the current year, Random reports the following results: Income: Rentals $200,000 Dividend (from a 25%-owned domestic corporation) 30,000 Taxable interest 15,000 Short-term capital gains 3,000 Long-term capital gains 17,000 Expenses related to rental income: Interest 30,000 Depreciation 32,000 Property taxes 11,000 Other Sec. 162 expenses 50,000 General and administrative expenses 10,000 Dividends paid on June 30 15,000

C5:3-33 Stock in Random Corporation is owned equally by two individual shareholders. During the current year, Random reports the following results: Income: Rentals $200,000 Dividend (from a 25%-owned domestic corporation) 30,000 Taxable interest 15,000 Short-term capital gains 3,000 Long-term capital gains 17,000 Expenses related to rental income: Interest 30,000 Depreciation 32,000 Property taxes 11,000 Other Sec. 162 expenses 50,000 General and administrative expenses 10,000 Dividends paid on June 30 15,000

g. What is Randoms regular taxable income and regular tax liability?

h. What is Randoms undistributed PHC income (UPHCI) and PHC tax liability?

C5:3-33 Stock in Random Corporation is owned equally by two individual shareholders. During the current year, Random reports the following results: C5:3-33 Stock in Random Corporation is owned equally by two individual shareholders. During the current year, Random reports the following resultsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started