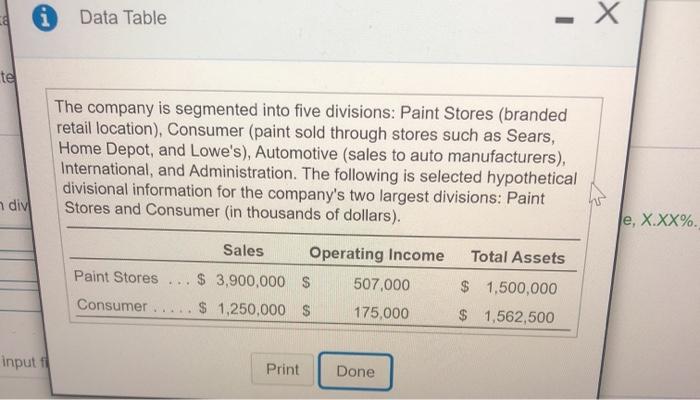

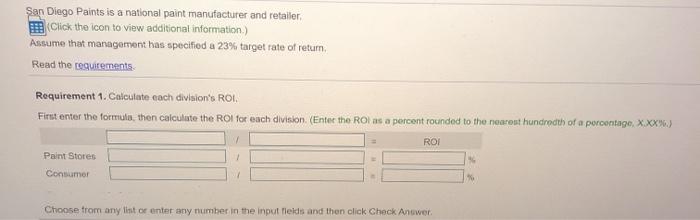

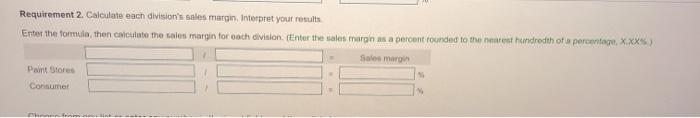

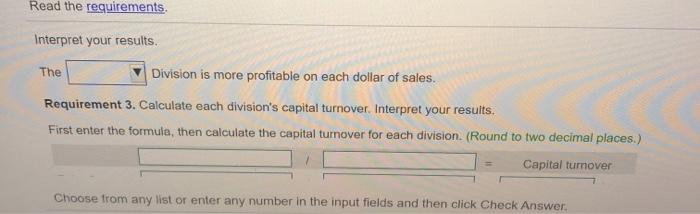

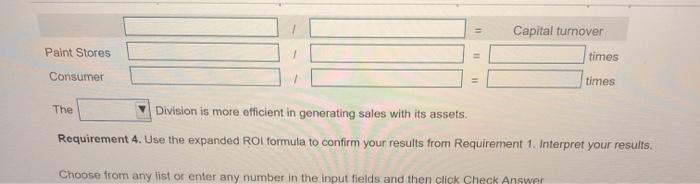

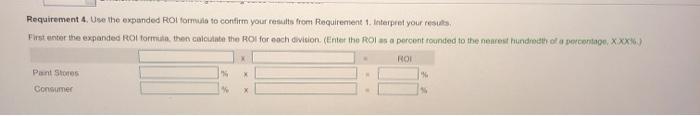

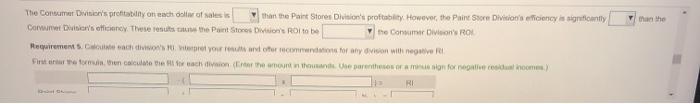

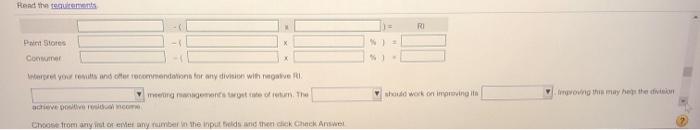

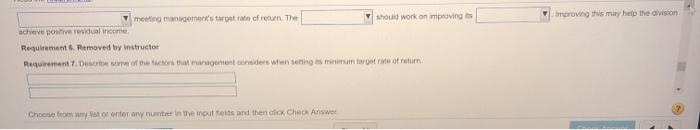

ca i Data Table - x tel The company is segmented into five divisions: Paint Stores (branded retail location), Consumer (paint sold through stores such as Sears, Home Depot, and Lowe's), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for the company's two largest divisions: Paint Stores and Consumer (in thousands of dollars). div Je, X.XX%. Total Assets Paint Stores Sales Operating Income $ 3,900,000 $ 507,000 $ 1,250,000 $ 175,000 Consumer $ 1.500,000 $ 1,562,500 input Print Done San Diego Paints is a national paint manufacturer and retailer, Click the icon to view additional information) Assume that management has specified a 23% target rate of return. Read the requirements Requirement 1. Calculate each division's ROI. First enter the formule, then calculate the ROI for each division (Enter the Rol as a percent rounded to the nearest hundredth of a porcentage. X.XX%) ROI Paint Stores Consumer Choose from any lint or enter any number in the input fields and then click Check Answer Requirement 2. Calculate each division's sales margin. Interpret your results Enter the formula then calculate the sales margin for each division (Enter the sales margin as a percent rounded to the nearest hundredth of a percentage XXX) Sales margin Paint Stores Consumer Read the requirements. Interpret your results. The Division is more profitable on each dollar of sales. Requirement 3. Calculate each division's capital turnover. Interpret your results. First enter the formula, then calculate the capital turnover for each division. (Round to two decimal places.) Capital turnover Choose from any list or enter any number in the input fields and then click Check Answer Capital turnover Paint Stores times Consumer times The Division is more efficient in generating sales with its assets. Requirement 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. Choose from any list or enter any number in the input fields and then click Check Answer Requirement 4. Use the expanded ROI formule to confirm your results from Requirement 1. Interpret your results, First enter the expanded ROI form the calculate the ROI for each division (Enter the ROI as a percent rounded to the nearest hundredth of a percentage XXX) ROI Pant Stores Consumer X than the The Consumer Division's profitabilny on each do of salesis than the Paint Stores Division's probability. However, the Paint Store Division's eficiency is significantly Corwin Disocy. These results to the Paint Stores Don's ROI the Consumer D'ROL Requirements. Ce cacho you and form for any icon with negative Fire in the calculate for each don the amount on se parentheses or informeerde home RI Read the requirements 1 = RO Paint Stores X W= Consumer Were your own or commendations for any division with negative meeting ang tum. The achieve should work on improving it Invoing this may be the Choose from any or any barn the inputs and then click Check Answer roving this help the division meeting management' target of return. The should work on improving achieve politesidual nome Requirements. Removed by instructor Requirement. De factors that management content wintings in mum target of return Chantom worrierar nun in the input toits and then chox Che Answer Requirement 7. Describe some of the factors that management considers when setting its minimum target rate of return. Requirement B. Explain why some firms prefer to use Rather than Rol for performance measurement Rideryb of Requirement plain why but w portomaron reports are not for avaite cerformance of investment stors Dodgut erhal performance are many o nome