Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cabana Cruise Line uses a combination of debt and equity to fund operations, and they have a bond rating of A. Market capitalization consists

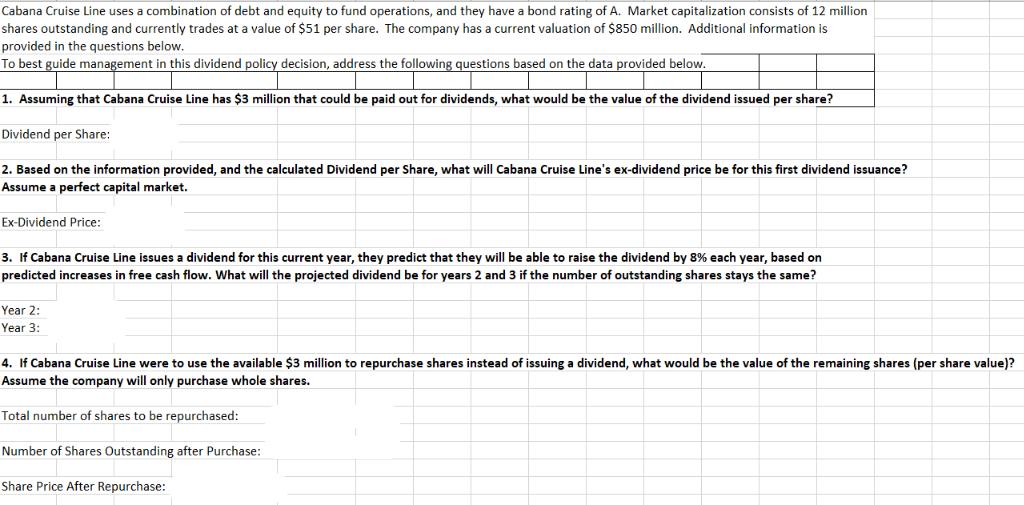

Cabana Cruise Line uses a combination of debt and equity to fund operations, and they have a bond rating of A. Market capitalization consists of 12 million shares outstanding and currently trades at a value of $51 per share. The company has a current valuation of $850 million. Additional information is provided in the questions below. To best guide management in this dividend policy decision, address the following questions based on the data provided below. 1. Assuming that Cabana Cruise Line has $3 million that could be paid out for dividends, what would be the value of the dividend issued per share? Dividend per Share: 2. Based on the information provided, and the calculated Dividend per Share, what will Cabana Cruise Line's ex-dividend price be for this first dividend issuance? Assume a perfect capital market. Ex-Dividend Price: 3. If Cabana Cruise Line issues a dividend for this current year, they predict that they will be able to raise the dividend by 8% each year, based on predicted increases i free cash flow. What will the projected dividend be for years 2 and 3 if the number of outstanding shares stays the same? Year 2: Year 3: 4. If Cabana Cruise Line were to use the available $3 million to repurchase shares instead of issuing a dividend, what would be the value of the remaining shares (per share value)? Assume the company will only purchase whole shares. Total number of shares to be repurchased: Number of Shares Outstanding after Purchase: Share Price After Repurchase:

Step by Step Solution

★★★★★

3.24 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started