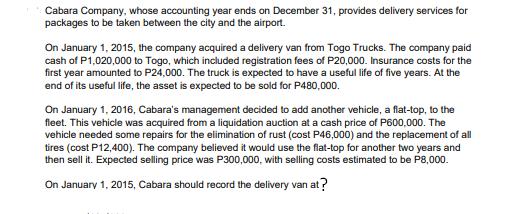

Question: Cabara Company, whose accounting year ends on December 31, provides delivery services for packages to be taken between the city and the airport. On

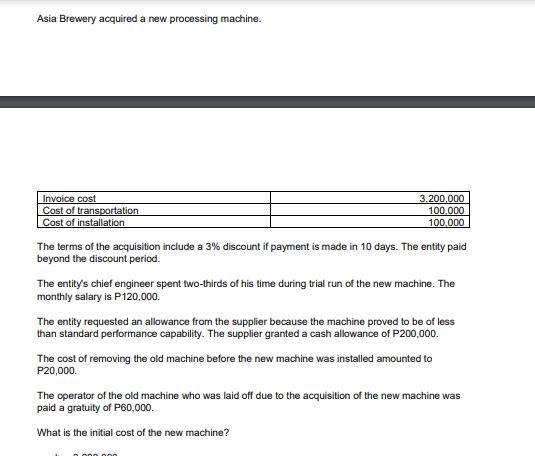

Cabara Company, whose accounting year ends on December 31, provides delivery services for packages to be taken between the city and the airport. On January 1, 2015, the company acquired a delivery van from Togo Trucks. The company paid cash of P1,020,000 to Togo, which included registration fees of P20,000. Insurance costs for the first year amounted to P24,000. The truck is expected to have a useful life of five years. At the end of its useful life, the asset is expected to be sold for P480,000. On January 1, 2016, Cabara's management decided to add another vehicle, a flat-top, to the fleet. This vehicle was acquired from a liquidation auction at a cash price of P600,000. The vehicle needed some repairs for the elimination of rust (cost P46,000) and the replacement of all tires (cost P12,400). The company believed it would use the flat-top for another two years and then sell it. Expected selling price was P300,000, with selling costs estimated to be P8,000. On January 1, 2015, Cabara should record the delivery van at? Asia Brewery acquired a new processing machine. Invoice cost Cost of transportation Cost of installation 3,200,000 100,000 100,000 The terms of the acquisition include a 3% discount if payment is made in 10 days. The entity paid beyond the discount period. The entity's chief engineer spent two-thirds of his time during trial run of the new machine. The monthly salary is P120,000. The entity requested an allowance from the supplier because the machine proved to be of less than standard performance capability. The supplier granted a cash allowance of P200,000. The cost of removing the old machine before the new machine was installed amounted to P20,000. The operator of the old machine who was laid off due to the acquisition of the new machine was paid a gratuity of P60,000. What is the initial cost of the new machine?

Step by Step Solution

There are 3 Steps involved in it

For the first question regarding Cabara Company and the delivery van Since we are to record the delivery van as an asset on January 1 2015 we need to ... View full answer

Get step-by-step solutions from verified subject matter experts