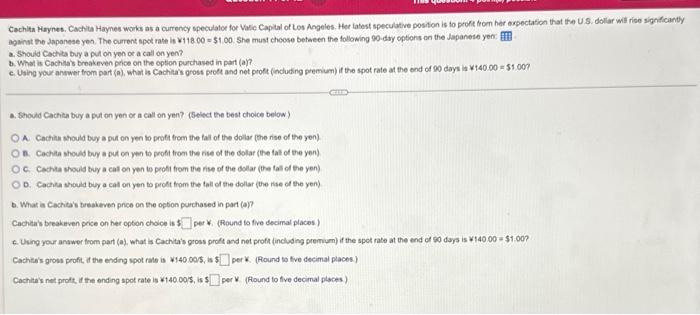

Cachlta Haynes. Cachita Haynes work as a currency speculator for Valic Capial of Los Angeles. Her latest speculative positon is io protit trom her mpectation that the U.S. dollar will rise signticanty againt the dapanese yen. The current apot rate is 18.00=$1,00. She must choose betaeen the following 90-dry options on the Japanese yen: a. Shoudd Cachila buy a put on yen or a call on yen? b. What is Cochita's breakeven perce on the option purchased in part (a)? 4. Shovdd Cachien biy a put on yen or a call on yen? (Fielect the best choice below) A. Cachila should buy a put on yen to preft from the fall of the dollar (the nise of the yen) n. Cachila should buy a put on yen to profit from the nise of the dollar (he fal of the yen) C. Cachta thould buy a cat on yen to peofi from the nise of the dollar (the tall de the yen) D. Cachica should buy a cat on yen to protit trom the tall of the dollar (the nite of the yen) b. What is Cachitars tireakevea price on the opton purchased in part (a)? Cachitais breakeven price on her opton cholce is: per. (Round to five decimal places) 6. Uving your answer trom part (a). what is Cachita's pross proft and net proft (incluaing premum) if the spot rate at the end of 90 doys is 140.00=$1.00 ? Cachiters grow profit, it the ending spot rale is $140,005, is $ per K. (Pound to tive decimal places) Cachiters net proft, it the ending spot rate is 140.00/5, is 5 per V (Alound to flve decimal plsces) Cachlta Haynes. Cachita Haynes work as a currency speculator for Valic Capial of Los Angeles. Her latest speculative positon is io protit trom her mpectation that the U.S. dollar will rise signticanty againt the dapanese yen. The current apot rate is 18.00=$1,00. She must choose betaeen the following 90-dry options on the Japanese yen: a. Shoudd Cachila buy a put on yen or a call on yen? b. What is Cochita's breakeven perce on the option purchased in part (a)? 4. Shovdd Cachien biy a put on yen or a call on yen? (Fielect the best choice below) A. Cachila should buy a put on yen to preft from the fall of the dollar (the nise of the yen) n. Cachila should buy a put on yen to profit from the nise of the dollar (he fal of the yen) C. Cachta thould buy a cat on yen to peofi from the nise of the dollar (the tall de the yen) D. Cachica should buy a cat on yen to protit trom the tall of the dollar (the nite of the yen) b. What is Cachitars tireakevea price on the opton purchased in part (a)? Cachitais breakeven price on her opton cholce is: per. (Round to five decimal places) 6. Uving your answer trom part (a). what is Cachita's pross proft and net proft (incluaing premum) if the spot rate at the end of 90 doys is 140.00=$1.00 ? Cachiters grow profit, it the ending spot rale is $140,005, is $ per K. (Pound to tive decimal places) Cachiters net proft, it the ending spot rate is 140.00/5, is 5 per V (Alound to flve decimal plsces)