Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cairo Corporation is maintaining sound financial records which showed that the EBT in 2018 was 4,750,000. The expected increase in EBT in 2019 is

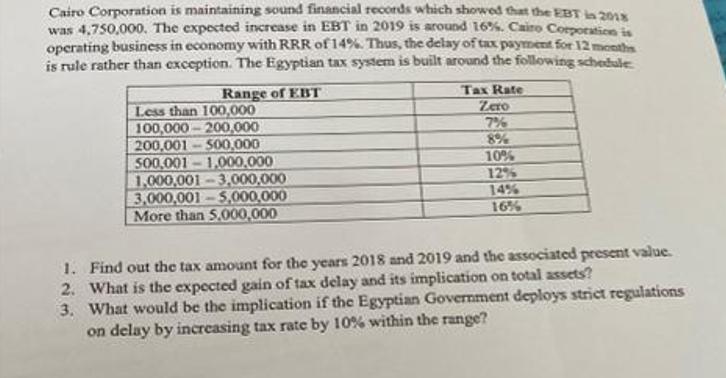

Cairo Corporation is maintaining sound financial records which showed that the EBT in 2018 was 4,750,000. The expected increase in EBT in 2019 is around 16%. Cairo Corporation is operating business in economy with RRR of 14%. Thus, the delay of tax payment for 12 months is rule rather than exception. The Egyptian tax system is built around the following schedule Range of EBT Less than 100,000 100,000-200,000 200,001-500,000 500,001-1,000,000 1,000,001-3,000,000 3,000,001-5,000,000 More than 5,000,000 Tax Rate Zero 7% 8% 10% 12% 14% 16% 1. Find out the tax amount for the years 2018 and 2019 and the associated present value. 2. What is the expected gain of tax delay and its implication on total assets? 3. What would be the implication if the Egyptian Government deploys strict regulations on delay by increasing tax rate by 10% within the range?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started