Answered step by step

Verified Expert Solution

Question

1 Approved Answer

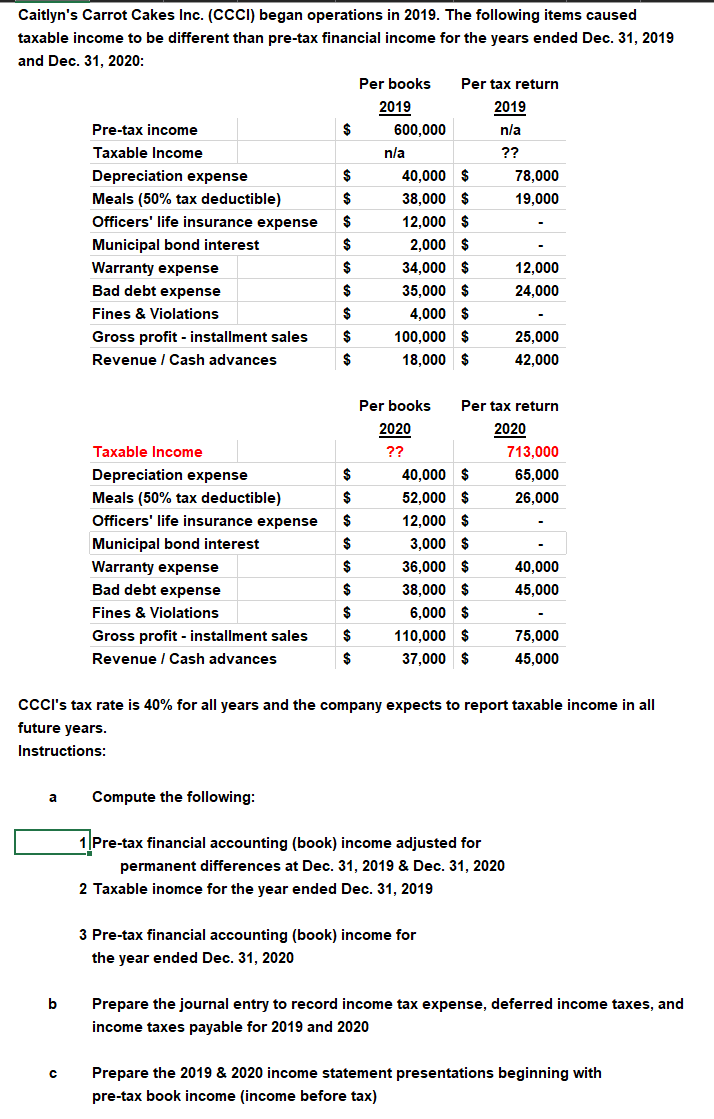

Caitlyn's Carrot Cakes Inc. (CCCI) began operations in 2019. The following items caused taxable income to be different than pre-tax financial income for the

Caitlyn's Carrot Cakes Inc. (CCCI) began operations in 2019. The following items caused taxable income to be different than pre-tax financial income for the years ended Dec. 31, 2019 and Dec. 31, 2020: Per books Per tax return 2019 2019 Pre-tax income $ 600,000 n/a Taxable Income n/a ?? Depreciation expense $ 40,000 $ 78,000 Meals (50% tax deductible) $ 38,000 $ 19,000 Officers' life insurance expense $ 12,000 $ Municipal bond interest $ 2,000 $ Warranty expense $ 34,000 $ 12,000 Bad debt expense $ 35,000 $ 24,000 Fines & Violations $ 4,000 $ Gross profit - installment sales $ 100,000 $ 25,000 Revenue / Cash advances $ 18,000 $ 42,000 Per books Per tax return 2020 2020 Taxable Income ?? 713,000 Depreciation expense $ 40,000 $ 65,000 Meals (50% tax deductible) $ 52,000 $ 26,000 Officers' life insurance expense $ 12,000 $ Municipal bond interest $ 3,000 $ Warranty expense $ 36,000 $ 40,000 Bad debt expense $ 38,000 $ 45,000 Fines & Violations $ 6,000 $ Gross profit - installment sales $ 110,000 $ 75,000 Revenue / Cash advances $ 37,000 $ 45,000 CCCI's tax rate is 40% for all years and the company expects to report taxable income in all future years. Instructions: a Compute the following: 1 Pre-tax financial accounting (book) income adjusted for permanent differences at Dec. 31, 2019 & Dec. 31, 2020 2 Taxable inomce for the year ended Dec. 31, 2019 3 Pre-tax financial accounting (book) income for the year ended Dec. 31, 2020 b Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019 and 2020 Prepare the 2019 & 2020 income statement presentations beginning with pre-tax book income (income before tax)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started