Answered step by step

Verified Expert Solution

Question

1 Approved Answer

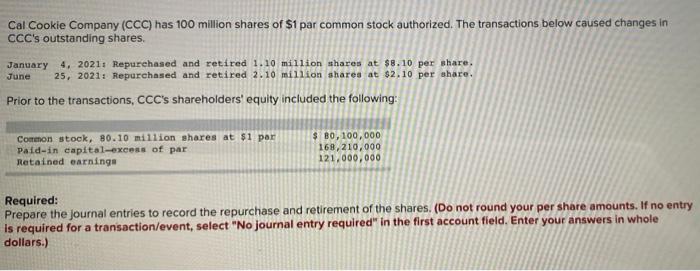

Cal Cookie Company (CCC) has 100 million shares of $1 par common stock authorized. The transactions below caused changes in CCC's outstanding shares. January

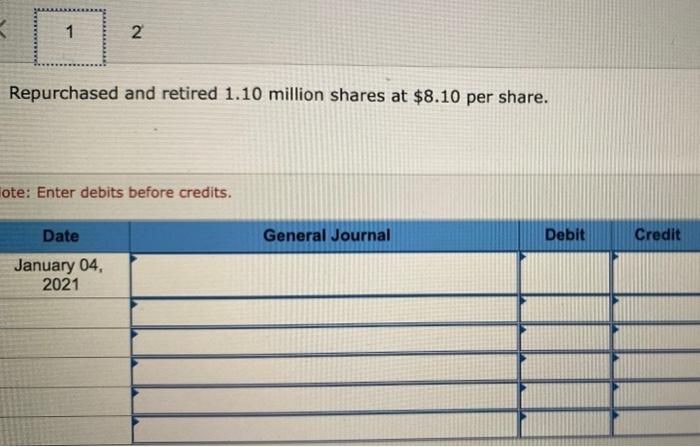

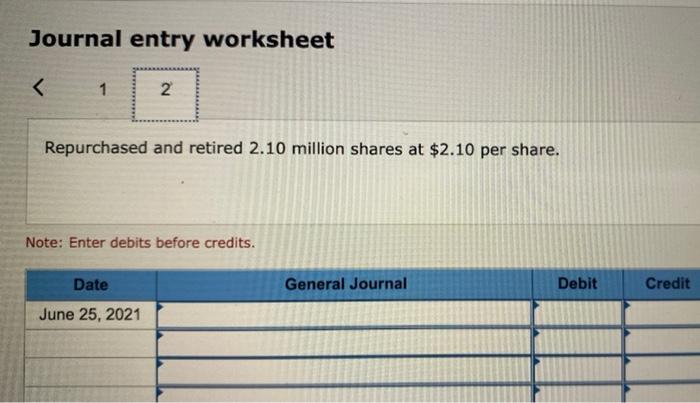

Cal Cookie Company (CCC) has 100 million shares of $1 par common stock authorized. The transactions below caused changes in CCC's outstanding shares. January 4, 2021: Repurehased and retired 1.10 million shares at $8.10 per share, 25, 2021: Repurchased and retired 2.10 million shares at $2.10 per ahare. June Prior to the transactions, CCC's shareholders' equity included the following: Common stock, 80.10 million shares at $1 par Paid-in capital-excess of par Retained earnings 0, 100, 000 168,210,000 121,000,000 Required: Prepare the journal entries to record the repurchase and retirement of the shares. (Do not round your per share amounts. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) 1 2 Repurchased and retired 1.10 million shares at $8.10 per share. ote: Enter debits before credits. Date General Journal Debit Credit January 04, 2021 Journal entry worksheet 2 Repurchased and retired 2.10 million shares at $2.10 per share. Note: Enter debits before credits. Date General Journal Debit Credit June 25, 2021

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Working note Calculation of paidin capital in excess of par per share Total paid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started