Answered step by step

Verified Expert Solution

Question

1 Approved Answer

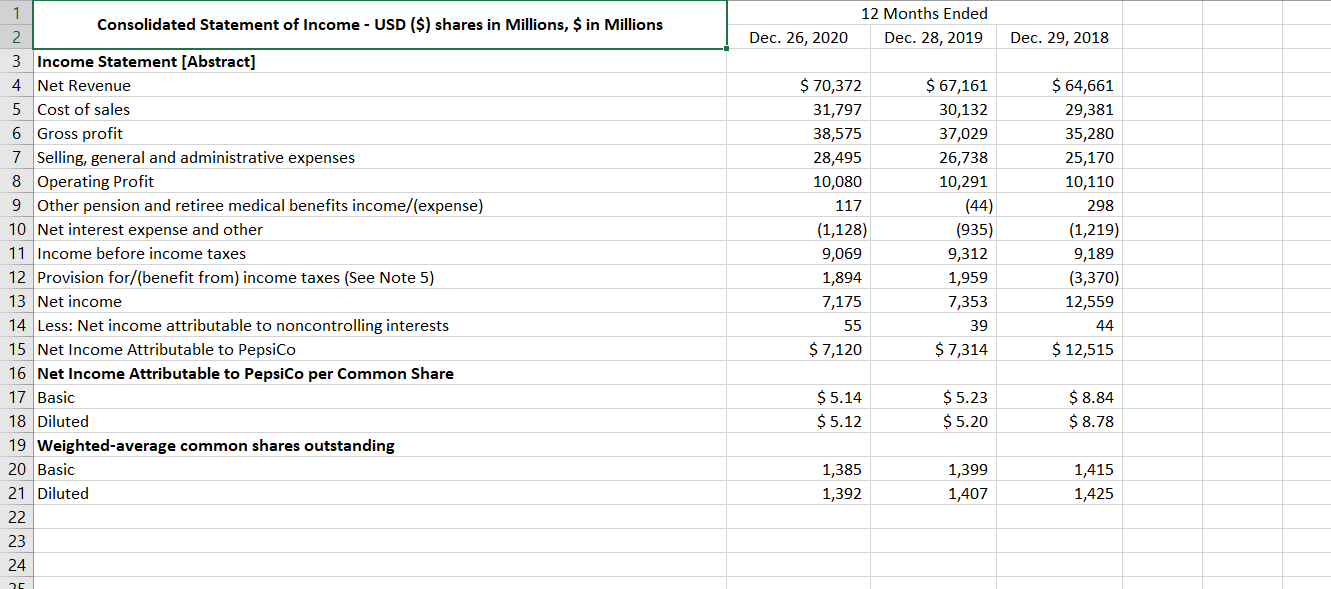

Calcuate: CFFA using = CF/CR+CF/SH 12 Months Ended Dec. 28, 2019 Dec. 26, 2020 Dec. 29, 2018 1 Consolidated Statement of Income - USD ($)

Calcuate: CFFA using

= CF/CR+CF/SH

12 Months Ended Dec. 28, 2019 Dec. 26, 2020 Dec. 29, 2018 1 Consolidated Statement of Income - USD ($) shares in Millions, $ in Millions 2 3 Income Statement [Abstract] 4 Net Revenue 5 Cost of sales 6 Gross profit 7 Selling, general and administrative expenses 8 Operating Profit 9 Other pension and retiree medical benefits income/(expense) 10 Net interest expense and other 11 Income before income taxes 12 Provision for/(benefit from) income taxes (See Note 5) 13 Net income 14 Less: Net income attributable to noncontrolling interests 15 Net Income Attributable to PepsiCo 16 Net Income Attributable to PepsiCo per Common Share 17 Basic 18 Diluted 19 Weighted average common shares outstanding 20 Basic 21 Diluted 22 23 24 $ 70,372 31,797 38,575 28,495 10,080 117 (1,128) 9,069 1,894 7,175 55 $ 7,120 $ 67,161 30,132 37,029 26,738 10,291 (44) (935) 9,312 1,959 7,353 39 $ 7,314 $ 64,661 29,381 35,280 25,170 10,110 298 (1,219) 9,189 (3,370) 12,559 44 $ 12,515 $ 5.14 $ 5.12 $ 5.23 $ 5.20 $ 8.84 $ 8.78 1,385 1,392 1,399 1,407 1,415 1,425 20 12 Months Ended Dec. 28, 2019 Dec. 26, 2020 Dec. 29, 2018 1 Consolidated Statement of Income - USD ($) shares in Millions, $ in Millions 2 3 Income Statement [Abstract] 4 Net Revenue 5 Cost of sales 6 Gross profit 7 Selling, general and administrative expenses 8 Operating Profit 9 Other pension and retiree medical benefits income/(expense) 10 Net interest expense and other 11 Income before income taxes 12 Provision for/(benefit from) income taxes (See Note 5) 13 Net income 14 Less: Net income attributable to noncontrolling interests 15 Net Income Attributable to PepsiCo 16 Net Income Attributable to PepsiCo per Common Share 17 Basic 18 Diluted 19 Weighted average common shares outstanding 20 Basic 21 Diluted 22 23 24 $ 70,372 31,797 38,575 28,495 10,080 117 (1,128) 9,069 1,894 7,175 55 $ 7,120 $ 67,161 30,132 37,029 26,738 10,291 (44) (935) 9,312 1,959 7,353 39 $ 7,314 $ 64,661 29,381 35,280 25,170 10,110 298 (1,219) 9,189 (3,370) 12,559 44 $ 12,515 $ 5.14 $ 5.12 $ 5.23 $ 5.20 $ 8.84 $ 8.78 1,385 1,392 1,399 1,407 1,415 1,425 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started