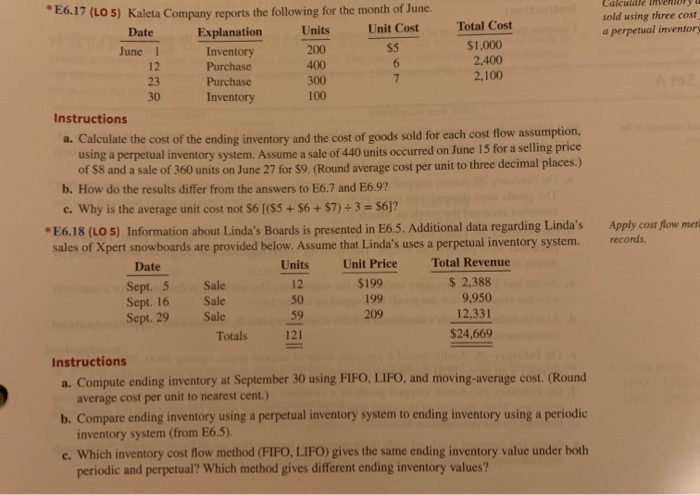

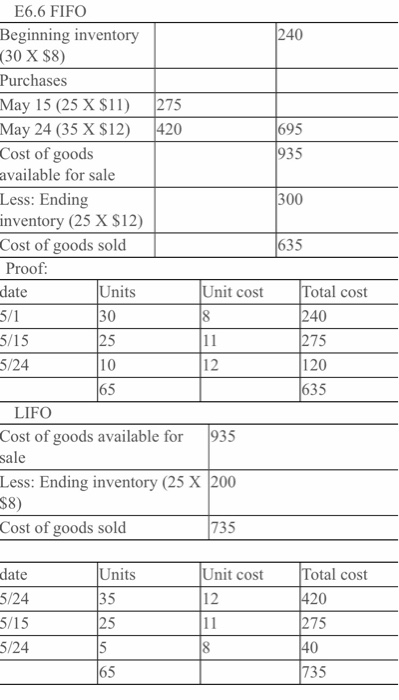

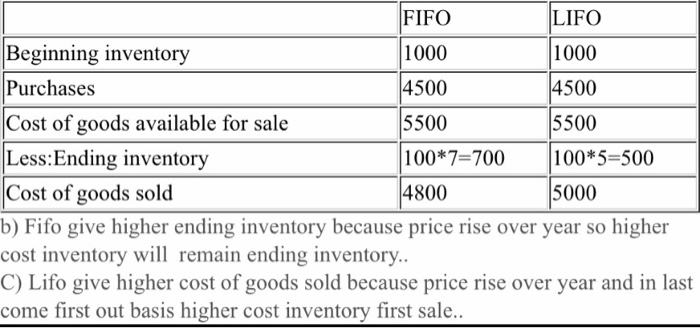

Calculale vendry sold using three cost a perpetual inventor *5.6.17 (LO5) Kaleta Company reports the following for the month of June. Date Explanation Units Unit Cost Total Cost June 1 Inventory 200 $1,000 12 Purchase 400 2.400 Purchase 300 2,100 Inventory 100 Instructions d. Calculate the cost of the ending inventory and the cost of goods sold for each cost flow assumption, using a perpetual inventory system. Assume a sale of 440 units occurred on June 15 for a selling price of 8 and a sale of 360 units on June 27 for $9. (Round average cost per unit to three decimal places.) b. How do the results differ from the answers to E6.7 and E6.92 c. Why is the average unit cost not $6 [(55 + $6 + $7) + 3 = $6]? *E6.18 (LO5) Information about Linda's Boards is presented in E6.5. Additional data regarding Linda's sales of Xpert snowboards are provided below. Assume that Linda's uses a perpetual inventory system Date Units Unit Price Total Revenue Sept. 5 Sale 12 $199 $ 2,388 Sept. 16 Sale 199 9,950 Sept. 29 Sale 209 12,331 Totals $24,669 Apply cost flow met records. 50 Instructions a. Compute ending inventory at September 30 using FIFO, LIFO, and moving average cost. (Round average cost per unit to nearest cent.) b. Compare ending inventory using a perpetual inventory system to ending inventory using a periodic inventory system (from E6.5). c. Which inventory cost flow method (FIFO, LIFO) gives the same ending inventory value under both periodic and perpetual? Which method gives different ending inventory values? 695 935 300 E6.6 FIFO Beginning inventory (30 X $8) Purchases May 15 (25 X $11) 275 May 24 (35 X $12) 420 Cost of goods available for sale Less: Ending inventory (25 X S12) Cost of goods sold Proof: date Unit cost 308 5/15 25 11 5/24 10 12 165 LIFO Cost of goods available for 935 sale Less: Ending inventory (25 X 200 635 Units 5/1 Total cost 240 275 120 1635 $8) Cost of goods sold 735 date 5/24 5/15 Units 35 25 Unit cost 12 11 Total cost 420 275 40 5/24 735 FIFO LIFO Beginning inventory 1000 1000 Purchases 4500 4500 Cost of goods available for sale 5500 5500 Less:Ending inventory 100*7=700 100*5=500 Cost of goods sold 5000 b) Fifo give higher ending inventory because price rise over year so higher cost inventory will remain ending inventory.. C) Lifo give higher cost of goods sold because price rise over year and in last come first out basis higher cost inventory first sale.. 4800