Answered step by step

Verified Expert Solution

Question

1 Approved Answer

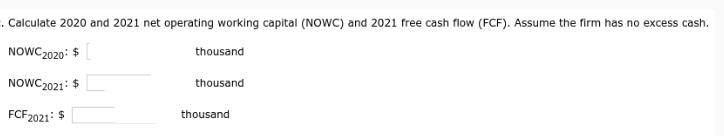

. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excess cash. NOWC

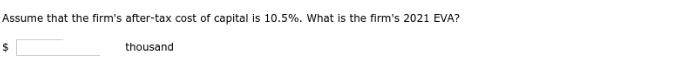

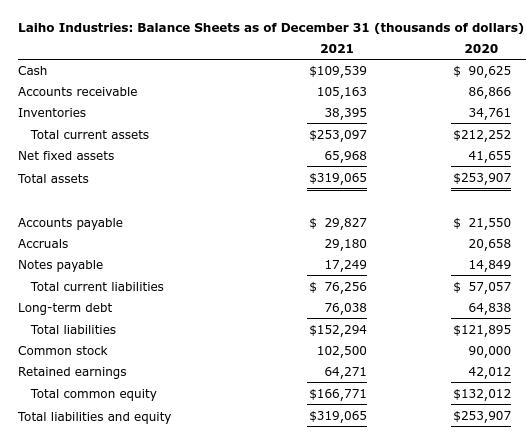

. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excess cash. NOWC 2020: $ NOWC2021: $ FCF 2021: $ thousand thousand thousand Assume that the firm's after-tax cost of capital is 10.5%. What is the firm's 2021 EVA? thousand $ Laiho Industries: Balance Sheets as of December 31 (thousands of dollars) 2020 $ 90,625 86,866 34,761 Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity 2021 $109,539 105,163 38,395 $253,097 65,968 $319,065 $ 29,827 29,180 17,249 $ 76,256 76,038 $152,294 102,500 64,271 $166,771 $319,065 $212,252 41,655 $253,907 $ 21,550 20,658 14,849 $ 57,057 64,838 $121,895 90,000 42,012 $132,012 $253,907

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Operating Working Capital NOWC for 2020 and 2021 we need to subtract the curren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started