Answered step by step

Verified Expert Solution

Question

1 Approved Answer

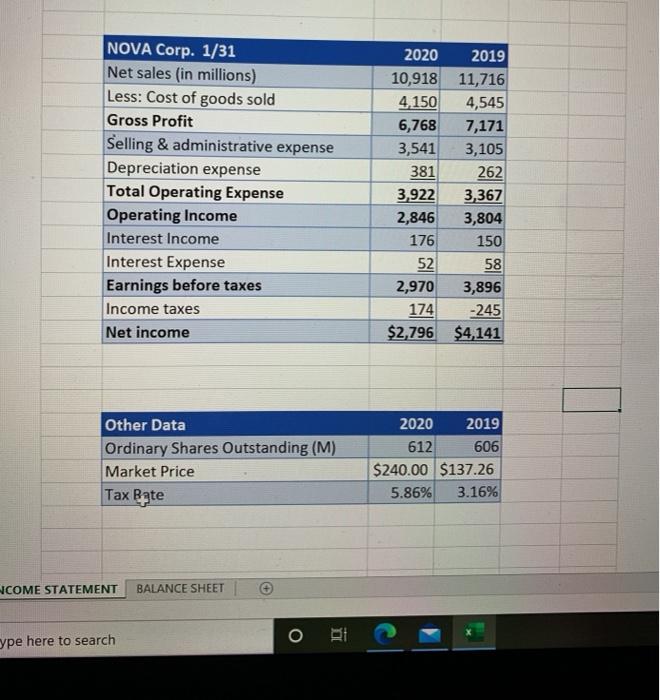

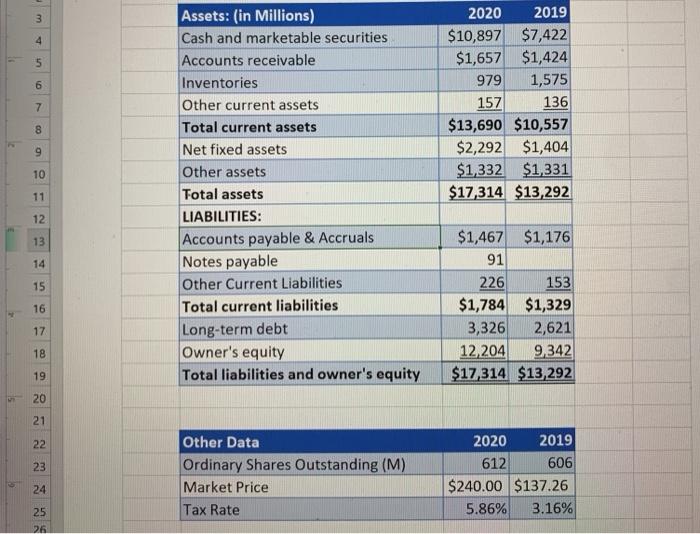

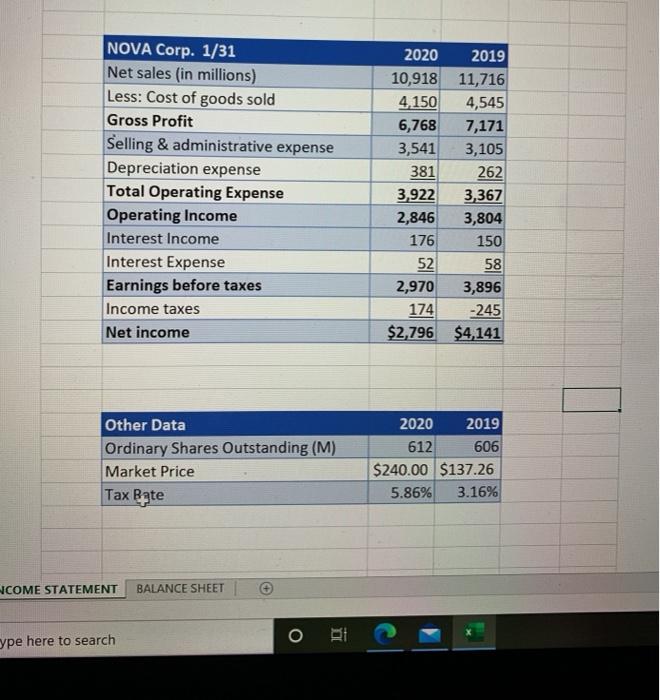

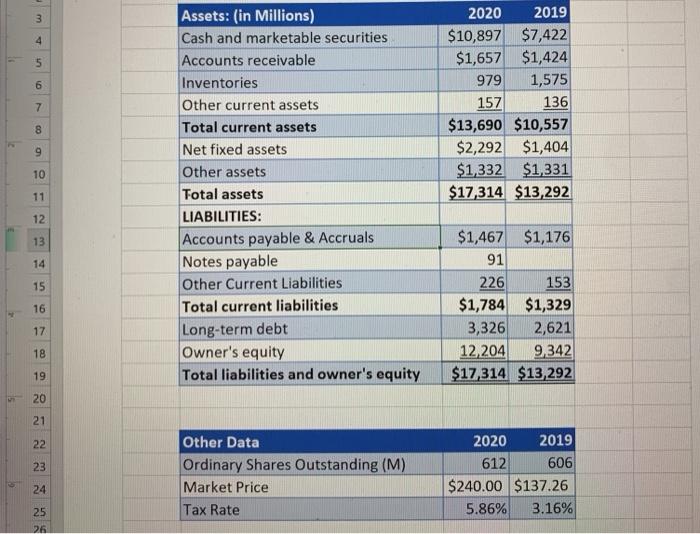

calculate 2020 times interest earned (TIE) ratio operating profit margin ratio return on asset ratio return on invested capital ratio basic earning power ratio NOVA

calculate 2020

NOVA Corp. 1/31 Net sales (in millions) Less: Cost of goods sold Gross Profit Selling & administrative expense Depreciation expense Total Operating Expense Operating Income Interest Income Interest Expense Earnings before taxes Income taxes Net income 2020 2019 10,918 11,716 4150 4,545 6,768 7,171 3,541 3,105 381 262 3,922 3,367 2,846 3,804 176 150 52 58 2,970 3,896 174 -245 $2,796 $4,141 Other Data Ordinary Shares Outstanding (M) Market Price 2020 2019 612 606 $240.00 $137.26 5.86% 3.16% Tax Bgte COME STATEMENT BALANCE SHEET ype here to search 3 4 5 6 7 2020 2019 $10,897 $7,422 $1,657 $1,424 979 1,575 157 136 $13,690 $10,557 $2,292 $1,404 $1,332 $1,331 $17,314 $13,292 8 9 10 Assets: (in Millions) Cash and marketable securities Accounts receivable Inventories Other current assets Total current assets Net fixed assets Other assets Total assets LIABILITIES: Accounts payable & Accruals Notes payable Other Current Liabilities Total current liabilities Long-term debt Owner's equity Total liabilities and owner's equity 11 12 13 14 15 16 $1,467 $1,176 91 226 153 $1,784 $1,329 3,326 2,621 12,204 9,342 $17,314 $13,292 17 18 19 20 21 22 23 Other Data Ordinary Shares Outstanding (M) Market Price Tax Rate 2020 2019 612 606 $240.00 $137.26 5.86% 3.16% 24 25 26 times interest earned (TIE) ratio

operating profit margin ratio

return on asset ratio

return on invested capital ratio

basic earning power ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started