Answered step by step

Verified Expert Solution

Question

1 Approved Answer

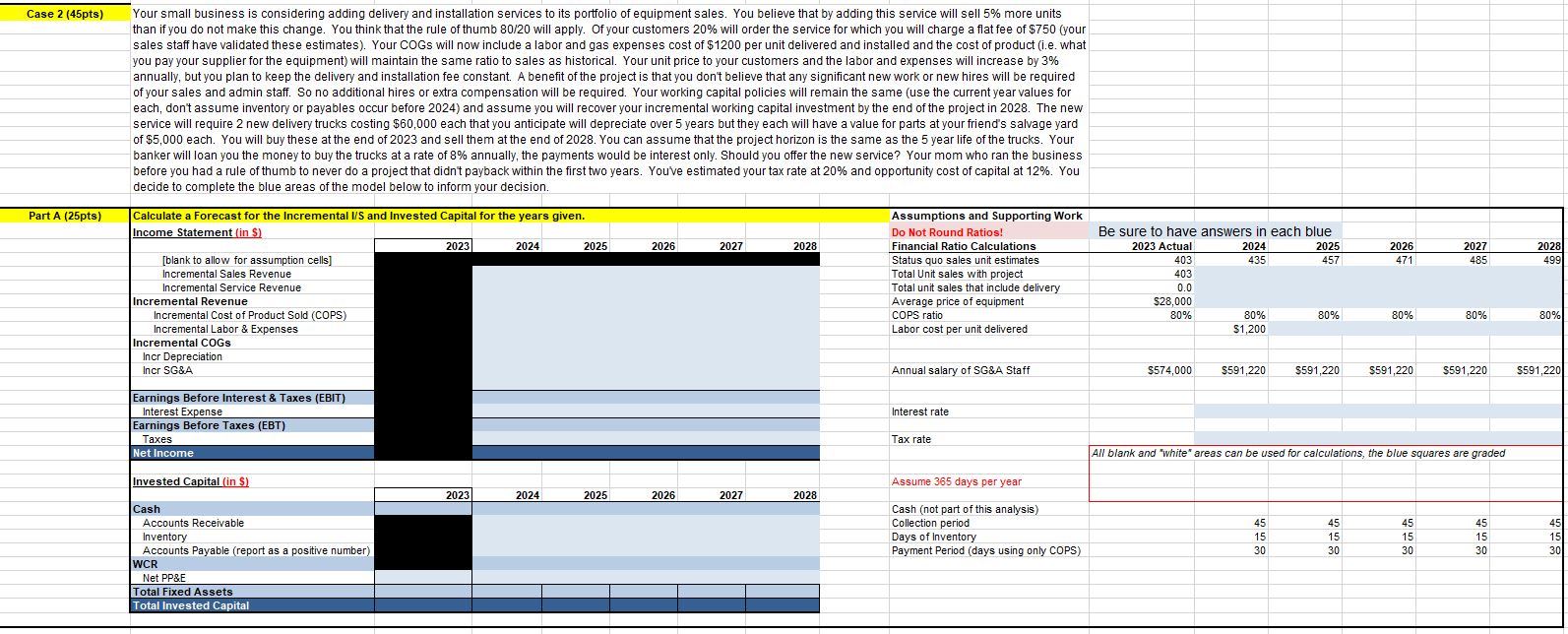

Calculate a Forecast for the Incremental I/S and Invested Capital for the years given. Your small business is considering adding delivery and installation services to

Calculate a Forecast for the Incremental I/S and Invested Capital for the years given.

Your small business is considering adding delivery and installation services to its portfolio of equipment sales. You believe that by adding this service will sell 5% more units han if you do not make this change. You think that the rule of thumb 80/20 will apply. Of your customers 20% will order the service for which you will charge a flat fee of $750 (your sales staff have validated these estimates). Your COGs will now include a labor and gas expenses cost of $1200 per unit delivered and installed and the cost of product (i.e. what rou pay your supplier for the equipment) will maintain the same ratio to sales as historical. Your unit price to your customers and the labor and expenses will increase by 3% annually, but you plan to keep the delivery and installation fee constant. A benefit of the project is that you don't believe that any significant new work or new hires will be required of your sales and admin staff. So no additional hires or extra compensation will be required. Your working capital policies will remain the same (use the current year values for each, don't assume inventory or payables occur before 2024) and assume you will recover your incremental working capital investment by the end of the project in 2028 . The new service will require 2 new delivery trucks costing $60,000 each that you anticipate will depreciate over 5 years but they each will have a value for parts at your friend's salvage yard of $5,000 each. You will buy these at the end of 2023 and sell them at the end of 2028 . You can assume that the project horizon is the same as the 5 year life of the trucks. Your panker will loan you the money to buy the trucks at a rate of 8% annually, the payments would be interest only. Should you offer the new service? Your mom who ran the business pefore you had a rule of thumb to never do a project that didn't payback within the first two years. You've estimated your tax rate at 20% and opportunity cost of capital at 12%. You decide to complete the blue areas of the model below to inform your decision. Your small business is considering adding delivery and installation services to its portfolio of equipment sales. You believe that by adding this service will sell 5% more units han if you do not make this change. You think that the rule of thumb 80/20 will apply. Of your customers 20% will order the service for which you will charge a flat fee of $750 (your sales staff have validated these estimates). Your COGs will now include a labor and gas expenses cost of $1200 per unit delivered and installed and the cost of product (i.e. what rou pay your supplier for the equipment) will maintain the same ratio to sales as historical. Your unit price to your customers and the labor and expenses will increase by 3% annually, but you plan to keep the delivery and installation fee constant. A benefit of the project is that you don't believe that any significant new work or new hires will be required of your sales and admin staff. So no additional hires or extra compensation will be required. Your working capital policies will remain the same (use the current year values for each, don't assume inventory or payables occur before 2024) and assume you will recover your incremental working capital investment by the end of the project in 2028 . The new service will require 2 new delivery trucks costing $60,000 each that you anticipate will depreciate over 5 years but they each will have a value for parts at your friend's salvage yard of $5,000 each. You will buy these at the end of 2023 and sell them at the end of 2028 . You can assume that the project horizon is the same as the 5 year life of the trucks. Your panker will loan you the money to buy the trucks at a rate of 8% annually, the payments would be interest only. Should you offer the new service? Your mom who ran the business pefore you had a rule of thumb to never do a project that didn't payback within the first two years. You've estimated your tax rate at 20% and opportunity cost of capital at 12%. You decide to complete the blue areas of the model below to inform your decisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started