Answered step by step

Verified Expert Solution

Question

1 Approved Answer

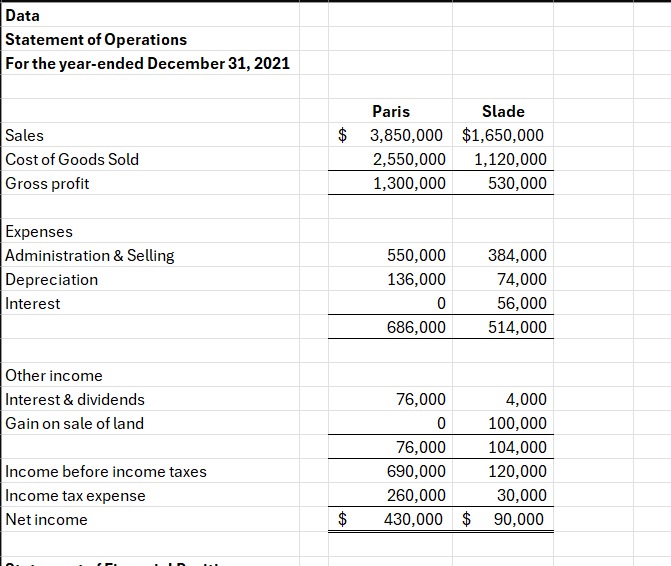

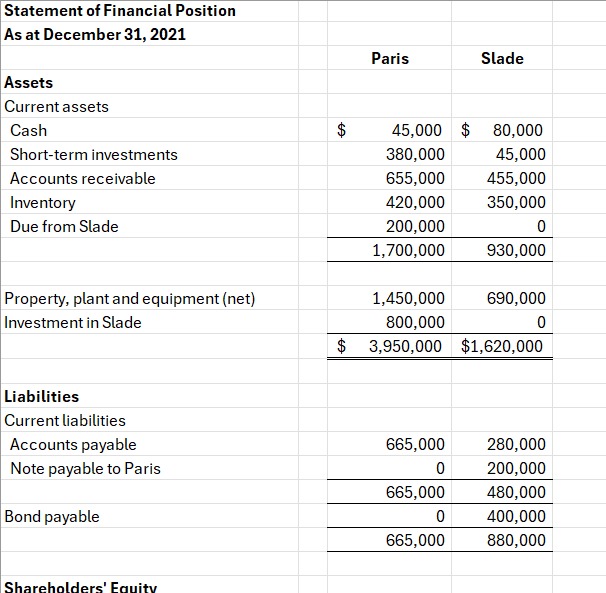

Calculate a schedule of changes to acquisition differential, since acquisition to current year to support the consolidation. Prepare the consolidated financial statements of Paris and

Calculate a schedule of changes to acquisition differential, since acquisition to current year to support the consolidation.

Prepare the consolidated financial statements of Paris and Slade for the year ended December 31, 2021, along with journal entries.

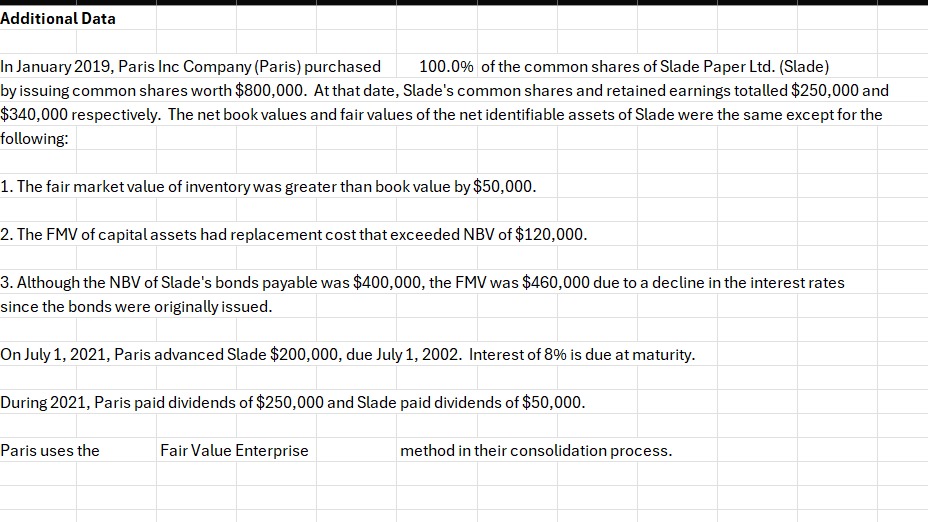

Additional Data 100.0% of the common shares of Slade Paper Ltd. (Slade) In January 2019, Paris Inc Company (Paris) purchased by issuing common shares worth $800,000. At that date, Slade's common shares and retained earnings totalled $250,000 and $340,000 respectively. The net book values and fair values of the net identifiable assets of Slade were the same except for the following: 1. The fair market value of inventory was greater than book value by $50,000. 2. The FMV of capital assets had replacement cost that exceeded NBV of $120,000. 3. Although the NBV of Slade's bonds payable was $400,000, the FMV was $460,000 due to a decline in the interest rates since the bonds were originally issued. On July 1, 2021, Paris advanced Slade $200,000, due July 1, 2002. Interest of 8% is due at maturity. During 2021, Paris paid dividends of $250,000 and Slade paid dividends of $50,000. Paris uses the Fair Value Enterprise method in their consolidation process.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started