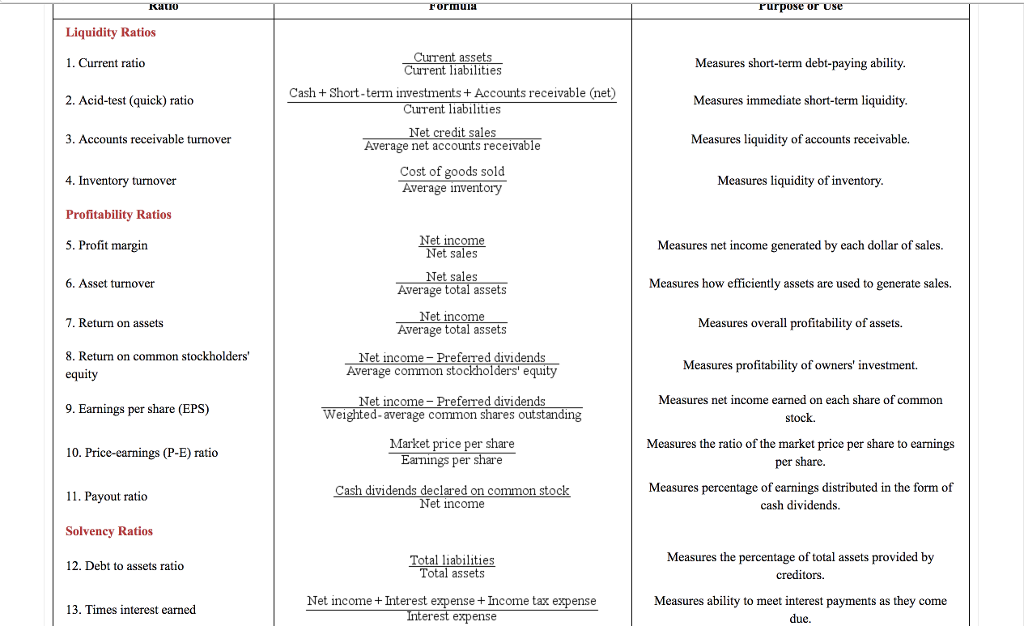

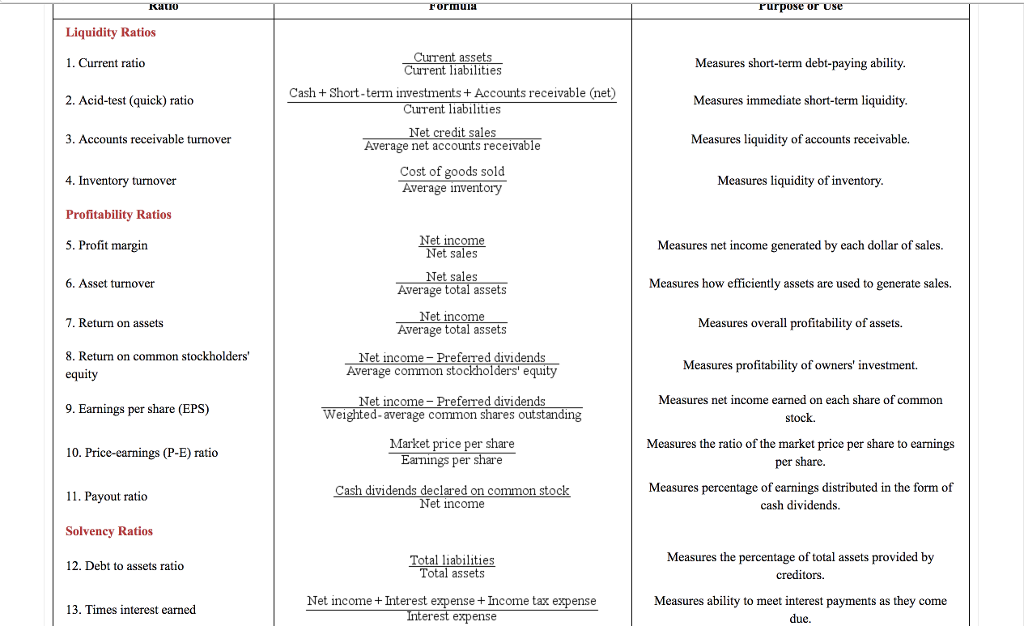

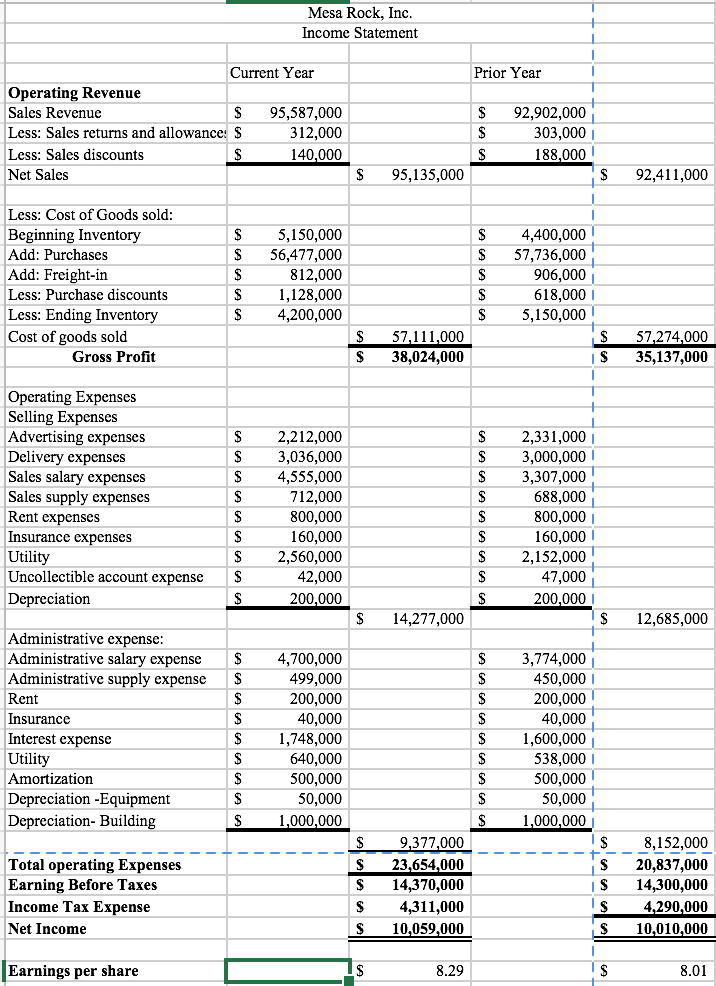

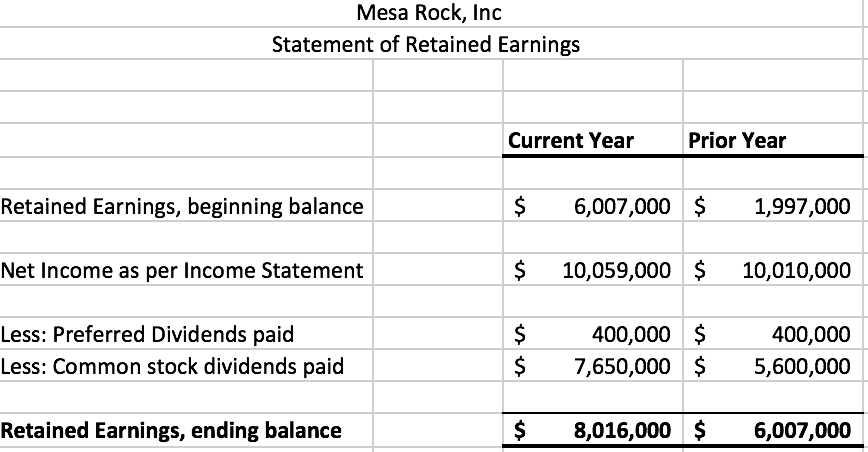

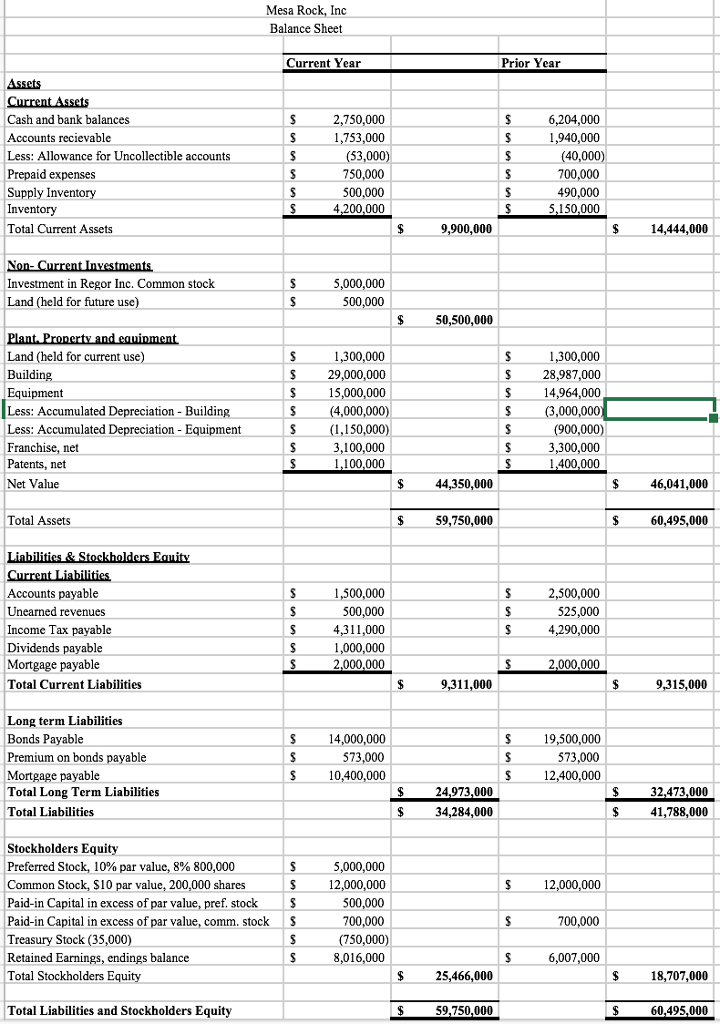

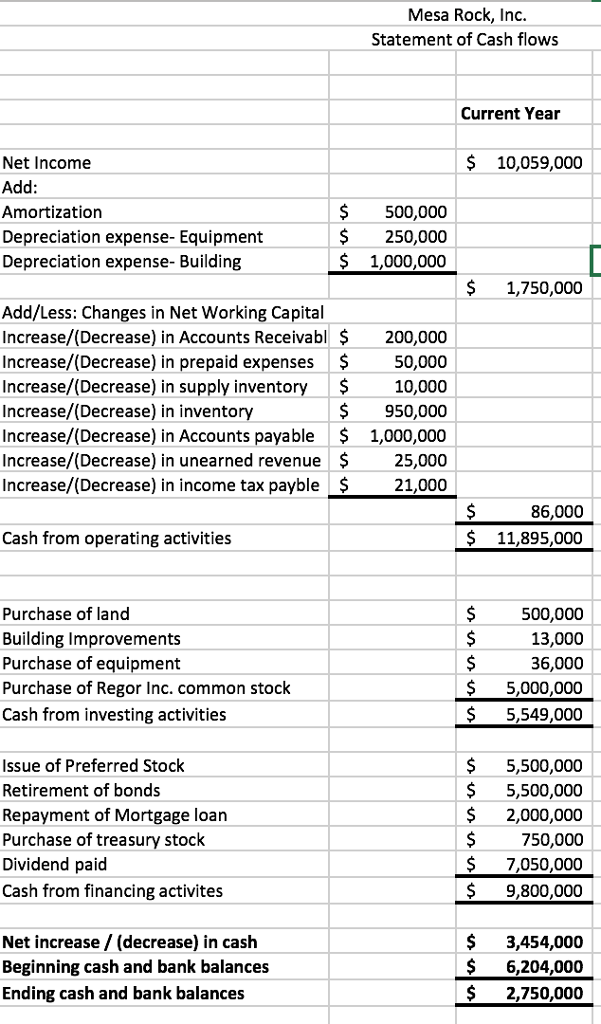

-Calculate all the ratios listed in Chapter 18 for the current year only.

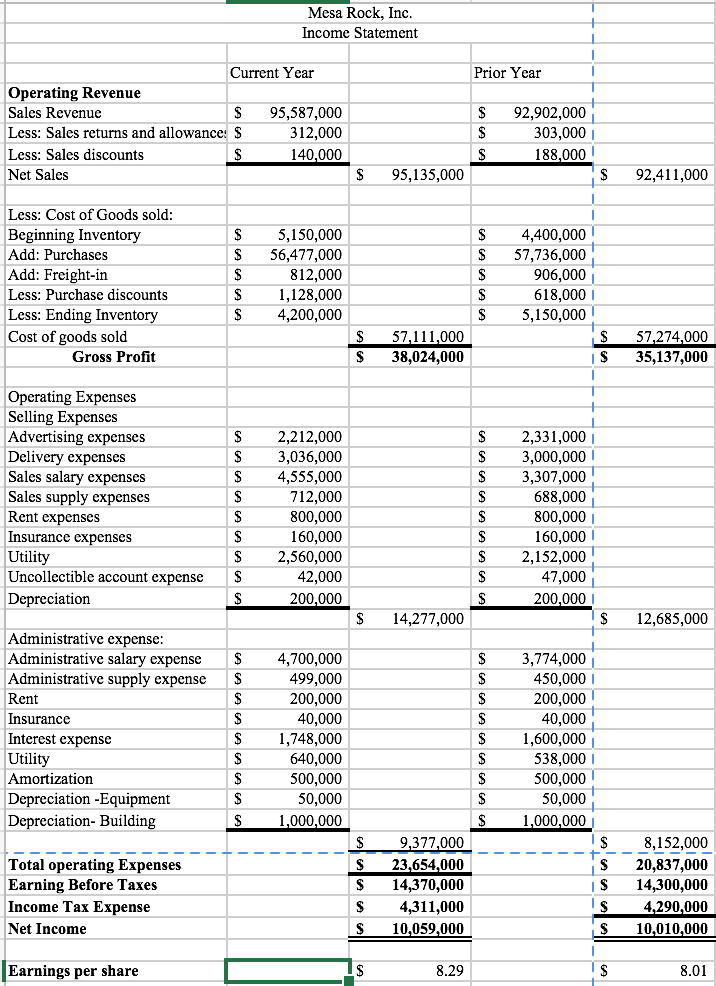

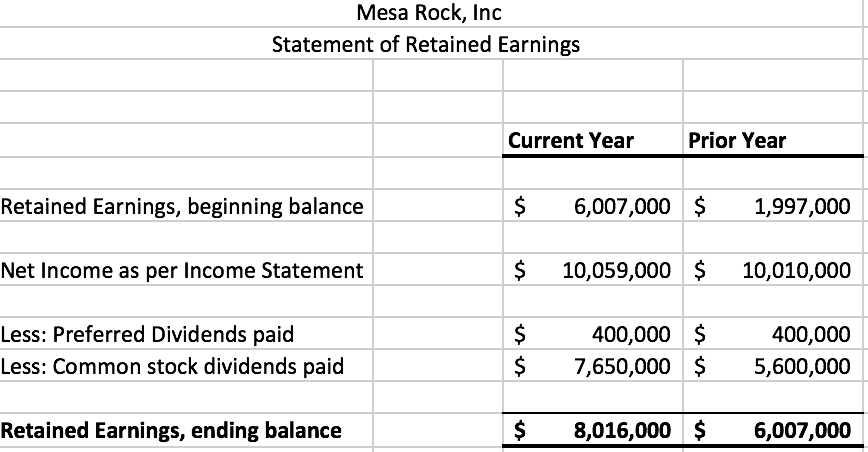

-Prepare a horizontal analysis and a vertical analysis of the current years Income Statement and Balance Sheet.

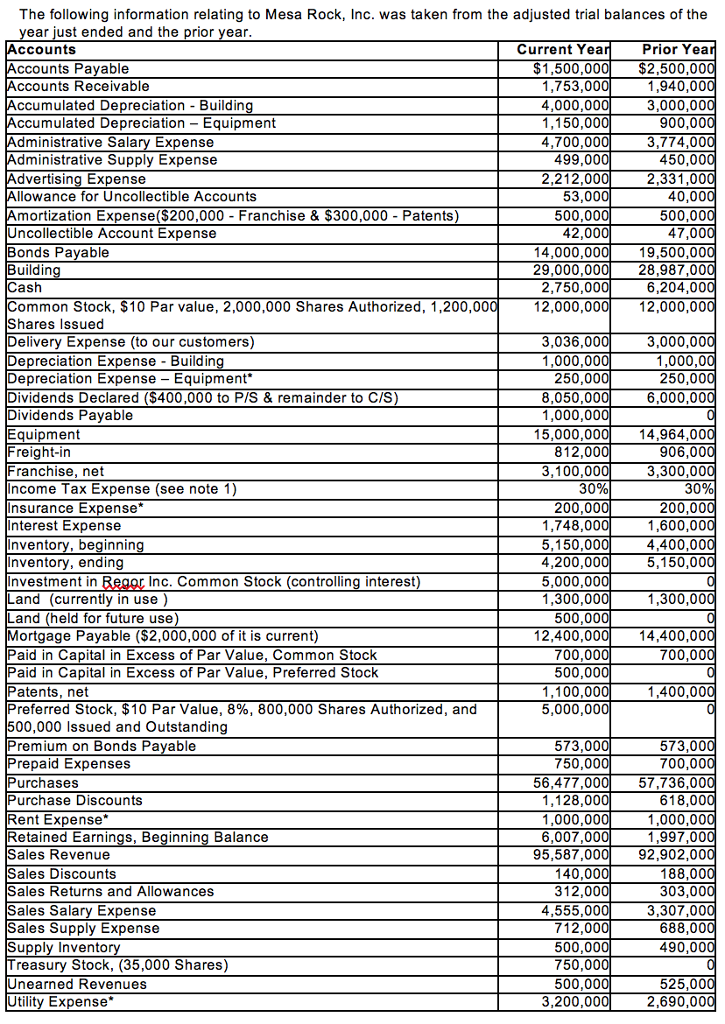

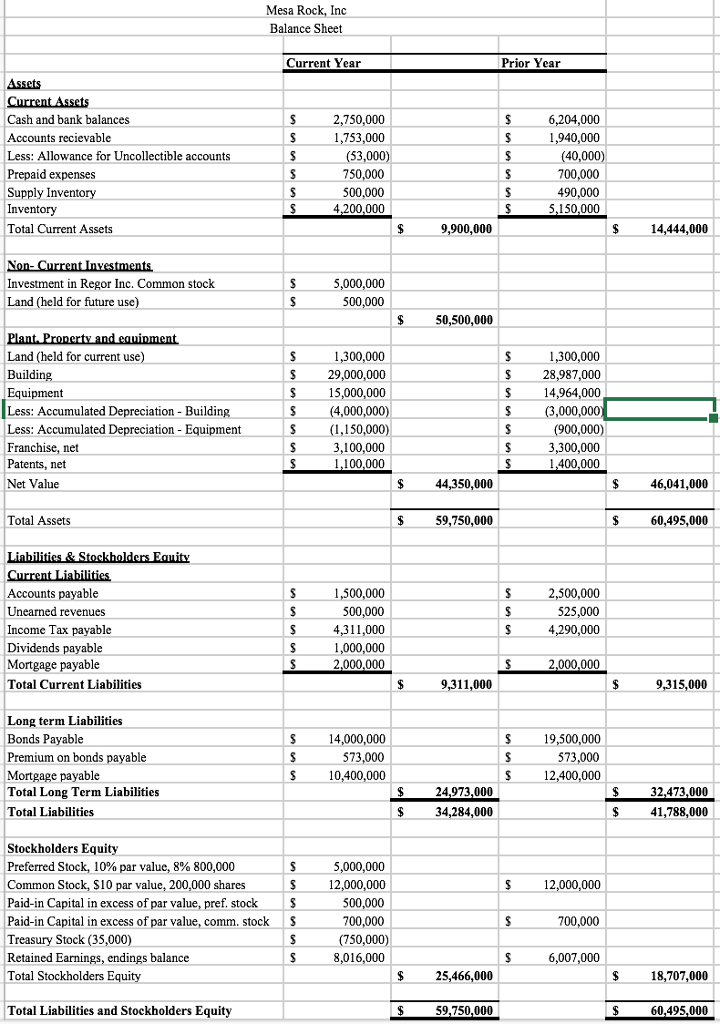

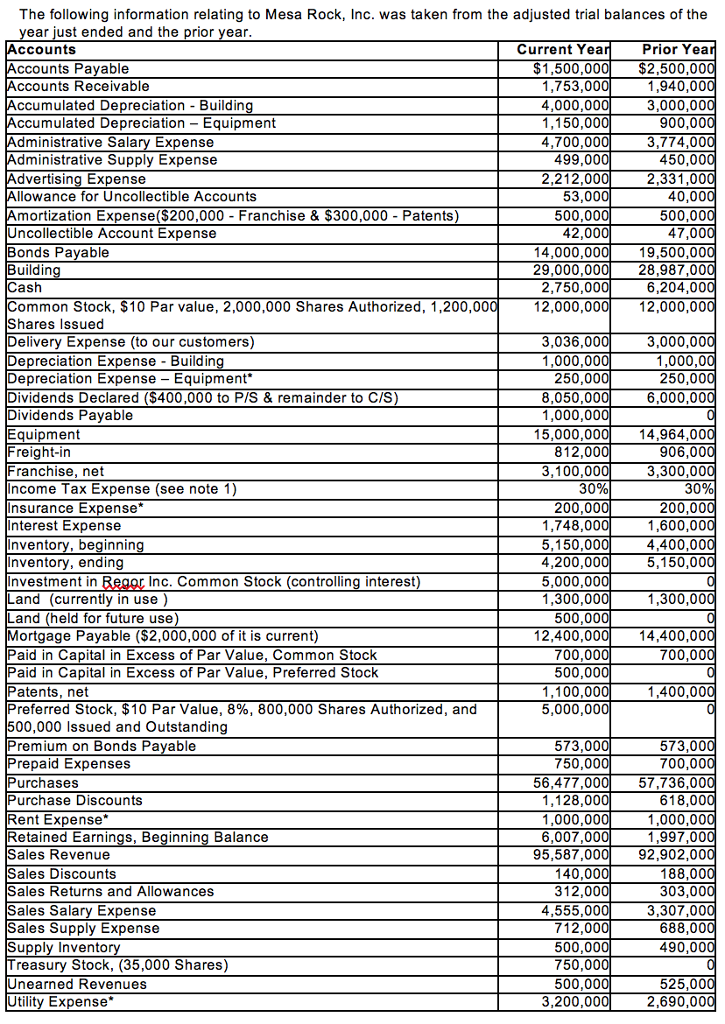

The following information relating to Mesa Rock, Inc. was taken from the adjusted trial balances of the year just ended and the prior year Current Year Prior Year Account Accounts Payabl S1.500.000L S2.500,000 Accounts Receivable 1.753.000 1940,000 Accumulated Depreciation Building 4.000.000 3,000,000 Accumulated Depreciation Equipment 1.150.000 900.000 4,700,000 3774,000 dministrative Salary Expense 499.000 450,000 dministrative Supply Expense Advertising Expense 2212,000 2331,000 Allowance for Uncollectible Accounts 53,000 40,000 Amortization Expense $200,000 Franchise & S300.000 Patents 500.000 500,000 42.000 47.000 Uncollectible Account Expense Bonds Payable 14.000.000 19,500,000 Building 29,000,000 28.98 1000 Cash 22.750,000 6,204,00 12,000,000 Common Stock, $10 Par value, 2,000,000 Shares Authorized, 1,200,000 12,000,000 Shares issued 3,036,000 3,000.00 Delivery Expense (to our customers) 1,000,000 1,000,00 Depreciation Expense Building Depreciation Expense-Equipment 250,000 250,000 Dividends Declared ($400,000 to PIS & remainder to CIS 8.050.000 6.000.000 Dividends Payable 1,000,000 Equipment 15.000.000 14.964.000 Freight-in 8112.000 906.000 3100,000 Franchise, net 3,300,000 1 30% 30% Income Tax Expense (see note Insurance Expense 200,000 200,000 1,748,000 1,600,000 Interest Expense 5.150,000 4.400,000 nventory, beginning 4.200,000 5.150,000 Inventory, ending Investment in Regar Inc. Common Stock (controlling interest 5.000.000 Land Currentlyin use 1.300,000 1,300,000 500,000 Land (held for future use Mortgage Payable S2,000,000 Of itis current 12.400,000 14.400.000 700,000 700,000 aid in Capital in Excess of Par Value, Common Stock Paid in Capital in Excess of Par Value, Preferred Stock 500,000I 0 Patients, net 1.100.000 1400,000 Preferred Stock, $10 Par Value, 8%, 800,000 Shares Authorized, and 5,000,000 500,000 Issued and Outstanding Premium on Bonds Payable 573,000 700.000 750.000 Prepaid Expenses Purchases 56,477 000 577 36,000 1.128.000 618.000 Purchase Discounts Rent Expense 1.000.000 1,000,000 6.00 O00 1997000 etained Earnings, Beginning Balance Sales Revenue 95.537.000 92,902,000 Sales Discounts 140,000 188,000 312,000 Sales Returns and Allowances 303,000 4.555.000 3.307000 Sales Salary Expense Sales Supply Expens 712.000 688.000 500,000 490,000 Supply Inventory Treasury Stock, 35,000 Shares) 750,000 500,000 525,000 Unearned Revenues Utility Expense 3.200.000 2.690.000