Answered step by step

Verified Expert Solution

Question

1 Approved Answer

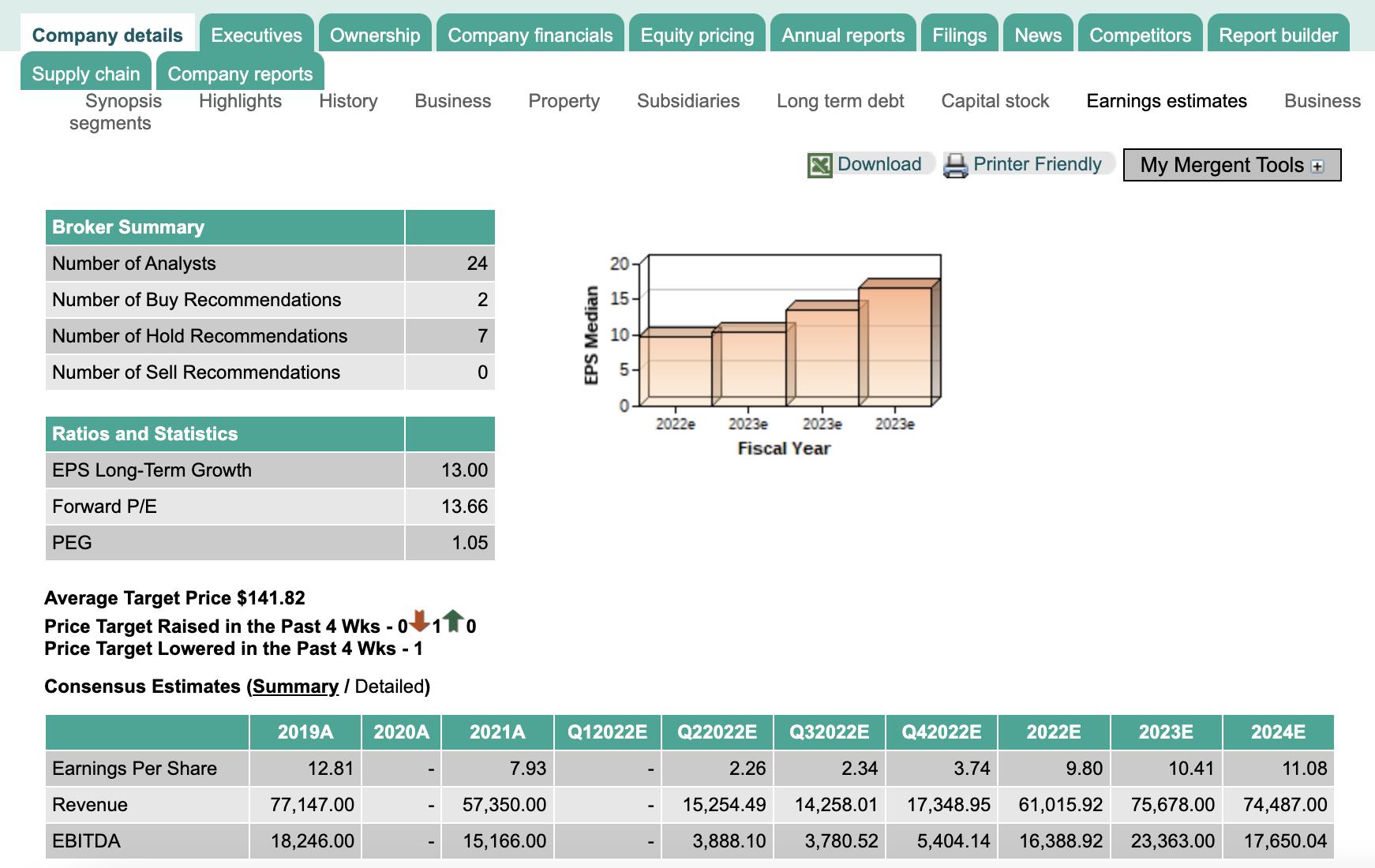

Calculate an estimated value of a share of the stock using multiples. Use the Forward P/E as the Benchmark PE in the model. Calculate the

Calculate an estimated value of a share of the stock using multiples. Use the Forward P/E as the Benchmark PE in the model. Calculate the estimated value for each year that a Consensus Estimate of Earnings per Share.

For example, suppose the Forward P/E is 27 and there are Consensus Estimates of $2.06 in 2021E and $2.25 in 2022E. According to the model, P1 would be $55.62 and P2 would be equal to $60.75. As described in the text, forecasted prices such as these are called Target Prices.

Company details Executives Ownership Company financials Supply chain Company reports Synopsis Highlights History Business Property segments Broker Summary Number of Analysts Number of Buy Recommendations Number of Hold Recommendations Number of Sell Recommendations Ratios and Statistics EPS Long-Term Growth Forward P/E PEG Average Target Price $141.82 Price Target Raised in the Past 4 Wks - 0 Price Target Lowered in the Past 4 Wks - 1 Consensus Estimates (Summary / Detailed) Earnings Per Share Revenue EBITDA 2019A 12.81 77,147.00 18,246.00 2020A 24 2 7 0 13.00 13.66 1.05 0 2021A 7.93 57,350.00 15,166.00 Equity pricing Subsidiaries 20- 15- 10- 2022e Q12022E Q22022E Annual reports Filings News 2.26 Long term debt 2023e 2023e Fiscal Year Download 2023e Capital stock 2.34 Q32022E Q42022E Competitors Report builder Printer Friendly 2022E Earnings estimates Business 9.80 3.74 10.41 15,254.49 14,258.01 17,348.95 61,015.92 75,678.00 3,888.10 3,780.52 5,404.14 16,388.92 23,363.00 My Mergent Tools + 2023E 2024E 11.08 74,487.00 17,650.04

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the estimated value of a share of the stoc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started