Answered step by step

Verified Expert Solution

Question

1 Approved Answer

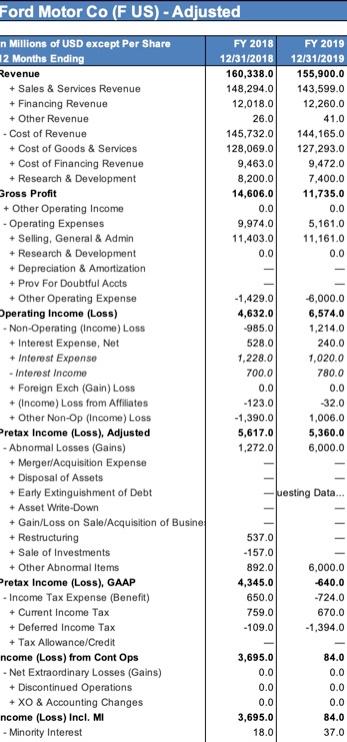

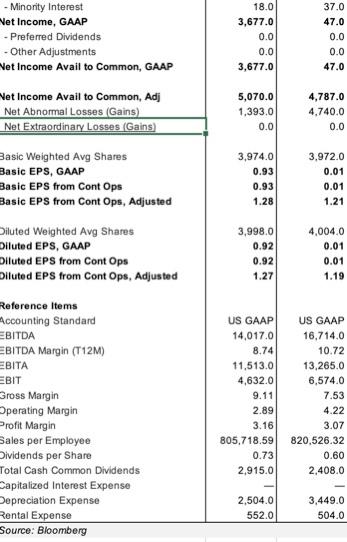

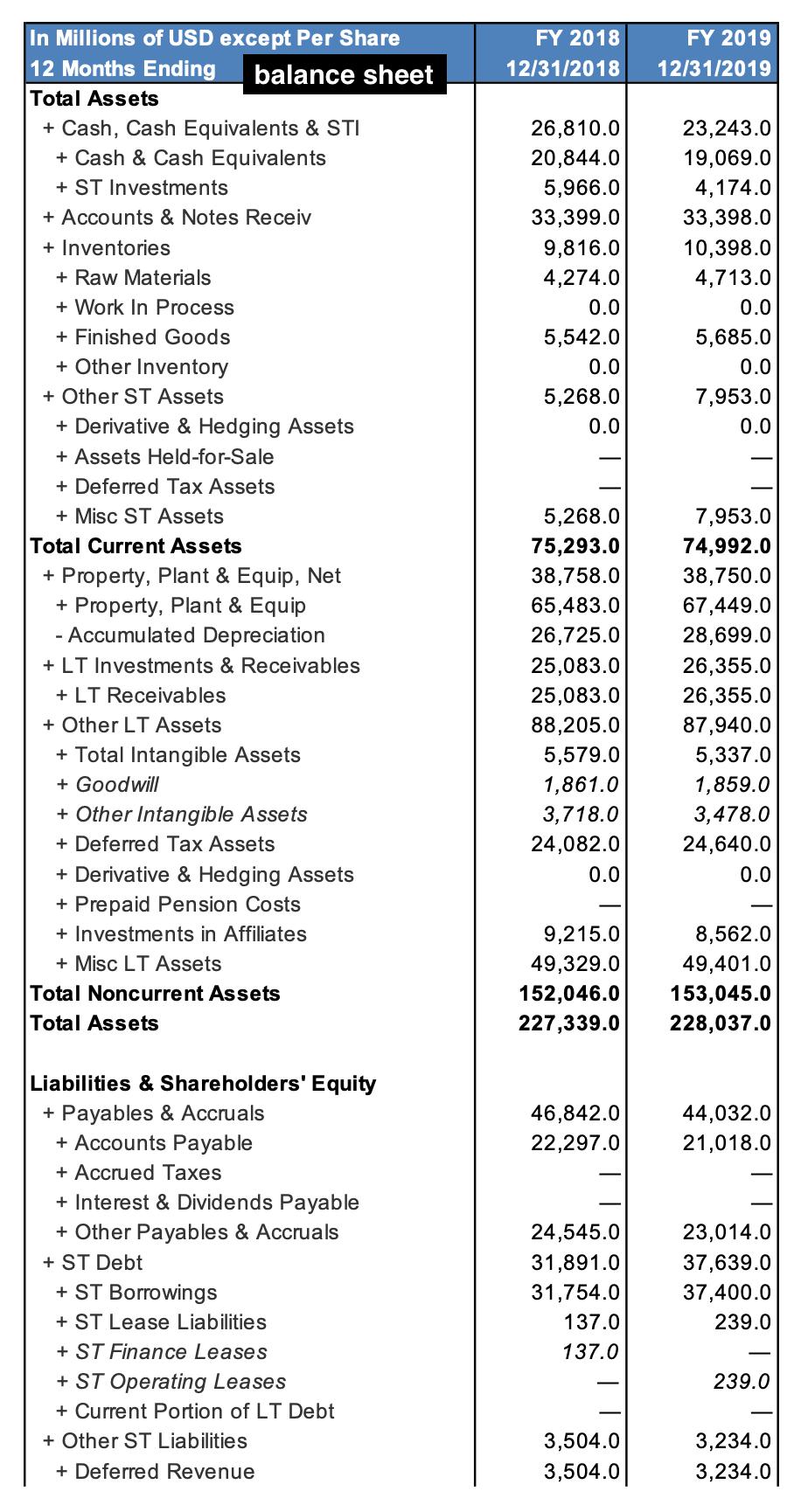

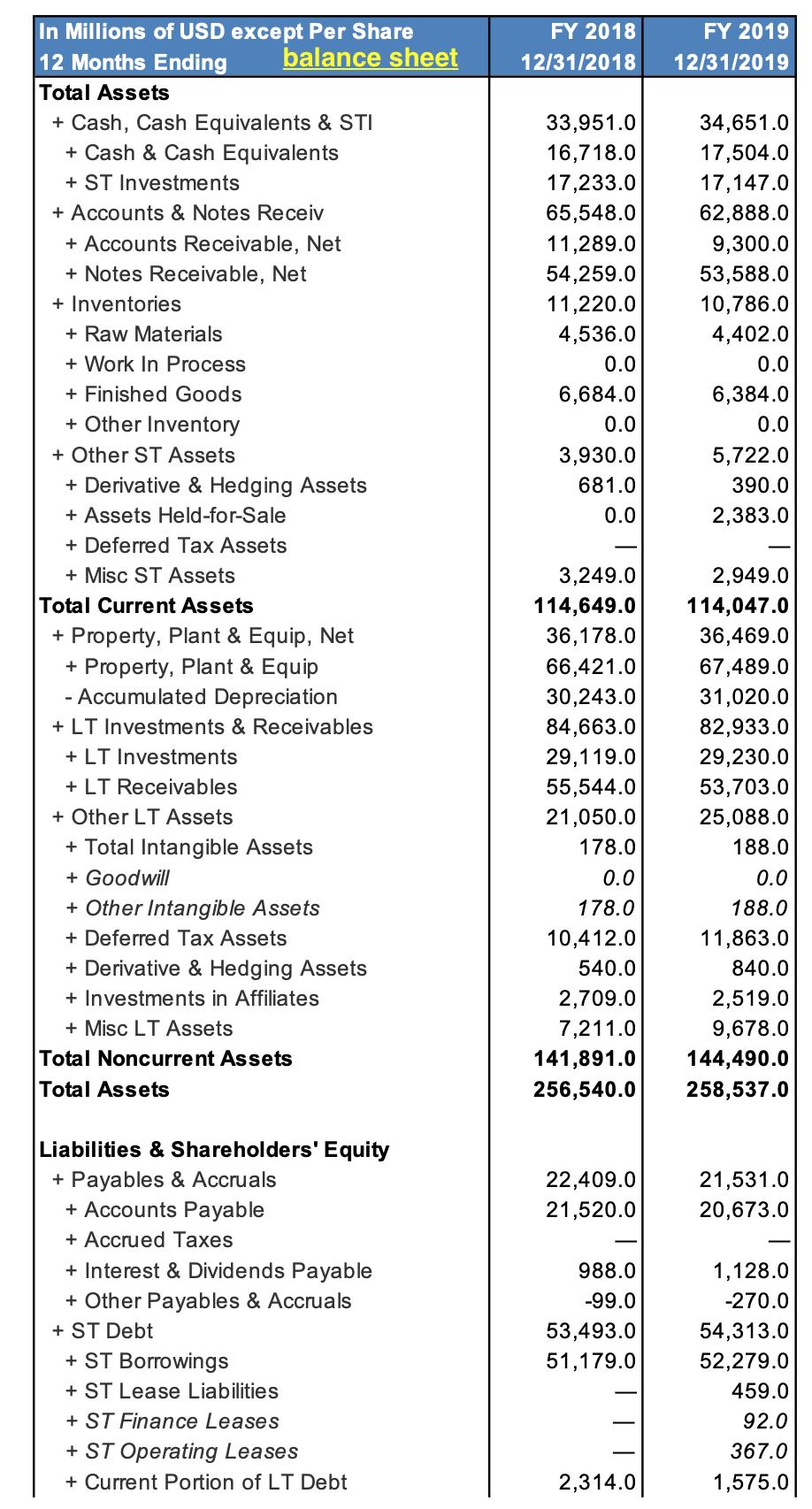

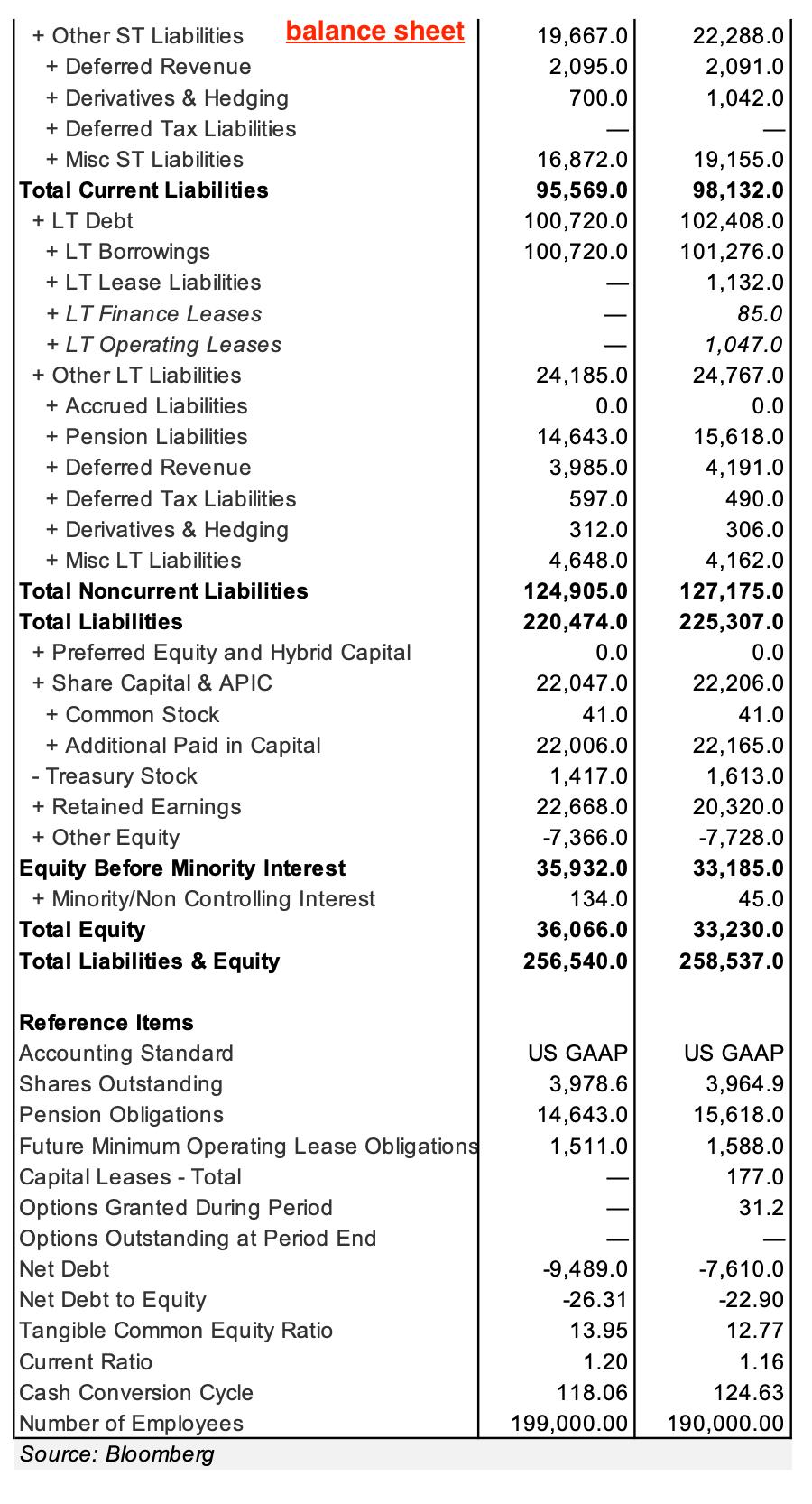

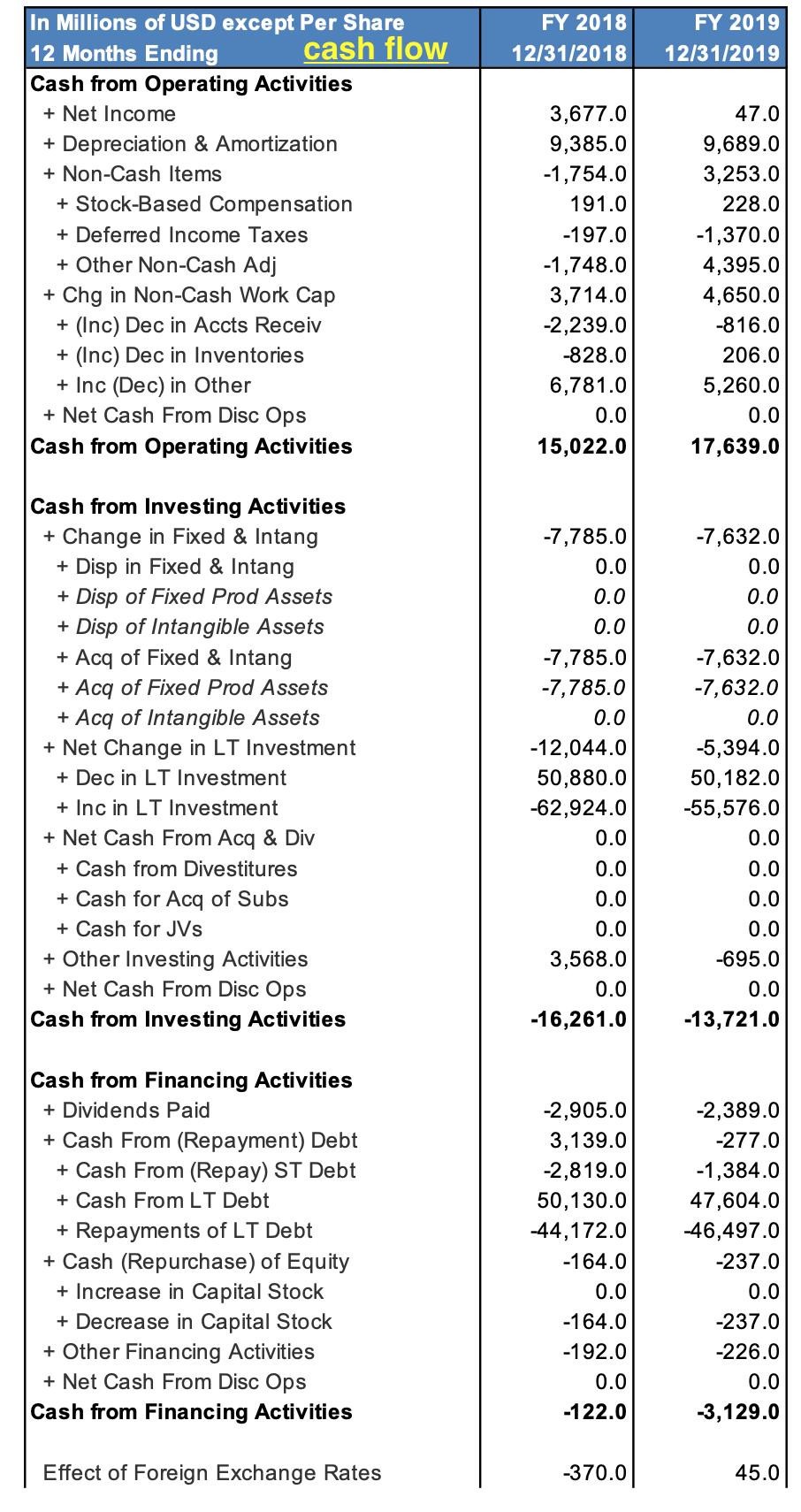

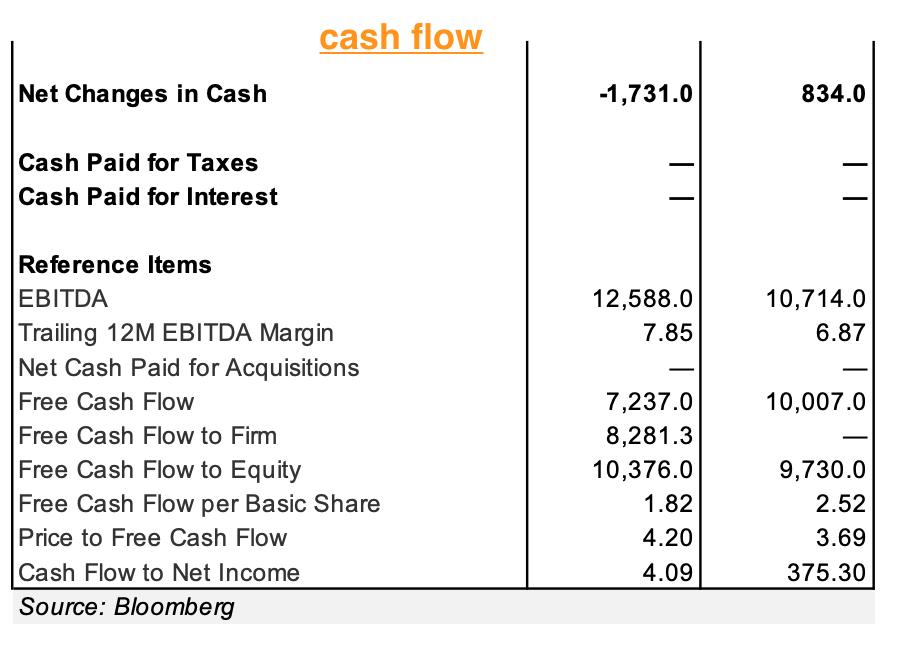

Calculate and interpret the two companies (Ford) and (GM) ratios (two years) Just the group of ratios mentioned in the grade center column. So you

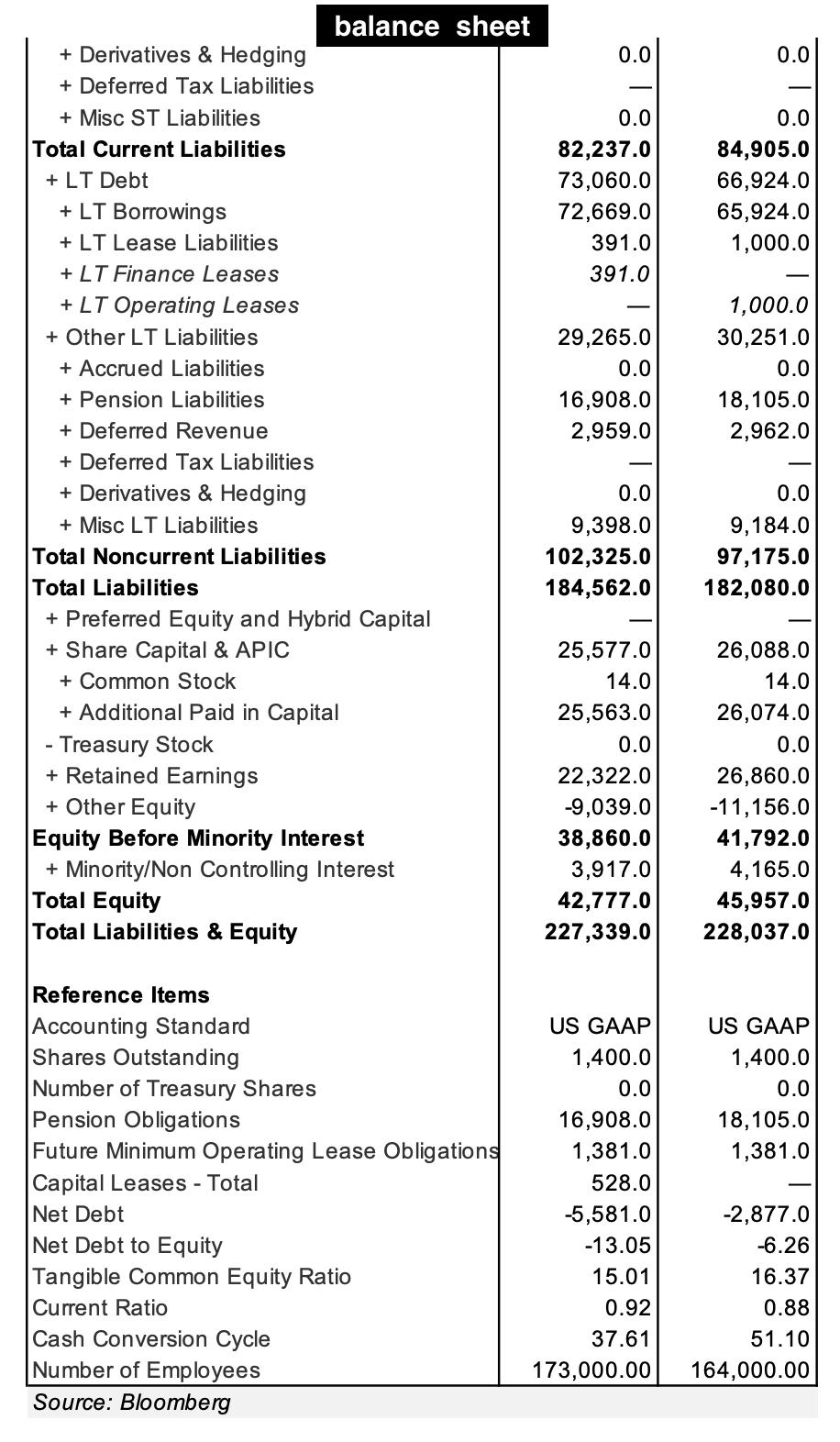

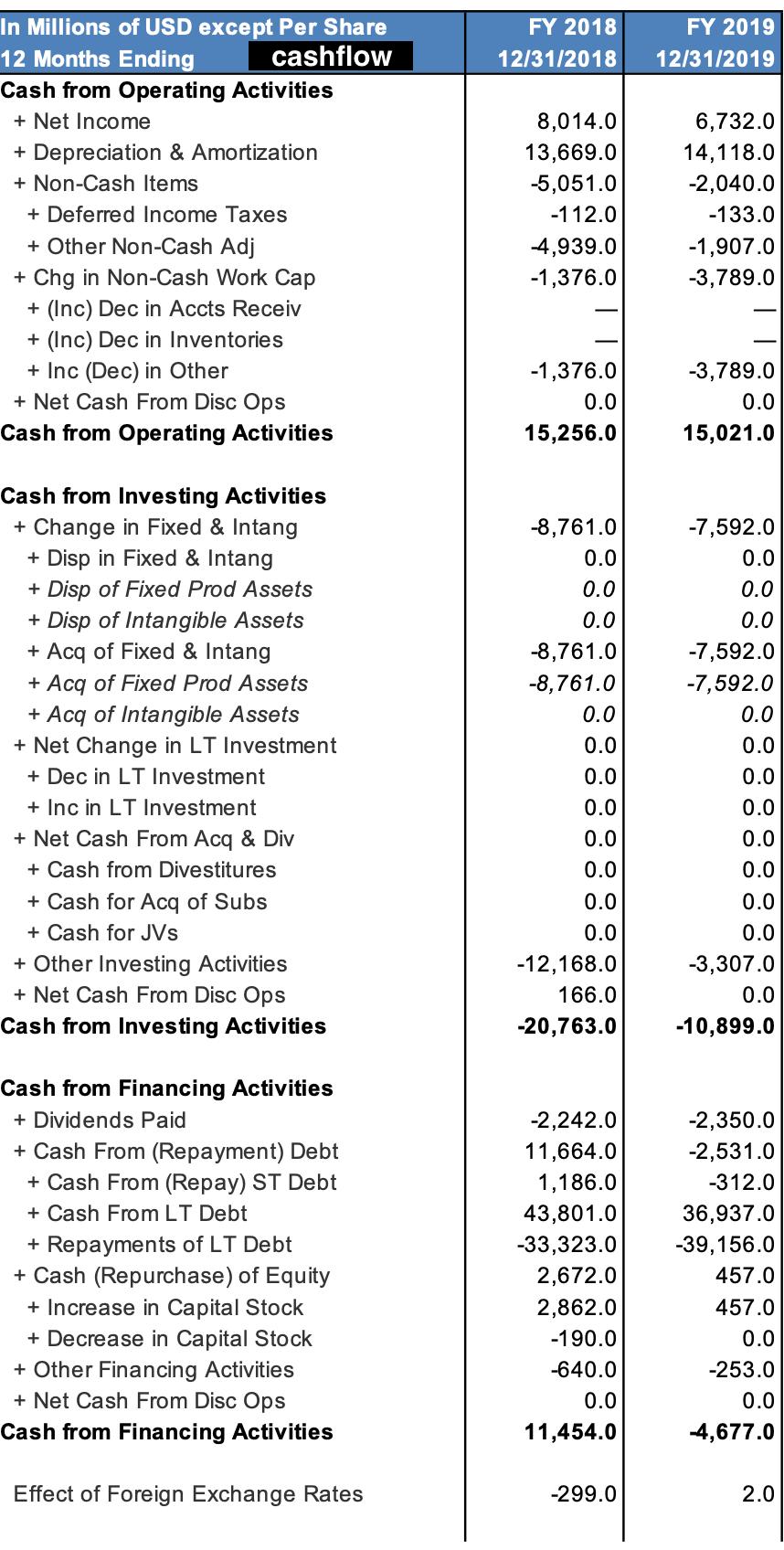

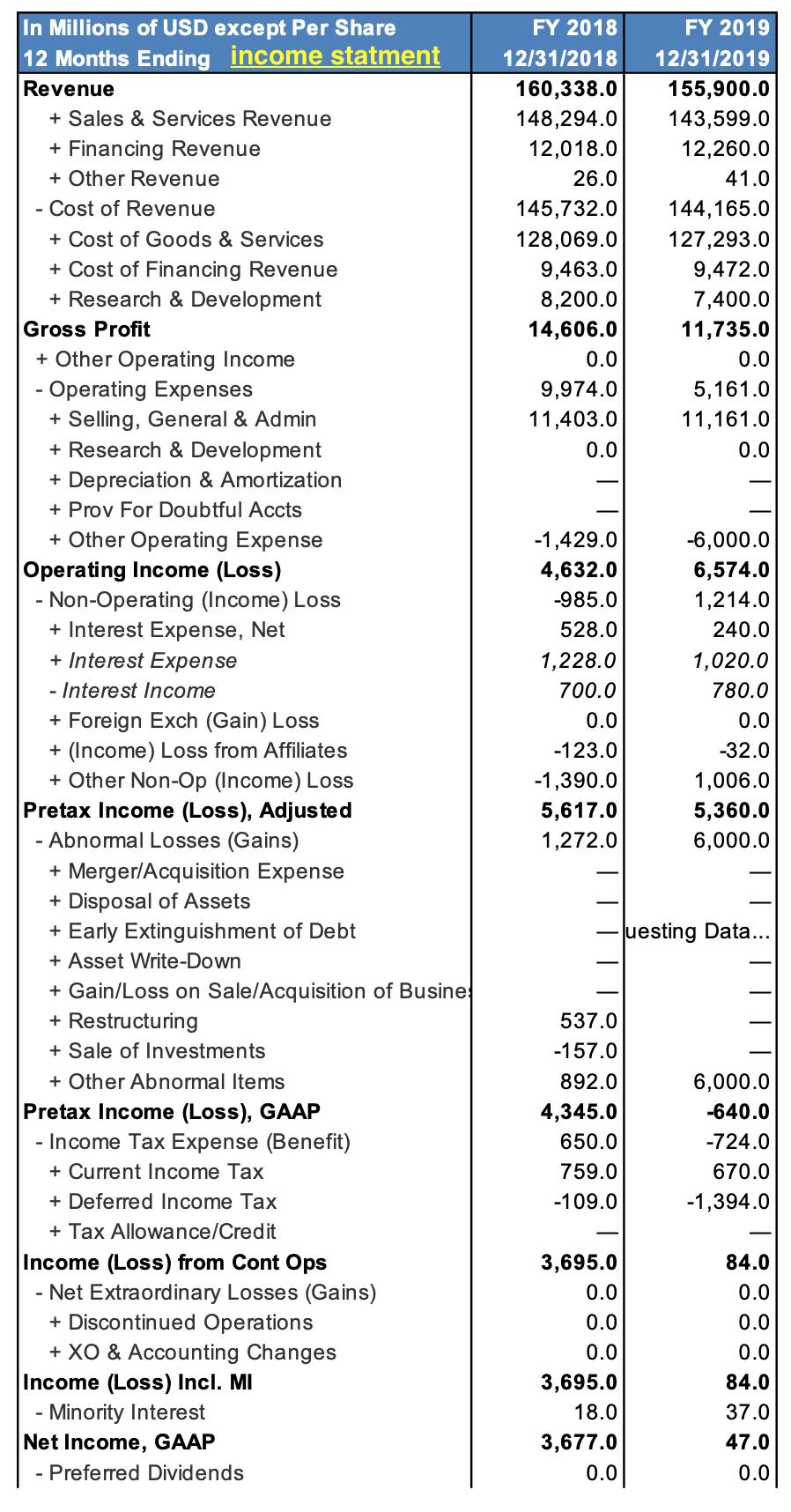

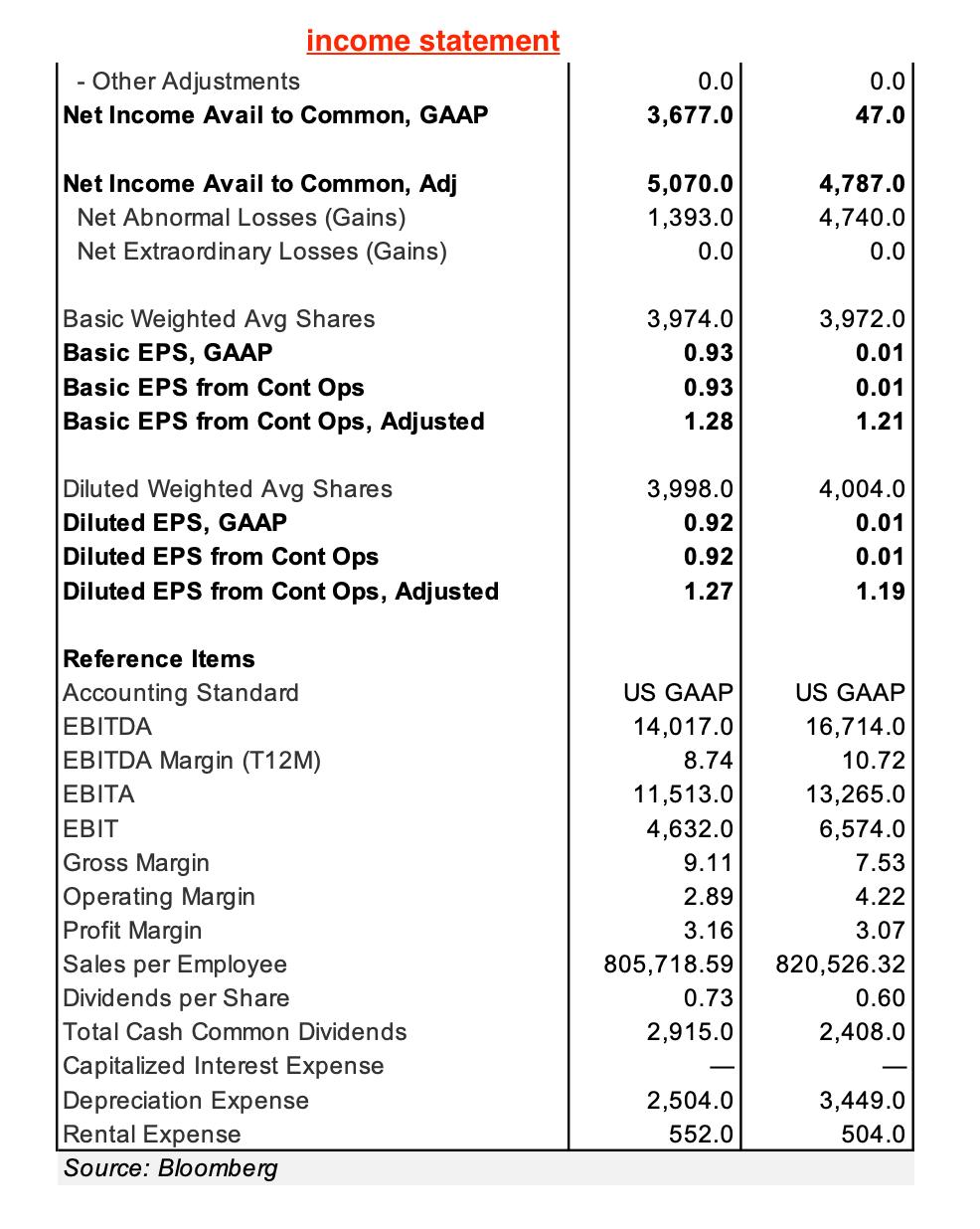

Calculate and interpret the two companies (Ford) and (GM) ratios (two years) Just the group of ratios mentioned in the grade center column. So you will upload your calculation and the interpretations, (Leverage Ratios)

![cash flow Net Changes in Cash 5,648.0] -553.0 Cash Paid for Taxes Cash Paid for Interest 660.0 3,597.0 689.0 4,214.0 18,114.0](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2020/10/5f76ff3f53cf1_1601634111794.jpg)

Ford Motor Co (F US) - Adjusted n Millions of USD except Per Share FY 2018 FY 2019 12 Months Ending 12/31/2018 12/31/2019 Revenue 160,338.0 155,900.0 Sales & Services Revenue 148,294.0 143,599.0 + Financing Revenue 12,018.0 12,260.0 + Other Revenue - Cost of Revenue + Cost of Goods & Services + Cost of Financing Revenue + Research & Development Gross Profit + Other Operating Income - Operating Expenses Selling, General & Admin + Research & Development + Depreciation & Amortization 26.0 41.0 145,732.0 144,165.0 128,069.0 127,293.0 9,463.0 9,472.0 8,200.0 7,400.0 14,606.0 11,735.0 0.0 0.0 9,974.0 5,161.0 11,403.0 11,161.0 0.0 0.0 + Prov For Doubtful Accts + Other Operating Expense -1,429.0 -6,000.0 Operating Income (Loss) - Non-Operating (Income) Loss + Interest Expense, Net + Interost Expense - Interest Income + Foreign Exch (Gain) Loss 4,632.0 6,574.0 -985.0 1,214.0 528.0 240.0 1,228.0 1,020.0 700.0 780.0 0.0 0.0 + (Income) Loss from Affiliates + Other Non-Op (Income) Loss Pretax Income (Loss), Adjusted -123.0 -32.0 -1,390.0 1,006.0 5,617.0 5,360.0 - Abnomal Losses (Gains) + Merger/Acquisition Expense + Disposal of Assets + Earty Extinguishment of Debt + Asset Write-Down + Gain/Loss on Sale/Acquisition of Busine + Restructuring 1,272.0 6,000.0 uesting Data. 537.0 + Sale of Investments -157.0 + Other Abnormal Items 892.0 6,000.0 Pretax Income (Loss), GAAP - Income Tax Expense (Benefit) 4,345.0 640.0 650.0 -724.0 Current Income Tax 759.0 670.0 + Deferred Income Tax + Tax Allowance/Credit -109.0 -1,394.0 ncome (Loss) from Cont Ops - Net Extraordinary Losses (Gains) + Discontinued Operations + XO & Accounting Changes 3,695.0 84.0 0.0 0.0 0.0 0.0 0.0 0.0 ncome (Loss) Incl. MI - Minority Interest 3,695.0 84.0 18.0 37.0

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Ford company FY 2018 FY 2019 1 Debt to quity Ratio Total LiabilitiesTotal shareholders Equity FY 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started