- Calculate annual yield to maturity for each issue. Assume par value of $1,000, semiannual coupon payments. Hint: find semiannual yield to maturity first, then multiply it by 2.

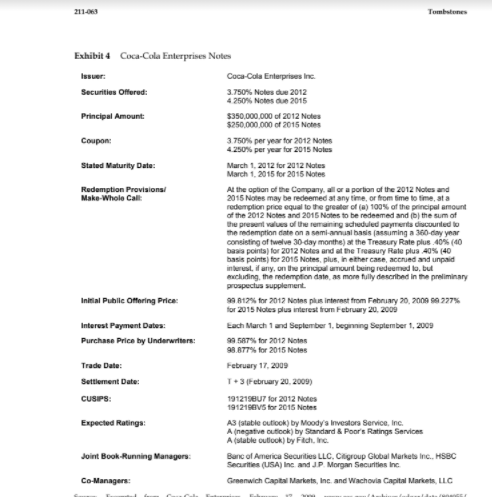

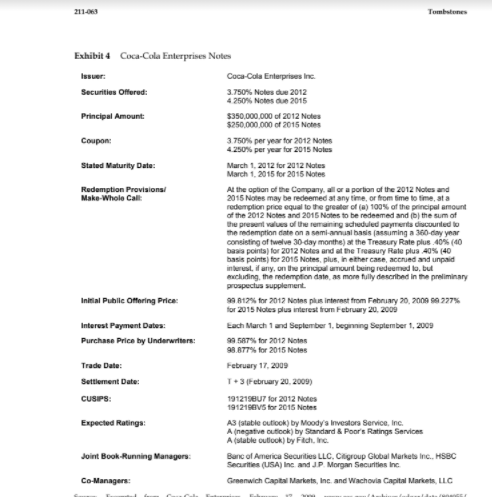

Tombstones Capital markets offer corporations varied ways to raise funds. This Note presents summary information for a selection of corporate securities issued during 2009-2010 following the financial crisis of 2008-2009. They include three issues of senior unsecured notes, one floating rate note, one common stock offering, and one convertible note. The issuers are Microsoft, Coca-Cola Enterprises, Norfolk Southern, IBM, Ford Motor, and Cephalon. Selected supplementary data on the issuers are summarized in Exhibit 1. A short glossary of terms appears at the end of the case. All three senior unsecured note issues were sold in $1,000 denominations and paid interest semi- annually. For each bond or note, the semi-annual interest payment equals one half the stated coupon rate times the $1,000 face amount. Following the same convention, the annual yield to maturity for such instruments is conventionally calculated and quoted as two times the semi-annual internal rate of return of the bond's market price and promised future payments of interest and principal. Coca-Cola Enterprises Notes On February 17, 2009, Coca-Cola Enterprises (the leading bottler of Coca-Cola beverages) issued $600 million in senior unsecured notes, comprised of one series of 3.75% notes due in 2012, and one series of 4.25% notes due in 2015 (see Exhibit 4). According to its SEC filing, the company planned to use the proceeds to pay down debt. 211-03 Tombstones Exhibit 4 Coca-Cola Enterprises Notes Issuer: Coca-Cola Enterprises Inc Securities Offered: 3.750% Notes de 2012 4250% Notes de 2015 Principal Amount: $350,000,000 of 2012 Notes $250.000.000 of 2015 Notes Coupon 3750% per year for 2012 Notes 4.250% per year for 2015 Notes Stated Maturity Date: March 1, 2012 for 2012 Notes March 1, 2015 for 2015 Notes Redemption Provisions the option of the Company, all or a portion of the 2012 Notes and Make-Whole Calt: 2015 Notes may be redeemed at any time, or from time to time, ata redemption price equal to the greator of (a) 100% of the principal amount of the 2012 Notes and 2015 Notes to be redeemed and the sum of the present values of the remaining scheduled payments discounted to the redemption date on a semi-amual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 40% (40 basis points for 2012 Notes and at the Treasury Rate plus 40% (40 basis points for 2015 Notes, plus, Inether case, accrued and unpaid interest, if any, on the principal amount being redeemed to, but excluding the redemption date as more fully described in the preliminary prospectus supplement Initial Public Offering Price: 99 12% for 2012 Notes plus interest from February 20, 2009 a 227 for 2015 Notes plus interest from February 20, 2009 Interest Payment Dates: Each March 1 and September 1, beginning September 1, 2009 Purchase Price by Underwriters: 9587% for 2012 Notes 98.877% for 2015 Notes Trade Date: February 17, 2009 Settlement Date: T+3 February 20, 2009) CUSIPS: 191219837 for 2012 Notes 191215EVS for 2015 Notes Expected Ratings A3 fatable outlook) by Moody's Investors Service, Inc. A negative outlook) by Standard & Poor's Ratings Services A (stable outlook) by Fichtne. Joint Book-Running Managers: Banc of America Securities LLC. Citigroup Global Markets Inc., HSBC Securities (USA) Inc and JP Morgan Securities Inc Co-Managers: Greenwich Capital Markets, Inc. and and Wachovia Capital Markets, LLC