Answered step by step

Verified Expert Solution

Question

1 Approved Answer

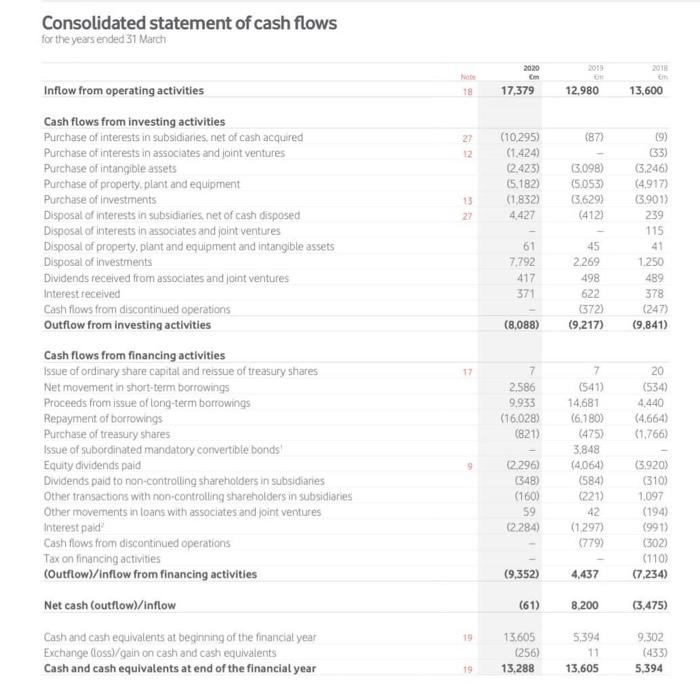

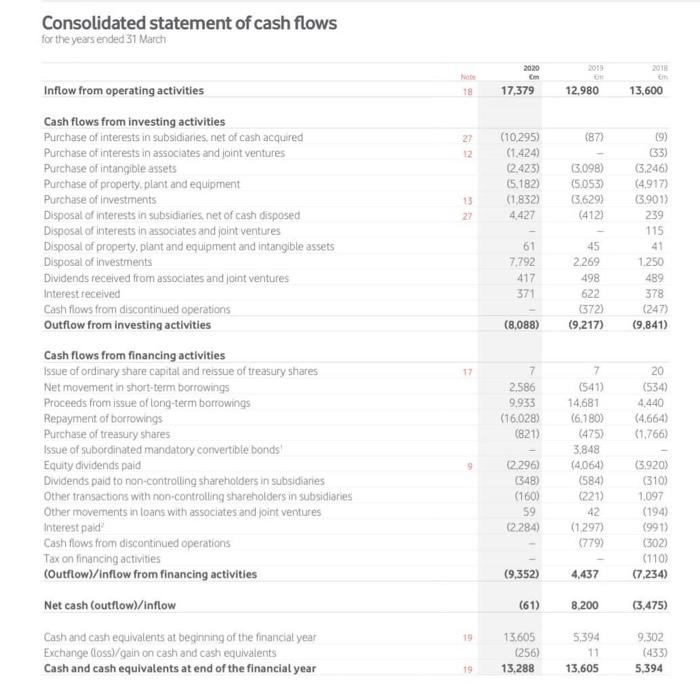

calculate at least ten financial ratios for the years attached Consolidated statement of cash flows for the years ended 31 March 2018 2020 Com 17,379

calculate at least ten financial ratios for the years attached

Consolidated statement of cash flows for the years ended 31 March 2018 2020 Com 17,379 Inflow from operating activities 12.980 13,600 (877 27 12 (10,295) (1.424) (2.425) (5.182) (1,832 4.427 (3.098) (5.053) (3.629) (412) 13 27 19) (33) (3,246) (4.917) (3.9012 239 115 41 1.250 489 378 (247) (9,841) 61 74792 417 371 45 2.269 498 622 (372) (9,217) (8,088) Cash flows from investing activities Purchase of interests in subsidiaries. net of cash acquired Purchase of interests in associates and joint ventures Purchase of intangible assets Purchase of property, plarit and equipment Purchase of investments Disposal of interests in subsidiaries, net of cash disposed Disposal of interests in associates and joint ventures Disposal of property, plant and equipment and intangible assets Disposal of investments Dividends received from associates and joint ventures Interest received Cash flows from discontinued operations Outflow from investing activities Cash flows from financing activities Issue of ordinary share capital and reissue of treasury shares Net movement in short-term borrowings Proceeds from issue of long-term borrowings Repayment of borrowings Purchase of treasury shares Issue of subordinated mandatory convertible bonds Equity dividends paid Dividends paid to non-controlling shareholders in subsidiaries Other transactions with non-controlling shareholders in subsidiaries Other movements in toans with associates and joint ventures Interest paid Cash flows from discontinued operations Tax on financing activities (Outflow)/inflow from financing activities Net cash Coutflow)/inflow Cash and cash equivalents at beginning of the financial year Exchange (loss/gain on cash and cash equivalents Cash and cash equivalents at end of the financial year 2,586 9.933 (16.028) (821) 20 (534) 4,440 (4,664) (1.766) (2.296) (348) (160) 59 (2.284) (541) 14,681 (6.180) (475) 3,848 (4,064) (584) (221) 42 (1297) (779) (3.920) (310) 1.097 (194) (991) (302) (110) (7,234) (9,352) 4,437 (61) 8.200 (3,475) 19 13.605 (256) 13,288 5,394 11 13,605 9,302 (433) 5,394 19 Consolidated statement of cash flows for the years ended 31 March 2018 2020 Com 17,379 Inflow from operating activities 12.980 13,600 (877 27 12 (10,295) (1.424) (2.425) (5.182) (1,832 4.427 (3.098) (5.053) (3.629) (412) 13 27 19) (33) (3,246) (4.917) (3.9012 239 115 41 1.250 489 378 (247) (9,841) 61 74792 417 371 45 2.269 498 622 (372) (9,217) (8,088) Cash flows from investing activities Purchase of interests in subsidiaries. net of cash acquired Purchase of interests in associates and joint ventures Purchase of intangible assets Purchase of property, plarit and equipment Purchase of investments Disposal of interests in subsidiaries, net of cash disposed Disposal of interests in associates and joint ventures Disposal of property, plant and equipment and intangible assets Disposal of investments Dividends received from associates and joint ventures Interest received Cash flows from discontinued operations Outflow from investing activities Cash flows from financing activities Issue of ordinary share capital and reissue of treasury shares Net movement in short-term borrowings Proceeds from issue of long-term borrowings Repayment of borrowings Purchase of treasury shares Issue of subordinated mandatory convertible bonds Equity dividends paid Dividends paid to non-controlling shareholders in subsidiaries Other transactions with non-controlling shareholders in subsidiaries Other movements in toans with associates and joint ventures Interest paid Cash flows from discontinued operations Tax on financing activities (Outflow)/inflow from financing activities Net cash Coutflow)/inflow Cash and cash equivalents at beginning of the financial year Exchange (loss/gain on cash and cash equivalents Cash and cash equivalents at end of the financial year 2,586 9.933 (16.028) (821) 20 (534) 4,440 (4,664) (1.766) (2.296) (348) (160) 59 (2.284) (541) 14,681 (6.180) (475) 3,848 (4,064) (584) (221) 42 (1297) (779) (3.920) (310) 1.097 (194) (991) (302) (110) (7,234) (9,352) 4,437 (61) 8.200 (3,475) 19 13.605 (256) 13,288 5,394 11 13,605 9,302 (433) 5,394 19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started