Answered step by step

Verified Expert Solution

Question

1 Approved Answer

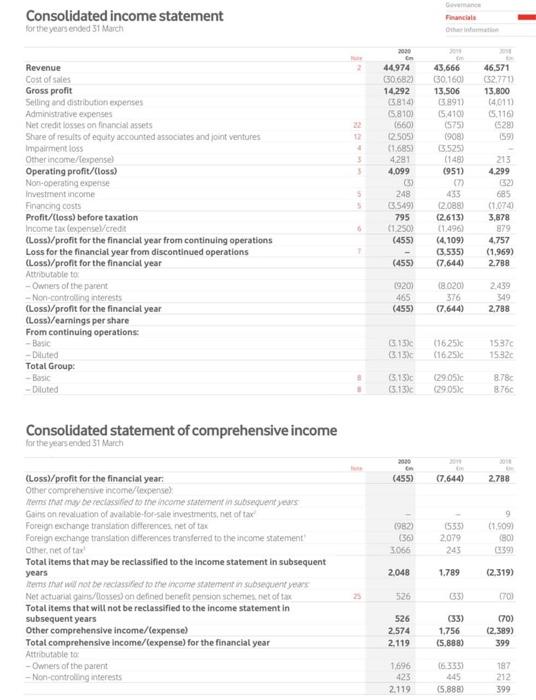

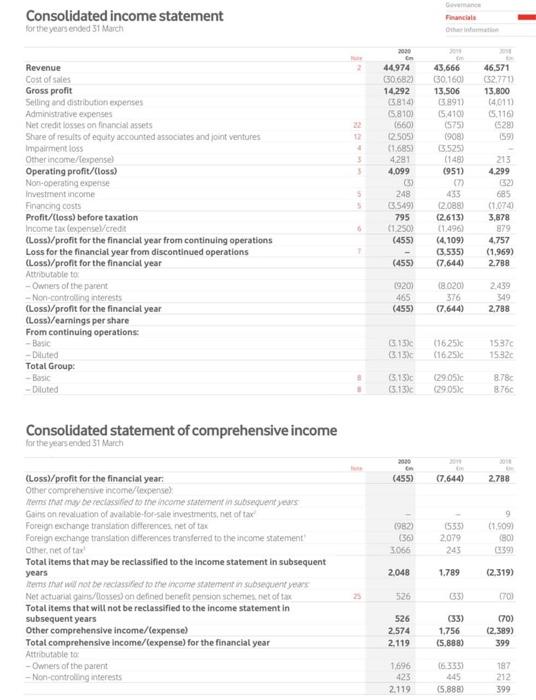

calculate at least ten financial ratios for the years attached Consolidated income statement for the years ended 31 March Face 2020 44,974 (50682) 14.292 5814

calculate at least ten financial ratios for the years attached

Consolidated income statement for the years ended 31 March Face 2020 44,974 (50682) 14.292 5814 6.8109 46.571 52.771 13.800 (4611) 5.116) (5280 159) (660) 3 12.505) (1.685) 4281 4,099 Revenue Cost of sales Gross profit Selling and distribution expenses Administrative expenses Net credit losses on financial assets Share of results of equity accounted associates and joint ventures Impairment loss Other income/expense Operating profit/(loss) Non-operating expense Investment income Financing costs Profit/(loss) before taxation Income tax expensel/credit (Loss)/profit for the financial year from continuing operations Loss for the financial year from discontinued operations (Loss)/profit for the financial year Attributable to - Owners of the parent -- Non-controlling interests (Loss)/profit for the financial year (Loss/earnings per share From continuing operations - Basic -Diluted Total Group -Basic - Dilated 43,666 50.160) 13,506 6991) (54100 (575 19081 3.525 (1481 (951) 7 433 12.0881 (2.613) (1.496) (4,109) (3.535) (7,644) 213 4.299 248 3549) 795 (1.250) (455) 685 (1.074 3,878 879 4.757 (1.969) 2.788 (455) 1920 465 18.020) 376 (7.644) 2439 349 2.788 (455) 6150 (3.150 (1625) (16 25 1537 15326 315) (3.13) (29.05 (2905) 8.780 8760 Consolidated statement of comprehensive income for the years ended 31 March 2020 (455) (7.644) 2.788 1982) (56 3066 1535 2,079 245 9 11.909) 800 339 2.048 1.789 (2.319) (Loss)/profit for the financial year, Other comprehensive income/expense) terns that may be reclassified to the income statement in subsequent years Gains on revaluation of available for sale investments, net of tax Foreign exchange translation differences.net of tax Foreign exchange translation differences transferred to the income statement Othernet of tax Total items that may be reclassified to the income statement in subsequent years terms well not be reckassiled to the income statement in subsequent years Net actuariat Gains/losses) on defined benefit pension schemek net of tax Total items that will not be reclassified to the income statement in subsequent years Other comprehensive income/lexpense) Total comprehensive income/lexpense) for the financial year Attributable to -Owners of the parent -Non-controlling interests 526 33) COB 526 2.574 (33) 1,756 (5,888) 070) (2.389) 399 1696 423 2.119 163353 445 (5.888) 187 212 399

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started