Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate BAE System's Cost of Equity (Ke), Cost of Debt (Kd) and Weighted Average Cost of Capital (WACC) for each year for the last 5

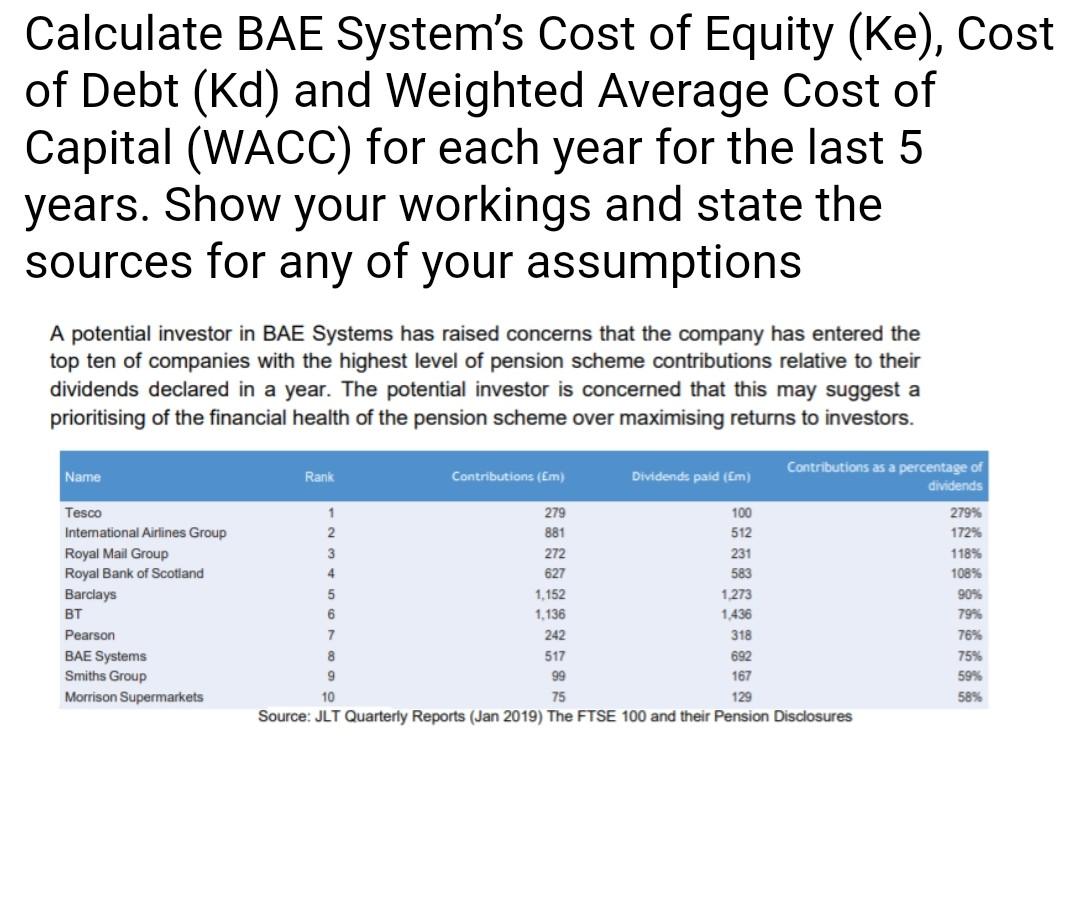

Calculate BAE System's Cost of Equity (Ke), Cost of Debt (Kd) and Weighted Average Cost of Capital (WACC) for each year for the last 5 years. Show your workings and state the sources for any of your assumptions A potential investor in BAE Systems has raised concerns that the company has entered the top ten of companies with the highest level of pension scheme contributions relative to their dividends declared in a year. The potential investor is concerned that this may suggest a prioritising of the financial health of the pension scheme over maximising returns to investors. Name Tesco Interational Airlines Group Royal Mail Group Royal Bank of Scotland Barclays BT Pearson BAE Systems Smiths Group Morrison Supermarkets Rank Contributions (Em) Dividends paid (Em) Contributions as a percentage of dividends 1 279 100 279% 2 881 512 172% 3 272 231 118% 4 627 583 108% 5 1.152 1.273 90% 6 1.136 1,436 799 7 242 318 76% 8 517 692 75% 9 99 167 59% 10 75 129 58% Source: JLT Quarterly Reports (Jan 2019) The FTSE 100 and their Pension Disclosures Calculate BAE System's Cost of Equity (Ke), Cost of Debt (Kd) and Weighted Average Cost of Capital (WACC) for each year for the last 5 years. Show your workings and state the sources for any of your assumptions A potential investor in BAE Systems has raised concerns that the company has entered the top ten of companies with the highest level of pension scheme contributions relative to their dividends declared in a year. The potential investor is concerned that this may suggest a prioritising of the financial health of the pension scheme over maximising returns to investors. Name Tesco Interational Airlines Group Royal Mail Group Royal Bank of Scotland Barclays BT Pearson BAE Systems Smiths Group Morrison Supermarkets Rank Contributions (Em) Dividends paid (Em) Contributions as a percentage of dividends 1 279 100 279% 2 881 512 172% 3 272 231 118% 4 627 583 108% 5 1.152 1.273 90% 6 1.136 1,436 799 7 242 318 76% 8 517 692 75% 9 99 167 59% 10 75 129 58% Source: JLT Quarterly Reports (Jan 2019) The FTSE 100 and their Pension Disclosures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started