Answered step by step

Verified Expert Solution

Question

1 Approved Answer

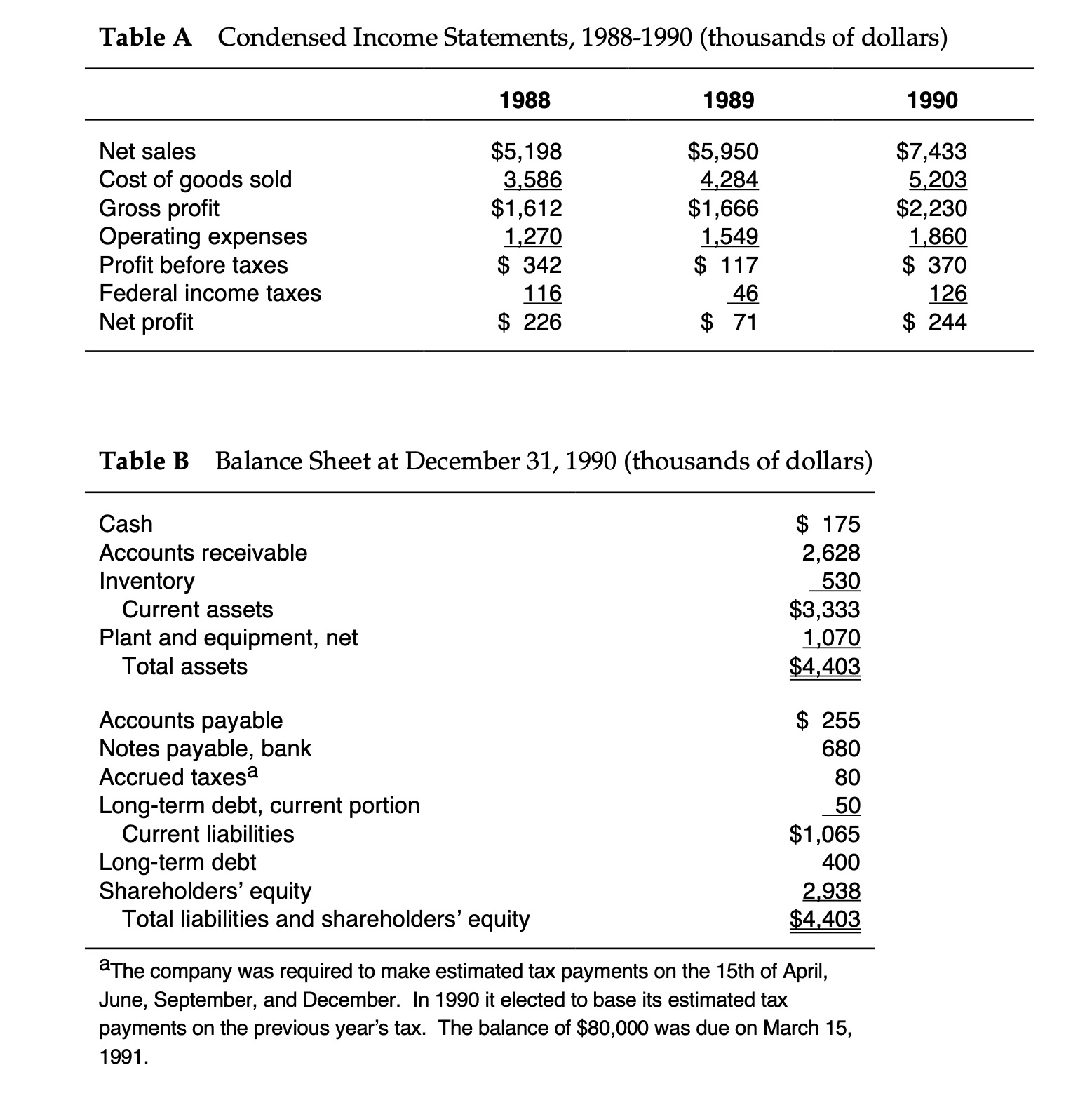

Calculate balance sheet financial analysis the : Current Ratio , Working Capital Leverage,A/R Turndays, Inventory Turndays, and Accounts payable turnover using balance sheet. Table A

Calculate balance sheet financial analysis the : Current Ratio , Working Capital Leverage,A/R Turndays, Inventory Turndays, and Accounts payable turnover using balance sheet.

Table A Condensed Income Statements, 1988-1990 (thousands of dollars) 1988 1989 1990 Net sales $5,198 $5,950 $7,433 Cost of goods sold 3,586 4,284 5,203 Gross profit $1,612 $1,666 $2,230 Operating expenses 1,270 1,549 1,860 Profit before taxes $ 342 $ 117 $ 370 Federal income taxes 116 46 126 Net profit $ 226 $ 71 $ 244 Table B Balance Sheet at December 31, 1990 (thousands of dollars) Cash Accounts receivable Inventory Current assets Plant and equipment, net Total assets Accounts payable Notes payable, bank Accrued taxesa Long-term debt, current portion Current liabilities Long-term debt $ 175 2,628 530 $3,333 1,070 $4,403 $ 255 680 80 50 $1,065 400 2,938 $4,403 Shareholders' equity Total liabilities and shareholders' equity aThe company was required to make estimated tax payments on the 15th of April, June, September, and December. In 1990 it elected to base its estimated tax payments on the previous year's tax. The balance of $80,000 was due on March 15, 1991.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided financial data we can calculate the following ratios 1 Current Ratio Divide current assets by current liabilities Current Assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started