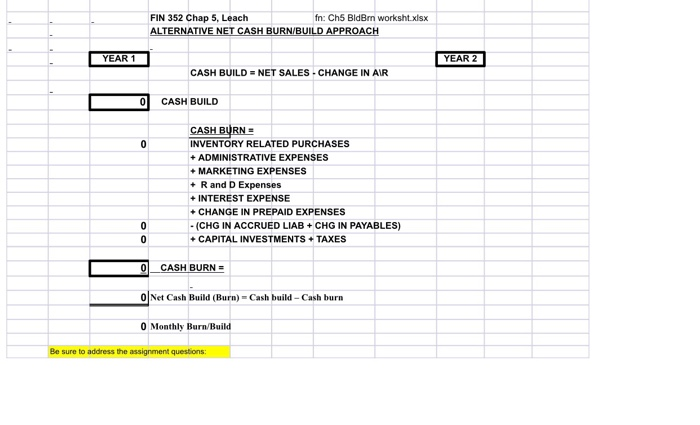

calculate cash build and cash burn

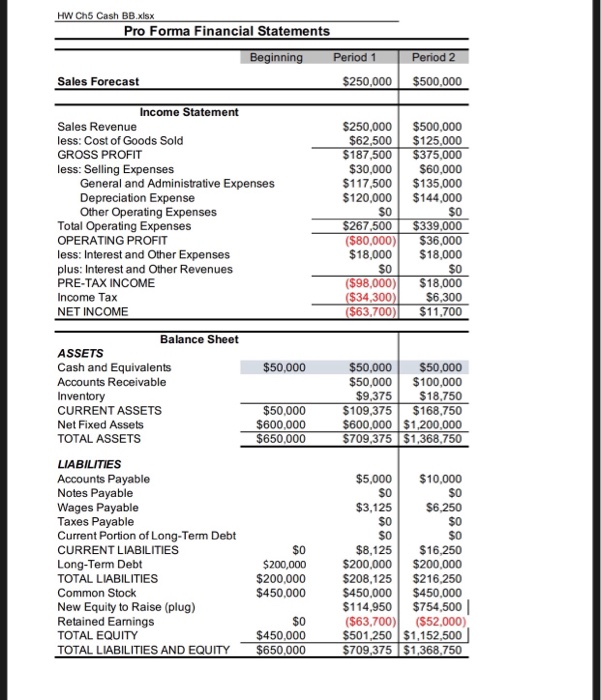

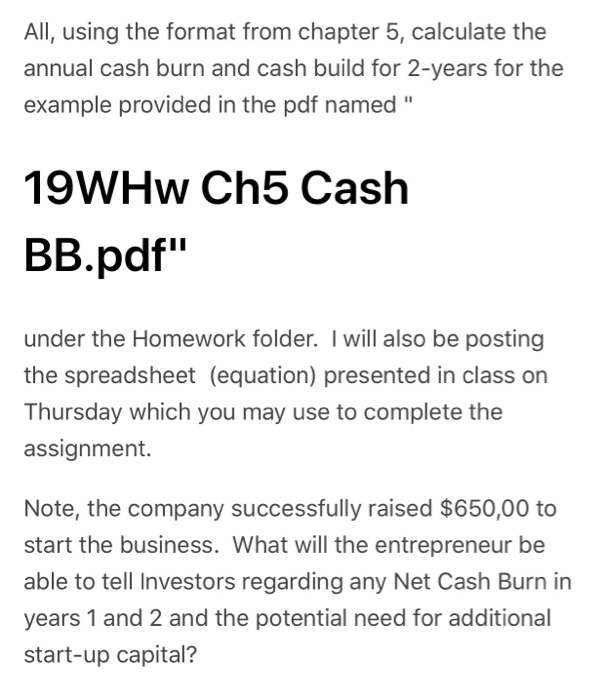

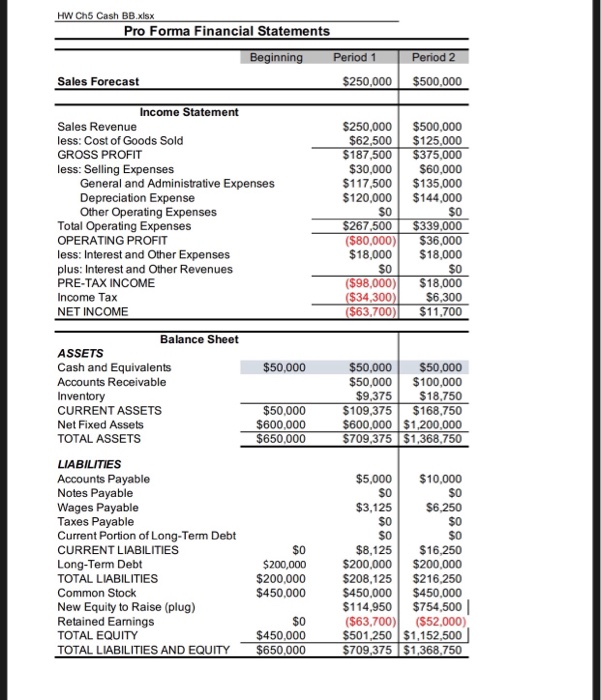

FIN 352 Chap 5, Leach ALTERNATIVE NET CASH BURN/BUILD APPROACH n: Chs BldBrn worksht xlis YEAR 1 YEAR 2 CASH BUILD-NET SALES . CHANGE IN AIR 0 CASH BUILD INVENTORY RELATED PURCHASES ADMINISTRATIVE EXPENSES MARKETING EXPENSES R and D Expenses INTEREST EXPENSE CHANGE IN PREPAID EXPENSES (CHG IN ACCRUED LIAB+CHG IN PAYABLES 0CAPITAL INVESTMENTS TAXES 01 CASH BURN O Net Cash Build (Burn) Cash build Cash burn 0 Monthly Burn/Build Be sure to address the assignment questions: HW Ch5 Cash BB.xlsx Pro Foma Financial Statements Sales Forecast $250,000 $500,000 Income Statement Sales Revenue less: Cost of Goods Sold GROSS PROFIT less: Selling Expenses $250,000 $500,000 $62,500 $125,000 $187,500 $375,000 $30,000 S60,000 $117,500 $135,000 $120,000 $144,000 S0 $267,500 $339,000 ($80,000) $36,000 $18,000$18,000 S0 (598,000) $18,000 $6,300 1,700 General and Administrative Expenses Depreciation Expense Other Operating Expenses Total Operating Expenses OPERATING PROFIT less: Interest and Other Expenses plus: Interest and Other Revenues PRE-TAX INCOME Income Tax NET INCOME S0 $34.300 ($63,700 Balance Sheet ASSETS Cash and Equivalents Accounts Receivable Inventory CURRENT ASSETS Net Fixed Assets TOTAL ASSETS $50,000 $50,000 $50,000 $50,000 $100,000 $9,375 $18,750 $109,375 $168,750 $600,000 $1,200,000 $709,375 $1,368.750 $50,000 $600,000 $650,000 LIABILITIES Accounts Payable Notes Payable Wages Payable Taxes Payable Current Portion of Long-Term Debt CURRENT LIABILITIES Long-Term Debt TOTAL LIABILITIES Common Stock New Equity to Raise (plug) Retained Earnings TOTAL EQUITY TOTAL LIABILITIES AND EQUITY $650,000 $5,000 $10,000 S0 $6,250 S0 S0 $8,125 $16,250 $200,000 $200,000 $208,125 $216,250 $450,000 $450,000 $114,950 $754,500 S0 $3,125 S0 SO $0 $200,000 $450,000 $0 $450,000 ($63,700) (S52,000) $501,250 $1,152,500 $709,375 $1,368,750 All, using the format from chapter 5, calculate the annual cash burn and cash build for 2-years for the example provided in the pdf named " 19WHw Ch5 Cash BB.pdf" under the Homework folder. I will also be posting the spreadsheet (equation) presented in class on Thursday which you may use to complete the assignment. Note, the company successfully raised $650,00 to start the business. What will the entrepreneur be able to tell Investors regarding any Net Cash Burn in years 1 and 2 and the potential need for additional start-up capital