Answered step by step

Verified Expert Solution

Question

1 Approved Answer

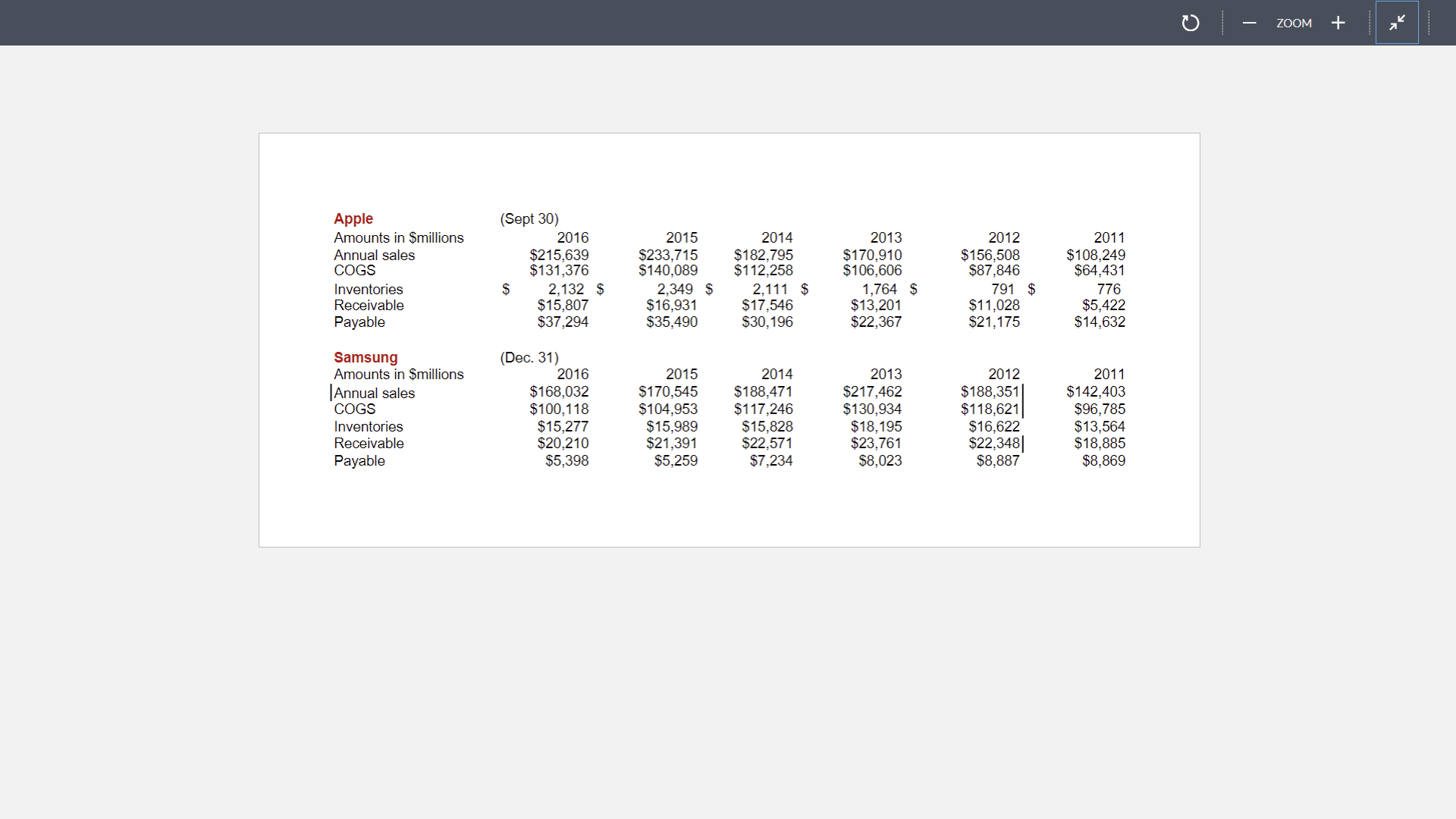

calculate cash conversion cycle for Apple and Samsung using the data provided in the following steps: 1 . Inventory DOS and turnover ( assuming 3

calculate cash conversion cycle for Apple and Samsung using the data provided in the following steps: 1 . Inventory DOS and turnover ( assuming 3 6 5 business days in a year ) 2 . Payable and receivable days 3 . Cash conversion cycle. Please answer the following questions: 1 . Which company has a shorter cycle ? 2 . Any systematic difference in payable, receivable and inventory days? Implications The data is provided below:

- ZOOM + COGS $215,639 $131,376 Inventories $ 2,132 $ 2,349 $ Receivable $15,807 Payable $37,294 $16,931 $35,490 Apple Amounts in $millions Annual sales (Sept 30) 2016 2015 $233,715 $140,089 2014 $182,795 $112,258 2013 $170,910 $106,606 2012 $156,508 $87,846 2011 $108,249 $64,431 311111 2,111 $ $17,546 $30,196 1,764 $ $13,201 $22,367 791 $ $11,028 $21,175 776 $5,422 $14,632 Samsung (Dec. 31) Amounts in $millions Annual sales 2016 $168,032 2015 2014 2013 2012 2011 $170,545 $188,471 $217,462 $188,351 $142,403 COGS $100,118 $104,953 $117,246 $130,934 $118,621 $96,785 Inventories $15,277 $15,989 $15,828 $18,195 $16.622 $13,564 Receivable $20,210 $21,391 $22,571 $23,761 $22,348| $18,885 Payable $5,398 $5,259 $7.234 $8,023 $8,887 $8,869

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started