Calculate: CFFA using

= OCF-NCS-(delta) NWC

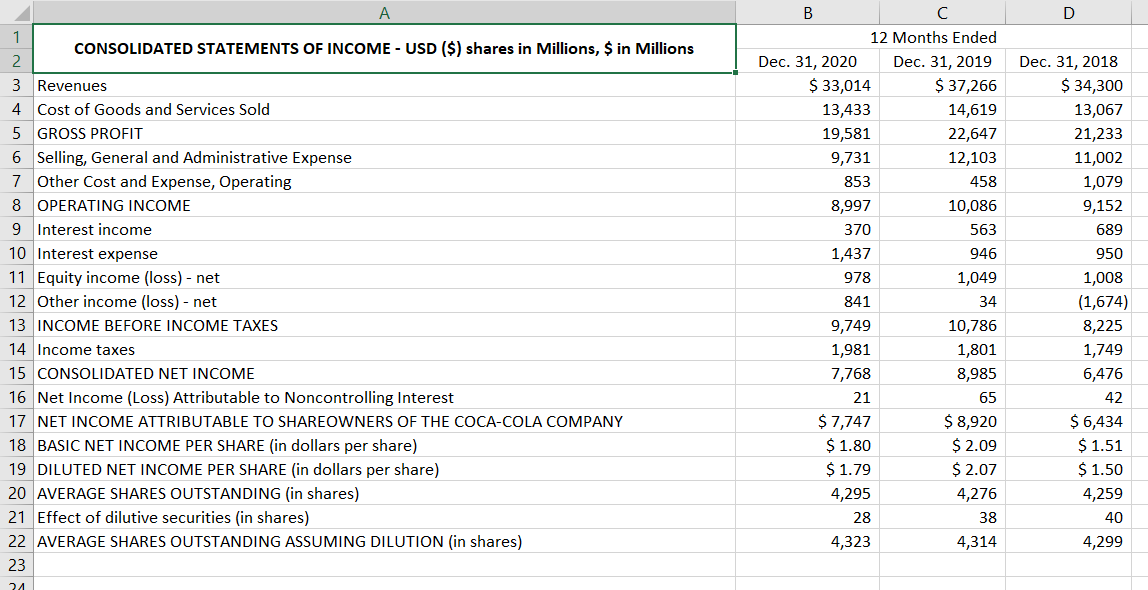

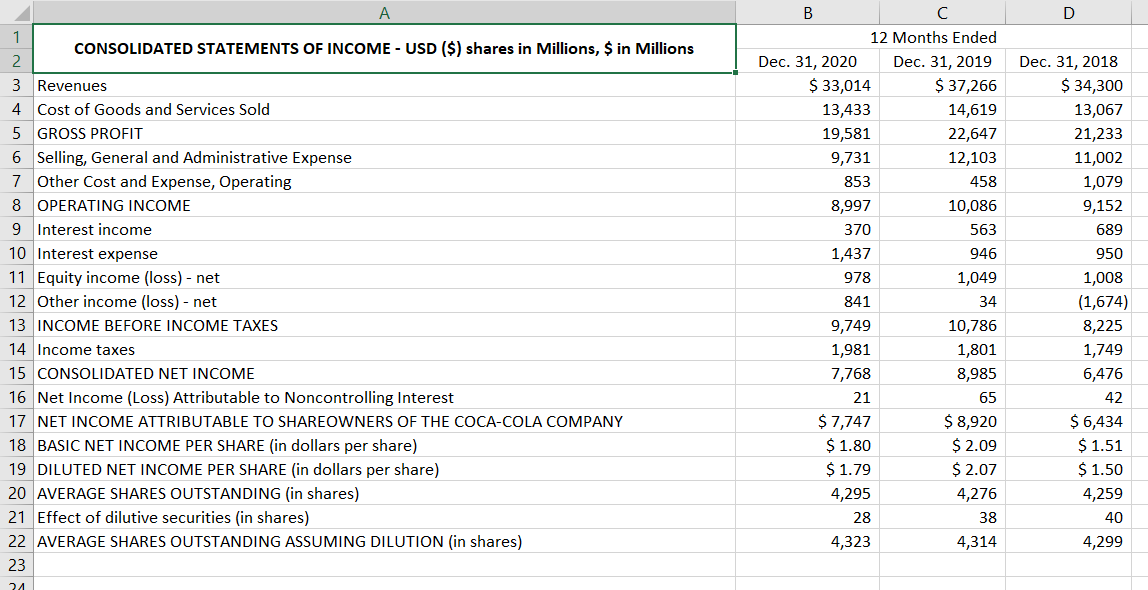

D 1 CONSOLIDATED STATEMENTS OF INCOME - USD ($) shares in Millions, $ in Millions 2 3 Revenues 4 Cost of Goods and Services Sold 5 GROSS PROFIT 6 Selling, General and Administrative Expense 7 Other Cost and Expense, Operating 8 OPERATING INCOME 9 Interest income 10 Interest expense 11 Equity income (loss) - net 12 Other income (loss) - net 13 INCOME BEFORE INCOME TAXES B 12 Months Ended Dec. 31, 2020 Dec. 31, 2019 $ 33,014 $ 37,266 13,433 14,619 19,581 22,647 9,731 12,103 853 458 8,997 10,086 370 563 1,437 946 978 1,049 841 34 9,749 10,786 1,981 1,801 7,768 8,985 21 65 $ 7,747 $ 8,920 $ 1.80 $ 2.09 $ 1.79 $ 2.07 4,295 4,276 28 38 4,323 4,314 Dec. 31, 2018 $ 34,300 13,067 21,233 11,002 1,079 9,152 689 950 1,008 (1,674) 8,225 1,749 6,476 42 $ 6,434 $ 1.51 $ 1.50 4,259 40 4,299 14 Income taxes 15 CONSOLIDATED NET INCOME 16 Net Income (Loss) Attributable to Noncontrolling Interest 17 NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 18 BASIC NET INCOME PER SHARE (in dollars per share) 19 DILUTED NET INCOME PER SHARE (in dollars per share) 20 AVERAGE SHARES OUTSTANDING (in shares) 21 Effect of dilutive securities (in shares) 22 AVERAGE SHARES OUTSTANDING ASSUMING DILUTION (in shares) 23 24 D 1 CONSOLIDATED STATEMENTS OF INCOME - USD ($) shares in Millions, $ in Millions 2 3 Revenues 4 Cost of Goods and Services Sold 5 GROSS PROFIT 6 Selling, General and Administrative Expense 7 Other Cost and Expense, Operating 8 OPERATING INCOME 9 Interest income 10 Interest expense 11 Equity income (loss) - net 12 Other income (loss) - net 13 INCOME BEFORE INCOME TAXES B 12 Months Ended Dec. 31, 2020 Dec. 31, 2019 $ 33,014 $ 37,266 13,433 14,619 19,581 22,647 9,731 12,103 853 458 8,997 10,086 370 563 1,437 946 978 1,049 841 34 9,749 10,786 1,981 1,801 7,768 8,985 21 65 $ 7,747 $ 8,920 $ 1.80 $ 2.09 $ 1.79 $ 2.07 4,295 4,276 28 38 4,323 4,314 Dec. 31, 2018 $ 34,300 13,067 21,233 11,002 1,079 9,152 689 950 1,008 (1,674) 8,225 1,749 6,476 42 $ 6,434 $ 1.51 $ 1.50 4,259 40 4,299 14 Income taxes 15 CONSOLIDATED NET INCOME 16 Net Income (Loss) Attributable to Noncontrolling Interest 17 NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 18 BASIC NET INCOME PER SHARE (in dollars per share) 19 DILUTED NET INCOME PER SHARE (in dollars per share) 20 AVERAGE SHARES OUTSTANDING (in shares) 21 Effect of dilutive securities (in shares) 22 AVERAGE SHARES OUTSTANDING ASSUMING DILUTION (in shares) 23 24